Indicator redrawing and how to choose an indicator without redrawing

When trading on the stock exchange using technical analysis, and especially indicator strategies, every trader has at least once encountered the phenomenon of indicator redrawing.

This phenomenon, or more accurately, technical feature, has harmed thousands of traders, as after believing in the strategy's algorithm and opening a trade based on a signal, the signal instantly disappears, as if it never existed.

However, if the trend continues and the signal works, no such disappearance is observed on the chart.

Most interestingly, these tools instill enormous confidence in traders that they have finally found the Holy Grail, as such indicators appear flawless in historical data.

However, using such algorithms can lead to the loss of a deposit, and their main drawback is the inability to conduct a more detailed analysis of the trade, as negative signals received are not saved in the historical data.

There can be many reasons why indicators redraw, but it typically depends on the type of indicator used, as well as the commercial aspect if you purchased the tool. So, let's look at the main reasons why indicators redraw.

1) Commerce. Fraudulent schemes

Many indicators sold on various platforms are specifically created by scammers with elements of redrawing to make the product look more convincing.

So, after looking at the indicator description, you can almost always see attached screenshots of the indicator on a historical chart.

If the indicator does not have a redraw feature, such signals will not look as ideal, and what's more, you may also see losing signals.

If the picture looks perfect, and all the trades in the image are perfect and as if copied, the indicator is most likely being redrawn.

Unfortunately, such tools are created by unscrupulous programmers and fraudulent sellers, and this phenomenon will continue in the future.

2) Novelty of the algorithm. Impossibility of coding the idea

Typically, a new, unique algorithm that has nothing in common with conventional technical analysis tools is very difficult to code, which ultimately leads to the creation of incomplete indicators with redrawing.

However, if the idea is truly worthwhile, improved algorithms appear in a very short time that correct this shortcoming.

It's important to understand that indicators like these aren't for sale, but rather distributed by enthusiastic programmers who simply publicly implemented their idea but lacked the skills and experience to complete the development.

3) Dependence of the indicator on the closing price

Almost all standard indicators repaint to some extent. However, don't confuse the repainting of an indicator signal before the candle closes with the repainting of a signal in historical data.

So, if the indicator is based on the closing price of a candle, as the price moves, namely inside the candle, the signal may appear or disappear repeatedly, but after the candle closes, the signal will remain in place.

This phenomenon can be observed with almost all oscillators and trend indicators, so the main recommendation when working with such tools is to consider a trade only after the bar closes.

How to choose a non-redrawing indicator

To avoid falling into the trap of a suddenly disappearing signal on the chart, it is necessary to test the instrument before starting real trading.

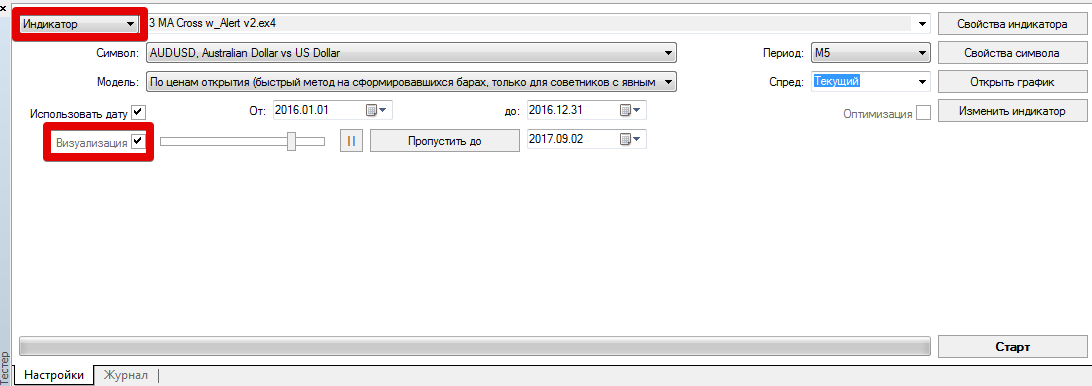

To do this, launch your strategy tester in the MT4 or MT5 trading terminal and select the "Indicator" test object, then select the indicator you want to test and launch the tester in visualization mode.

This way, you can see how signals are formed historically in just a few minutes. You can also test the indicator's performance in real time by dragging the tool onto a minute chart and monitoring it for several hours.

If you are purchasing an indicator from a seller, ask them to provide a demo version of the tool.

If the seller is afraid you'll hack them and refuses, ask them to enable desktop display in Skype, then have them run the indicator in the tester in visualization mode on their computer.

This way, you can see how the indicator works and avoid scammers trying to sell you a repainting indicator.

In conclusion, I would like to note that indicator redrawing is a common occurrence that can be easily eliminated by conducting simple testing.

However, it's important to understand that when purchasing an indicator from a stranger, there's a high risk of being scammed, so don't hesitate to express your skepticism when communicating with the seller!

And ask for a demo version of the product or visual testing via Skype or other services that allow you to see the seller's desktop!