What awaits gold in 2017.

Almost any investor considers gold as an alternative to existing investments.

As a rule, this is long -term investment for not one month, and sometimes even a year. The main thing is to choose the most successful moment for the purchase.

The price of gold has increased several times in the past decades, though after reaching a peak of $ 1886 per ounce in 2011, the rate began to decline.

The bottom was achieved in 2015, and the rising trend again prevailed on the market, especially pleased the beginning of 2017, the cost of gold in the new year has already increased by 6%.

What awaits the price of gold in 2017, if the prospects of further growth?

America does not like the low exchange rate of the Euro.

It would seem that a strong currency is always beneficial for the country it represents, but in practice the situation is quite the opposite.

A strong national currency is always a blow to exports, since the strengthening of the national currency leads to a proportional rise in the price of goods.

For this reason, most countries try to prevent their currencies from strengthening excessively by intervening.

The last few years have seen a significant drop in the Euro, which has played a positive role for the European economy.

Recently, the head of the US National Trade Council, Peter Navarro, saw in the fall of the Eurocurrency some patterns, which could only be caused artificially.

He accused the German government of undervaluing the exchange rate.

Ruble forecast for 2017.

There are a lot of opinions about what the ruble exchange rate will be in 2017, because many decisions depend on this information.

Betting on deposits and loans depend on the national currency, decisions in which currency to store your money, food prices and other goods.

First of all, it should be noted that the course of the Russian ruble depends not only on the price of oil, but also on the state of the Russian economy.

Its strengthening usually leads to the devaluation of the national currency, and a decrease in economic indicators causes inflation.

What do experts say on this issue and what prerequisites exist.

How the dollar will react to Trump's Inauguration.

The euro/dollar rally has been going on for several months now, the dollar exchange rate is quite unstable, forex trend changes literally in minutes.

But it is precisely this fact that helps many traders make money on short-term euro/dollar transactions.

One of the reasons for the sharp jumps in the exchange rate is news from the United States, namely about the political situation within the country; one of the most significant events will take place today.

Today at 17.30 Moscow time the inauguration of the new President of the United States of America should take place.

The event itself is unlikely to affect the exchange rate of the US dollar, but the mass demonstrations planned for this day could definitely lead to a weakening of the dollar.

The USA and the ever-growing national debt.

Not so long ago, one of the hottest news was the possibility of a default in the United States, which would mean a record drop in the dollar.

But after the passage of the fiscal cliff law, the situation improved significantly and the government continued to sell government securities.

At the moment, the US national debt has almost reached $20 trillion, but bonds are still in demand.

The growth of government debt is due to a decrease in interest rates on this type of securities; it is quite profitable to borrow at a low interest rate.

True, constant borrowing still leads to an increase in annual payments; in 2016, $220 billion was spent on servicing external debt.

Every year the number of players betting on the collapse of the US financial system is growing; the number of long-term sales transactions already amounts to $100 billion.

The pound was scared by the news.

Despite the fact that UK GDP has shown good growth over the past six months, the British pound is still sensitive to reports about Brexit.

Monday, January 16, was no exception, after it became known over the weekend that Prime Minister Theresa May would give a speech on Tuesday, January 17.

The market's reaction to the news was a record gap of several thousand points; the British pound reached a three-month level of $1.1986.

True, by the evening the rate had risen by a couple of hundred points, but only tomorrow will show whether this is another correction or a change of mood.

The results of the UK's decisive actions to leave the European Union are rather ambiguous; forecasts for the economic situation are diametrically opposed.

US banks show record profits.

At the end of 2016, a number of American banks significantly increased their profits, such data was reported to news agencies on Friday.

Moreover, the growth amounted to several billion dollars compared to last year, mainly large financial institutions such as:

JPMorgan Chase – the profit of the largest bank in America at the end of 2016 amounted to 24.7 billion US dollars. In relative terms, profit increased by 1.2%.

The bank's main income was income from classical banking operations and its investment activities.

Bank of America – showed even greater growth; in 2016, the profitability of operations increased by as much as 13% and amounted to $17.9 billion.

Trends on the American stock exchange.

It is the trend that is the driving force of any trend, in other words, it is the mood that reigns among the players opening positions.

Over the past couple of months, the American securities market has presented a lot of surprises to its participants; trading has ceased to be languid, but has turned into a dynamic race.

The main tone for trading here is set by the largest participants - banks and hedge funds, whose capital amounts to tens of billions of dollars.

By observing the behavior of market makers, you can understand where the market will move in the near future, that is, identify the main trend.

