Spread Rebate Services and Should You Use Them?

A rebate is a return of a portion of the broker's commission to the trader for each trade; it's a kind of cashback on the money paid to open a trade.

A spread rebate allows a trader to receive a portion of this commission back after the trade is completed.

This can be a fixed or percentage income depending on the volume and frequency of trading operations.

This technique is one of the tools for attracting clients and can help reduce trading costs, increasing the trader's overall profit.

The rapid development of forex brokers and their affiliate programs has led to a completely new phenomenon: the emergence of so-called "rebate services.".

What are the Rebate service's payments based on?

Rebate services are special partners of brokerage companies that receive compensation for each client they attract and their trading activity. It's no secret that each broker takes a commission in the form of a spread for opening a position.

These affiliate programs were created to increase the number of clients they attract and reduce advertising costs.

Affiliate trading involves a broker sharing a portion of the trader's commission with the partner who referred the trader.

Affiliate trading involves a broker sharing a portion of the trader's commission with the partner who referred the trader.

Rebate services receive a commission if you sign up based on their recommendation, and then pass a portion of the commission on to you.

Regardless of whether you opened a profitable or unprofitable trade, the rebate service will receive a reward for you.

Disadvantages of Rebate Services

: Just think about it: rebate services share their affiliate commission with us, regardless of whether my position is profitable or unprofitable—almost every novice trader thinks so. However, the first requirement we encounter is the requirement to open an account using the service's affiliate link, regardless of whether you're already registered with the chosen brokerage company.

Naturally, every trader wants to work only with a reputable company that they've personally verified, so they begin by re-registering an account with the same broker they previously traded with, but using the service's affiliate link. Ultimately, you may earn money from the rebate service, but when you want to withdraw your funds from the broker's account, problems may arise.

The fact is that only one account is allowed per person, so unscrupulous managers can exploit this loophole and deny your withdrawal, accusing you of fraud.

The second drawback of rebate services is the lack of transparency in commission payment.

Unfortunately, not all can boast positive reviews. The fact is that most services only credit their accounts once a week and can simply lose out on trades. For example, you may be denied a portion of your commission because you closed trades earlier than a minute or because of some other condition that no one warned you about when you registered with the rebate service.

There are also a large number of outright scammers who try to avoid paying you in every possible way.

There are also a large number of outright scammers who try to avoid paying you in every possible way.

The third drawback is the push of various "kitchen schemes."

Almost every rebate service has its own top list of recommended brokers. Typically, these brokers offer very high commissions on major currency pairs and boast a spotless reputation.

InstaForex, a popular broker among rebate services , has a spread of 3 pips, or about $30 per lot, while brokers like Alpari , RoboForex , and Amarkets not only have smaller spreads but also offer rebates themselves.

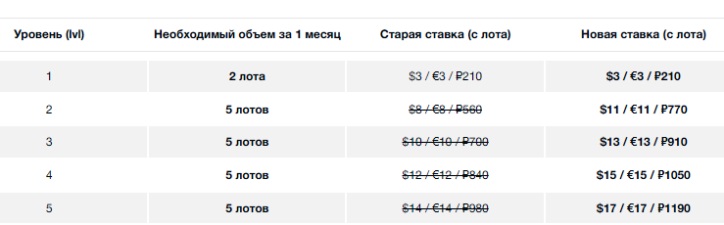

Here's an example of a spread refund from broker Amarkets:

The latest unfortunate incident involving the MOFT rebate service was also remembered by thousands of traders, as the company actively promoted MMSIS and placed it at the top of all its ratings, offering super deals on spread refunds.

The latest unfortunate incident involving the MOFT rebate service was also remembered by thousands of traders, as the company actively promoted MMSIS and placed it at the top of all its ratings, offering super deals on spread refunds.

In my opinion, it's better to trade with a broker with the lowest spread than to try to compensate for it through third-party firms. Spread comparison between brokers - https://time-forex.com/vsebrokery/sravnenie-forks-brokerov