How to trade gold in MetaTrader 4

Get any first-grade student out of their desk and ask them to name at least one expensive metal, and they'll immediately say gold. We've all thought about buying this precious metal at least once in our lives, and not necessarily in bullion form.

metal, and they'll immediately say gold. We've all thought about buying this precious metal at least once in our lives, and not necessarily in bullion form.

Every housewife knows that as long as she has at least one piece of gold jewelry, she can handle any emergency, because she can always find the money.

Thus, from childhood, we're inadvertently taught to invest in gold, because no matter how much humanity mines, its value always rises.

Until recently, investing in gold was extremely difficult. At the household level, everyone tried to buy expensive gold jewelry, and businesses, despite all the fees and expenses, tried to buy gold bullion from state banks.

The trading process is no different from the usual currency trading, and even unlike buying gold as a commodity, it's much more profitable, as the bank isn't fleecing you, as is often the case. If you log into the MT4 trading terminal, you'll find it in the symbol panel and it's called XAU/USD.

Essentially, if you look at the symbol set, it turns out you're buying gold with dollars. Besides simply investing in gold, you can profit from price fluctuations.

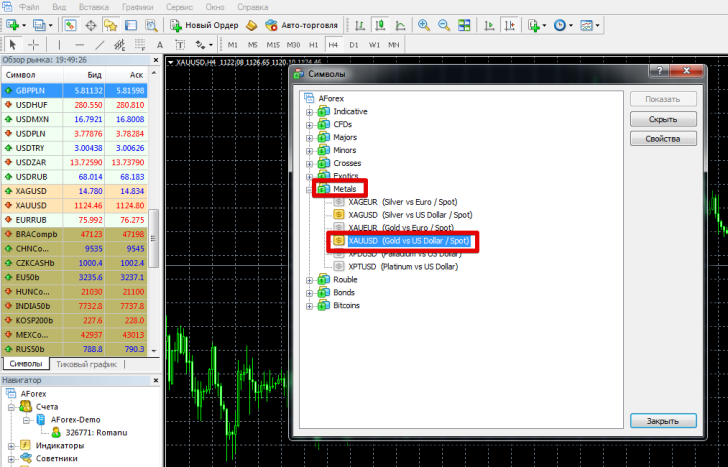

If you don't see this currency pair in your trading terminal, I recommend going to the symbols menu, opening the metals tab, and simply clicking on gold. After this simple step, this instrument will appear in the list:

Now, I'd like to discuss how to analyze this currency pair, what factors influence it, and what actually drives the gold price. Many investors and traders note that gold is a highly volatile instrument and very difficult to predict.

Now, I'd like to discuss how to analyze this currency pair, what factors influence it, and what actually drives the gold price. Many investors and traders note that gold is a highly volatile instrument and very difficult to predict.

Indeed, many fundamental factors , but before you start trading gold in the MT4 trading terminal, you should know that the primary players in this market are national central banks. To maintain the financial stability of any currency, central banks hold gold reserves and actively speculate with them.

For example, gold rises during a crisis, as investors try to preserve their wealth by buying this metal. As you know, the Swiss economy is heavily tied to the banking sector, so, despite not owning any gold deposits, the Swiss franc exchange rate is directly linked to the gold price. Therefore, if a major crisis is imminent, capital typically flows to Switzerland, which means the price of gold rises.

A significant factor when analyzing the potential price of precious metals is production data. According to the latest data, China leads the world in gold production, followed by Australia, Russia, and the United States, Peru, South Africa, Canada, and Mexico. Analyzing gold production reports from these countries offers a high probability of predicting potential price changes.

Many traders closely monitor the Australian dollar, as it acts as a kind of indicator. If the Australian dollar rises, the price of gold also rises, and if the Australian dollar falls, gold also declines. However, for a more detailed analysis, traders use reports from major gold mining companies.

For example, the top five gold mining companies are led by Canadian company Barrick, which produces an average of 190 tonnes of gold per year. The second-largest producer is American company Newmont, which produces an average of 150 tonnes of gold per year. Rounding out the top three is South African company AngolGold Ashanti, which produces an average of 130 tonnes of gold per year.

Fourth and fifth place go to two Canadian companies, Goldcorp and Kinross, with an average annual production of 80 tonnes. Why did I include this list? These companies develop gold deposits around the world, so by analyzing them, you'll always be aware of the potential price movement.

It's worth remembering that gold rises rapidly during a crisis, so you might see a pattern like this: a decline in major indices and a rise in the XAU/USD currency pair. Many note that gold is also affected by the price of oil, as it has a global impact on the economies of all countries.

It's worth noting that gold is bought and sold in dollars, so it's worth closely monitoring key US economic indicators and political statements.

When trading gold on the MT4 trading platform, you have access to a variety of technical and graphical analysis tools, which also actively apply to this asset.

Before you begin trading gold on the MT4 trading platform, you should familiarize yourself with your broker's trading conditions, as different brokers typically charge different commissions, and the spread is generally too large to lose money.

You can download the trading platform from one of the brokers - https://time-forex.com/vsebrokery/brokery-zoloto-serebro