The name itself - Hedge fund - implies the use of hedging tactics, that is, the funds try to open approximately the same number of long and short positions.

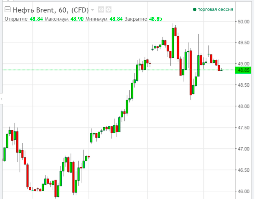

Oil forecast for 2017.

Recently, oil has become one of the most unpredictable assets, its price is either rapidly falling or regaining lost positions.

The importance of the oil price indicator is simply invaluable, since most exchange instruments have a close correlation with oil.

The economies of most world powers and the development of many sectors of the economy depend on the cost of black gold.

What will be the forecast for oil prices in 2017?

If we evaluate the current trend, most factors indicate a rise in oil prices.

The analytical company BMI Research also confirms the upward trend for 2017; according to forecasts, the price of oil will rise to $60 per barrel.

The trend will continue and reach $64 per barrel in 2018.

Great Britain is the leader of 2016.

The UK's exit from the European Union became the main topic of 2016, with even more economists interested in how the country's economy would behave.

Most analysts predicted a decline in production and GDP, since most of the UK economy is focused on the EU.

But the latest data made it possible to call the UK the strongest economy of the world in 2016.

Moreover, it should be noted that over the past six months, growth acceleration has been observed, such indicators as the business activity index and GDP .

The dollar reached its highest in 14 years.

After the New Year, the American currency will continue to break records on Forex; on January 3, 2017, the US dollar strengthened against the euro to 1.0336 dollars per euro.

The price has not reached this level since 2002, and the increase in price is associated precisely with the dollar, and not with the depreciation of the euro, since at the same time there was an increase in the price of the USDX index - which shows the ratio of the currency to a basket of six currencies.

In general, the American currency has risen in price by 6% over two months, which is a fairly significant indicator in the foreign exchange market.

It should be noted that on January 4, the euro currency showed significant growth, winning back about 1.5% against the dollar, but this is rather correction of an existing trend in Forexthan a reversal of a new trend.

Why is the euro falling in price and what are its prospects?

While almost all Forex traders are scalpers, there are many players who prefer longer trades.

It is important for these traders to know the fundamental basis for the formation of the exchange rate, which will allow them to identify a long-term trend and determine its prospects.

One of the most popular currencies on the Forex market at the moment is the euro, its rate has been rapidly going down in recent months.

Whether there is a real reason for the depreciation of the euro or the trend was formed under the influence of panic, this factor is of decisive importance.

The British Stock Exchange FTSE index is steadily rising.

The FTSE index is a reflection of the share price of the 100 largest companies in the UK; it shows the situation in the country's economy.

Although in our case, the increase in value is most likely due to the fact that investors are transferring savings from the falling pound into shares of the most attractive companies.

Despite the fact that the pound has recently lost noticeable weight, on December 30 the FTSE index surpassed its all-time high.

The growth per day was 0.3%, which is quite a lot for such a short period of time.

Now the FTSE - 100 has reached 7142.83, the value of the index has been growing steadily over the past month, in December the increase was 412.11 points.

Sweden for abandoning negative rates.

An unpleasant surprise for lovers of the Swedish krona was the introduction of a negative discount rate a year ago.

That is, now for keeping money on deposit in the national currency of Sweden, the account owner lost 0.5% per annum.

Quite a big loss for the deposit, if we add to this an inflation rate of 1.5% and a decline in the currency by more than 15% in relation to other monetary units.

According to recent statements, the Swedish government has strengthened the position of those who are ready to abandon such a policy, although it works great in the fight against deflation.

Recently, there has been an increase in Sweden's main economic indicators, which allows us to say that even the abandonment of negative rates will not lead to a sharp increase in inflation.

Bitcoin is gradually regaining its position.

A few years ago, a record rise in the price of cryptocurrencies came as a surprise to the army of skeptics; one bitcoin rose in price thousands of times in just a few years.

A year ago there was a huge correction, as a result of which the electronic currency lost half of its value.

It would seem that further growth is not possible, but recently Bitcoin has again shown stable growth, the crypto currency has risen in price by 5%.

Now its rate is 884 US dollars per bitcoin.

Many experts associate the current trend with the decline of the Chinese Yuan; the population is looking for alternative sources of investment and often choose cryptocurrency.

Demand for the US dollar is growing in China.

The unprecedented strengthening of the US dollar caused an increase in demand around the world, even those who are usually pessimistic about the US currency became interested in it.

