My stock portfolio and how much it will earn in 2025

When building a securities portfolio, it's important not just to select companies with big names, but to build a system.

Diversification is a key principle that allows you to reduce risks and achieve stability even in volatile market conditions.

At different times of the year, some industries grow, others decline, and a balanced portfolio helps smooth out these fluctuations.

My portfolio is dominated by dividend stocks, but also includes bonds and non-dividend growth stocks.

When selecting issuers, I focused on the profitability of the business, the current financial condition of the companies, and how far their shares are from their historical highs.

At the same time, the portfolio also included stocks that defied the general trend, such as Intel. While they were losing money at the time, their price was three times lower than their peak, making them attractive from the standpoint of a possible recovery.

Below is a summary table of results for all securities for 2025.

| Company | Industry | Rising cost | Dividends |

|---|---|---|---|

| Svenska Handelsbanken | Banking sector | +6,7% | 10% |

| Ares Capital | Investment fund (BDC) | -11% | 8% |

| CMB TECH NV (CMBT) | Logistics and freight transportation | +3% | 0,3% |

| Verizon | Telecommunications | +4,7% | 7% |

| Applied Materials | Semiconductors / equipment | +33,5% | 0,7% |

| Intel | Semiconductors | +99,2% | 0% |

| Royal Bank of Canada Pref J | Banking sector | +6,2% | 5% |

| Pfizer bonds | Pharmaceuticals (bonds) | +1,1% | 5% |

| Pfizer shares | Pharmaceuticals | -4,6% | 6,8% |

| Nordea Bank | Banking sector | +29% | 7% |

| SIGA Tech | Biotechnology | -5,5% | 8% |

| NVIDIA | GPU / AI / technology | +25% | 0,02% |

Approximately the same amount of funds was invested in each of the securities in order to distribute capital proportionally.

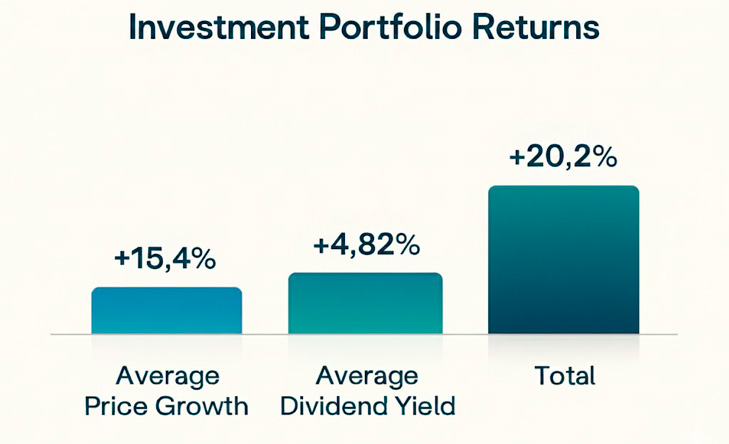

The result was the following picture.

The average portfolio growth was +15.4% , which, in my opinion, is quite good for the first 11 months of last year. Despite the presence of loss-making positions (Ares Capital, SIGA Tech, Pfizer shares), their impact was offset by strong gains in other issuers—Intel, Applied Materials, Nordea, and NVIDIA.

The portfolio's average dividend yield was 4.82% , which is quite respectable considering the portfolio also includes growth stocks. Even where stocks declined in value—for example, in Ares Capital or SIGA Tech—dividends partially offset the negative results.

Intel was the best buy of the year. Its nearly 100% demonstrates that buying a good company during a period of undervaluation can be one of the most profitable decisions.

That said, I wouldn't completely copy my portfolio now, as the situation with some securities has changed slightly.

Specifically, I've decided against buying shares of companies like Intel, NVIDIA, Applied Materials, and possibly CMB TECH NV (CMBT). Because tech companies have already risen in price, and there's no reason to expect dividends from them.

The situation with CMB TECH NV is also ambiguous. On the one hand, the company is incurring losses and has stopped paying dividends. On the other hand, its share price is quite attractive, and if the situation with freight transportation changes, the share price could rise, and the company could begin paying dividends again.

Overall, the result is quite good, but for greater peace of mind, I would recommend hedging your stock portfolio by buying gold, which will further reduce potential risks.