How to buy company shares online and in real life

Everyone is probably familiar with scenes from films when an old American man discovers in his closet a couple of dozen securities of a well-known company, which he bought for pennies about thirty years ago.

Naturally, during this time the price of securities skyrockets, and the old man successfully becomes a millionaire.

This investment is a kind of lottery with low risk and fairly high chances of choosing the main prize.

How to buy shares of companies to profit from changes in market value and possibly accrued dividends from us?

Thanks to the development of financial services and the Internet, purchasing securities is becoming easier every day.

And it doesn’t matter at all where in the world you are, because you can buy shares of profitable companies both in real life and online without leaving your home.

You must decide for yourself which option is preferable for you and solves the tasks, and we will try to consider all the available possibilities and describe a little technical aspects.

How can an individual buy shares of popular companies?

The first option is perhaps the easiest to understand, but at the same time difficult to execute; when you choose it, you become the proud owner of a security:

As you understand, we are talking about a purchase with you recorded as the owner of a part of the company in the register of shareholders, this gives you the right, under certain conditions, to participate in the management of the company and receive dividends from its profits.

As you understand, we are talking about a purchase with you recorded as the owner of a part of the company in the register of shareholders, this gives you the right, under certain conditions, to participate in the management of the company and receive dividends from its profits.

Advantages and disadvantages

One of the advantages is the actual ownership of a security; this shapes your image and has a positive effect on data on your solvency.

There are also disadvantages, these include low liquidity; it takes some time to quickly sell shares.

Also, information that you are the owner will be available to regulatory authorities and if the value increases, you will have to pay income tax. It is possible to buy shares of global companies in specialized companies providing similar services and in some banks.

A few years ago there were quite a lot of such companies, but now I have not been able to find such intermediaries via the Internet.

Most of the companies well-known in this market of services ceased to exist, and the rest switched to working online. The second option is to buy shares using CFD contracts , in this case you make a transaction, as a result of which you also have the opportunity to make money on rising prices and receive dividends.

But you are not the real owner and your name is not included in the register of shareholders of the company whose security you purchased:

At the moment, this is the most affordable way to make money speculating in securities.

At the moment, this is the most affordable way to make money speculating in securities.

Advantages and disadvantages

First of all, it should be noted the availability of this option. In order to buy shares of companies, you just need to open an account with a broker , fund it and open a purchase transaction.

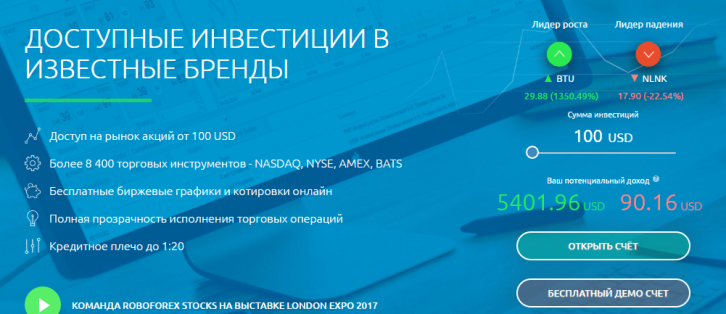

Buying and selling is carried out literally in a matter of seconds, there are more than 8,000 shares available for investment, there is the possibility of using leverage, the minimum investment is $100.

Among the disadvantages, it should be noted that you need to take a free stock trading training course .

Or at least learn how to open trades in a trading platform. In my opinion, buying company shares online is a more interesting option and it has much greater opportunities than purchasing in real life.

After all, here you can almost completely automate the entire process, for example, set a pending order, which will open a transaction as soon as the price of a security becomes attractive. In addition, it is possible to try investing in demo mode and only then invest real money in the process.