China was no exception; demand began to grow from the beginning of the year, and after Trump’s victory in the elections, the trend intensified even more.

There are several reasons for this situation:

1. Firstly, this is a massive withdrawal of capital from the territory of the Middle Kingdom, which only intensifies with the slowdown in economic growth.

2. Distrust of the yuan - the population has traditionally become accustomed to trusting the US dollar and not trusting the national currency, which can either grow rapidly or fall even more rapidly.

Dollar-euro parity will soon be achieved.

Not everyone remembers the times when 1 euro cost less than a dollar; everything changed after the terrorist attacks in New York fifteen years ago.

After the notorious events, the US dollar fell for a long time against most major world currencies.

How justified was this drop? After all, in reality, the American economy did not suffer damage that would lead to a two-fold drop in the US currency.

Confirming this fact over the past few years, the US dollar is confidently regaining its position in world markets.

Now the exchange rate of the euro/dollar currency pair has already reached 1.03 dollars per euro, many analysts claim the possible achievement of parity between these two currencies.

Prospects for growth in the price of shares of defense enterprises.

Another relative calm has ended, and the world is once again entering a period of escalation. Most countries are dramatically increasing their defense budgets.

EU countries spend 219 billion a year on defense, even for Europe this is quite an impressive amount, and in 2017 most EU members will increase their military budgets by 15-20%.

The Baltic states are also trying to keep up with their colleagues; starting next year, the Baltic countries will increase military spending by 50%.

After that, the total cost will be $1.45 billion.

Investments in Chinese tourism.

The tourism sector has been developing quite rapidly in recent years, mainly due to the popularization of active recreation.

The tourism market has enormous prospects and is valued at hundreds of billions of dollars; it is not for nothing that this industry has become a priority in many countries.

Recently, the Chinese government announced unprecedented investments in the tourism sector; in total, up to $290 billion will be allocated for the tourism business.

The financing program provides for a phased receipt of funds; the entire amount will be disbursed by 2020.

At the same time, the average annual investment will be about $100 billion.

Black Swans 2017.

The term “Black Swans” is familiar to almost any stock market player; it characterizes an unexpected event that significantly affects the economy or finances.

It is black swans that cause the maximum movement of courses on the currency exchange or the maximum change in the quotes on the stock.

What surprises can we bring us the coming 2017, according to experts of one of the largest holding companies.

1. The growth of the US economy - now the US economy is at a fairly low level, that is, the change of president, and government policy can lead to acceleration of economic growth.

Declining unemployment rate in the US.

The unemployment rate has always been one of the most important indicators that characterize the country's economy.

An increase in unemployment in most cases causes a depreciation of national currency, and conversely, a decrease in the value of this indicator can cause a strengthening of the national currency.

The latest news from the United States of America reports a positive trend, thanks to which unemployment in the United States has dropped to a nine-year low.

Now this figure is 4.6%, which is 0.3% lower than the data for October 2016, the message was made on Friday, December 2.

The UK still pays.

The scandalous exit of Great Britain from the European Union continues to be one of the main news of world news agencies.

The event is quite ambiguous for both the European Union and the UK; sales markets are closely connected and therefore the countries are doing their best to maintain established relations.

To maintain economic ties, the UK even agrees to pay contributions as a member of the European Union, this statement was made by British Minister David Davis.

The main task of the country’s government’s actions is to prevent the abolition of duty-free tariffs, which could lead to an increase in prices for goods and, as a result, a refusal to extend them in 2017.

The price of gold has hit investors.

There are a lot of investment companies with thousands of clients and billions of dollars in capital, the main object of investment being investments in gold.

After all, over the course of several decades, this metal has been steadily rising in price; what could be more profitable and reliable than gold?

This strategy was justified until recently; since 2013, the price of gold has dropped from $1,700 per ounce to $1,200. A particularly sharp drop, more than 7%, has been observed over the past few months.

This situation causes an outflow of funds from investment funds specializing in gold purchases.

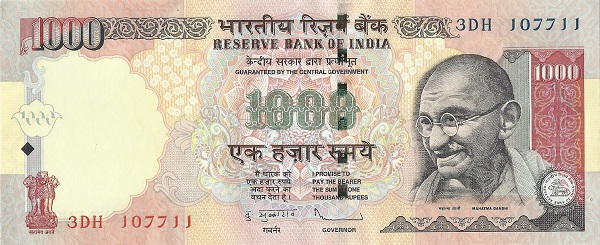

Currency reform in India and its consequences.

