Top 5 global financiers

In any field there are the most successful, the best, and of course, stock trading is no exception.

The most successful traders have made huge fortunes, amounting to billions of dollars.

Most people who have achieved success in trading started trading on the stock exchange literally from scratch and were able to achieve success only through their own hard work.

Therefore, their experience is a valuable lesson and example for traders who also want to become one of the world's top financiers.

- Paul Tudor Jones

Basic information:

- Born: 1954 in Tennessee, USA.

- Current net worth: $7.5 billion.

- The main trading instrument in the market: Commodities

Jones earned money writing financial articles for his father's newspaper while he was a student at the University of Virginia.

After graduating in 1976, he had many options, even an invitation to attend Harvard Business School, but Jones declined them all. Instead, he decided to pursue a career in commodities trading, which turned out to be the best choice.

Under the guidance of Eli Tallis, an experienced cotton trader, Jones acquired the skills necessary to become a commodity broker at E.F. Hutton & Co. at the age of 24.

In 1980, Paul Tudor Jones founded Tudor Investment Corporation, his own hedge fund. This fund focuses on interest rate volatility in the money market.

Today, the fund manages approximately $11 billion in assets. Jones's most successful trade stemmed from his correct prediction of the 1987 stock market crash.

This led him to open a short position selling futures contracts and in just one day he made a profit of 125.9% or $100 million.

Paul Tudor Jones advises novice forex traders: "The most important rule is to defend well, not to attack aggressively." When opening a new position, Johnson always recommends having a backup plan in case something goes wrong.

- George Soros

Basic information:

- Year of birth: 1930, Hungary.

- Current net worth: $6.7 billion.

- The main trading instrument on the market: Forex (Currency)

George Soros is deservedly considered one of the world's top financiers. He was born and raised during the Nazi occupation, when the only goal for Jews was survival. And it was during this difficult time that his most important investment philosophy was formed: "First survive, then make money.".

Having started his career while still a student at the Singer & Friedlander School in London, George Soros achieved his first profitable results.

Then, having acquired a number of assets, he founded his own hedge funds. His first hedge fund was Double Eagle (1969), later renamed Quantum.

From 1970 to 2000, he managed this fund with great success, achieving an average return of 30% per year and, at its peak, up to 100% per annum. The Quantum Fund is considered the most successful investment fund in the history of the global economy.

He then used the profits from that fund to found Soros Fund Management (1973), which averaged 20% annual returns, making it one of the most profitable hedge funds in world history.

In managing these two funds, George Soros developed a unique trading technique, specifically using his unique understanding of economic trends to identify market inefficiencies and eliminate them with large leveraged trades.

And it was this trading technique that led him to his greatest success in 1992, when he earned the nickname "The Man Who Broke the Bank of England.".

At the time, the pound sterling was being artificially inflated under the European Exchange Rate Mechanism (ERM), and George Soros predicted that the British government would have to devalue its currency, leading to a depreciation of the British pound.

Opening a short position on the British pound sterling for a huge amount of $10 billion helped George Soros make $2 billion in profit in just 1 month.

This is undoubtedly the largest deal ever made in the Forex market, ensuring that George Soros remains among the top financiers in the Forex market.

Since Black Wednesday, George Soros has continued to invest, trade, and grow his assets, becoming one of the richest forex traders.

George Soros advises beginning traders: "The market is always in a state of uncertainty and change; money is made by ignoring the obvious and betting on the unexpected.".

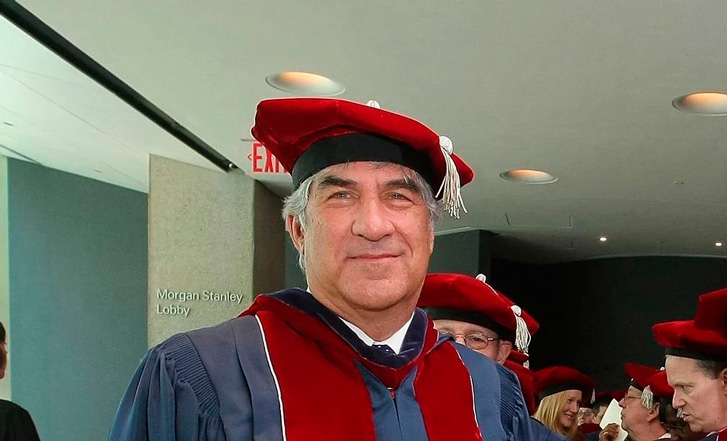

- Bruce Kovner

Basic information:

- Year of birth: 1945, New York, USA.

- Current net worth: $6.6 billion.

- The main trading instrument in the market: Commodities

Before becoming a trader, Bruce Kovner was involved in a wide range of activities, including politics, city administration and teaching

Bruce began his trading career at the age of 32 in 1977 when a family friend introduced him to the financial markets.

He began with an intensive self-study program on the history and nature of money, commodity, and debt markets. After more than a year of research, Kovner borrowed $3,000 from his MasterCharge account and began trading futures. Specifically, he bought soybean futures and made his first profit of $22,000.

Having achieved success with his own capital, Kovner joined Commodities Corporation (now part of Goldman Sachs) as a senior trader. There, he earned millions of dollars for the company and established himself in the market.

In 1983, Kovner founded Caxton Associates to manage his hedge fund. He focused on trading financial and commodity markets based on macroeconomic conditions.

During Kovner's 28 years at the helm, Caxton became one of the largest and most successful macro hedge funds in the world, with $12 billion in assets and an average annual net return of over 21%.

Before founding Caxton Associates, he also had an unparalleled track record in both the commodity and stock markets, with a 90% return over 10 years. This is a truly remarkable achievement, one that very few professionals can match.

After leaving Caxton Associates in 2011, he founded investment company Cam Capital in 2012, managing his personal wealth through stock trading and trading activities.

In more than 20 years of running his fund, Bruce Kovner only lost in 1994.

Bruce Kovner is a master macroanalyst. He believes that only by understanding the economy, how it works, and how capital flows can traders and investors be successful.

In addition, controlling emotions and maintaining discipline before opening a position is also one of the essential skills a trader needs.

- Stanley Druckenmiller

Basic information:

- Born: 1953 in Pennsylvania, USA.

- Current Net Worth: 6.4

- The main trading instrument on the market: Forex (Currency)

From an early age, Druckenmiller showed a passion for business and finance. This passion led him to study English and economics at Bowdoin University. After completing his studies, Druckenmiller worked at the National Bank of Pittsburgh.

He earned a decent salary as head of equity research, but left in 1981 to start his own firm, Duquesne Capital Management.

Druckenmiller's investment acumen and extensive knowledge of capital markets caught the attention of George Soros. In 1988, Soros hired him as chief portfolio manager of the Quantum Fund. During this time, he executed one of the greatest trades in history. A single bet on the British pound earned $2 billion in just a month. Soros and Druckenmiller are said to have been the duo that "broke" the Bank of England.

After leaving Quantum Fund in 2000, Druckenmiller went on to manage Duquesne Capital and amassed a fortune of $12 billion.

Much of his wealth is tied to investment firm Duquesne Capital Management and his work at the Quantum fund.

Druckenmiller currently makes his personal investments in energy stocks, the New York Times, and other securities.

Much of Druckenmiller's trading and investing strategies focus on maximizing opportunities when they're right and minimizing losses when they're wrong. His investing style also contradicts the principle of "Don't put all your eggs in one basket." Instead, he says, "I like to put all my eggs in one basket and then monitor that basket very carefully.".

- Joe Lewis

Basic information:

- Year of birth: 1937, London, England.

- Current net worth: $5.2 billion.

- The main trading instrument of the market: Forex (currency)

Joe Lewis is a British trader with an inspiring success story. He started working at the age of fifteen, helping his family in the catering business.

Having inherited the business, he, with the ability and experience of a natural businessman, took every opportunity to help the family business model expand and grow.

But he eventually sold it for £30 million, making him a millionaire before his trading career even began. Lewis then moved to the Bahamas with all his earnings and dedicated himself entirely to his forex trading career.

The trade that earned Joe Lewis billions of dollars was the Bank of England's Black Wednesday trade. Joe Lewis is also reportedly a member of an elite club of legendary traders, including George Soros and Julian H. Robertson, Jr. Together with George Soros, he earned billions of dollars on this trade.

Not content to rest on his laurels, three years later Joe Lewis made a similar short sale, but this time the victim currency was the Mexican peso. Mexico had accumulated a massive trade deficit in 1994, prompting speculators to bet that the peso, which was clearly lacking government support, would collapse. In early 1995, the peso collapsed, and speculators like Joe Lewis reaped huge profits.

Joe Lewis's strategy and trading style changed significantly after Black Wednesday. Before his deal with the Bank of England on Black Wednesday, he was considered a rational, methodical trader who took only calculated risks.

His previous trades were typically limited to a few million dollars, but after successfully selling the pound sterling, that number grew to billions of dollars thanks to a strategy of betting big on coins in a bad position.

Joe Lewis advises new traders to remain humble and brag about "just getting rich" - this is an obstacle to the success they desire.

We hope this information about how traders who now form the top financiers earned their capital will serve as a role model and the foundation for your own success.