For several weeks now, news about currency reform in India has been one of the key events in news agencies; let us remind you that we are talking about the withdrawal of the largest banknotes from circulation.

If in the first days the very fact of the reform, its goals and objectives were discussed, now more attention is paid to the results. What is happening to the Indian economy now and what impact is this having on global markets?

Disappointing news from Japan and the fall of the Yen.

Recently, Japan has been increasingly worried about natural disasters; before the country has had time to recover from one shock, a new disaster brings trouble.

First of all, this is a significant drop in exports; in October, compared to last year, exports of Japanese goods fell by more than 10%.

Moreover, this is not a short-term decline, but a long-term trend; a decrease in demand for goods from Japan has been observed for more than a year.

The main reasons for this situation were the general deterioration in the global economy, which caused a sharp drop in demand, consumers are now buying essential goods, unfortunately, electronics do not fall into this category.

A new jump in oil prices.

Good news has been rare lately, so the sharp rise in oil prices came as a pleasant surprise to many Russians.

I would like to hope that the trend will continue and the price will reach $100 in the foreseeable future.

In the meantime, on Tuesday, December 22, 2016, the price of oil was just a couple of cents short of breaking the psychological mark of $50 per barrel.

The following days there was a minor correction, after which we can expect a resumption of the upward trend.

Perhaps a positive role will be played by the decision to stabilize the energy market, which will be made by the countries that are the largest oil and gas producers.

Gold news.

The price of the precious metal has always pleased those who decided to invest money in gold with surprises, and this time there were some surprises.

As soon as forecasts became known in which Trump would win the US presidential election, the price of gold increased, and it seemed that a fairly stable trend had formed.

The surprise was the price drop after the news from India; who would have thought that the fight against the shadow economy could bring down the gold market.

After the Indian government decided to withdraw from circulation and exchange the highest denomination banknotes, Indian investors had no time for buying gold.

And as you know, this country is the largest consumer of precious metal and often forms market demand.

US GDP growth forecast.

No matter what skeptics say about Trump’s election, most analysts have adjusted their forecasts for US economic growth.

According to experts, US GDP growth is expected to be 2.2% in 2017; according to preliminary forecasts made earlier, this figure was at 1.5%.

That is, with Trump, the American economy will grow 0.7% faster next year, which is quite a lot, given its size.

An equally optimistic long-term forecast is that growth is expected at 2.4% in 2018.

The forecasts are based on the plans of the new president, which he announced after his election, but in fact these are only plans, and they do not always come true.

US government bonds – a downward trend is just around the corner.

No matter how much there is talk about the insolvency of the economy of the United States of America and its proximity to collapse, US government bonds still remain one of the most attractive investment instruments.

Moreover, these securities are mainly used by Central Banks to create reserves that stabilize national currency units.

Recently, the yield on government bonds has increased significantly and reached 1.734%, in fact this is the maximum for 2016.

It would seem that an increase in yield clearly leads to an increase in price, but despite this, Russia and China began to gradually reduce the share of this type of securities in their reserves.

The Russian portfolio lost weight from 89.1 to 76.5, that is, by 12.6 billion, while China sold bonds worth $28.1 billion. It is clear that these amounts are quite insignificant, but still they can serve as the first bell to the beginning of a mass sale and the formation of a downward trend.

The rise in oil prices stimulates the ruble.

No matter how much skeptics claim cheap oil, their expectations were not met; Brent oil began to rise in price and reached $46 per barrel, while Light is selling at $45.

The reason for the rise in price was statements about the intentions of OPEC members to develop a plan to reduce oil production.

This information came from one of the employees of the Egyptian Ministry of Oil Production.

According to him, this issue will be the key one at the December summit; low prices do not suit the majority of OPEC participants.

The second reason that influenced the increase in oil prices was the terrorist attacks in Nigeria, due to which key oil pumping routes were damaged.

Trading volumes on American exchanges remain high.

As you know, one of the most significant indicators that influence the strength of a trend is volumes. They are the ones who can confirm or refute the existing trend.

The US elections followed by the election of Donald Trump as President caused a downward trend in most securities, market volatility reached unprecedented proportions.

According to the latest data, trading volumes on the New York Stock Exchange continue to remain high - on November 15, transactions were concluded with 800,000,000 shares, this figure is 45 percent higher than average volumes.

True, a growth trend is beginning to be visible, for example, the total number of securities for which the price has increased is 10% more than the number of those who have lost weight.

It can be argued that the market is gradually recovering from the shock and it is time to think about buying transactions.

Page 5 of 6