What will happen to the dollar exchange rate against other currencies in 2020?

While Europe is slowly beginning to cope with the consequences of the coronavirus infection, the United States is increasingly breaking infection records.

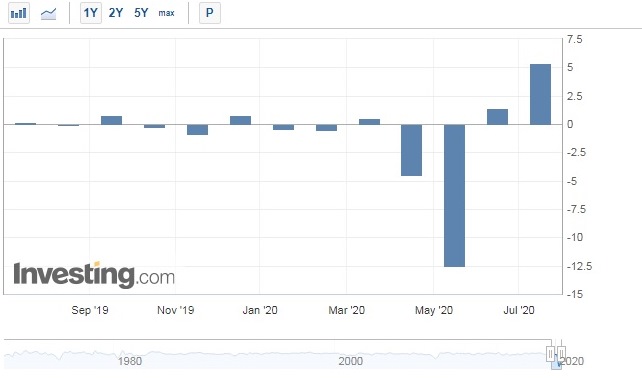

This situation is bound to cause a downturn in the economy, whose indicators are relatively low.

The unemployment rate remains quite high; it has fallen slightly over the past two months and is now around 11%.

However, this is still quite high, considering that the average unemployment rate in the US in previous years rarely exceeded 3.5%.

However, it should be noted that industrial production increased significantly in June 2020, indicating the beginning of a positive trend and that unemployment will soon begin to decline.

Against the backdrop of the dollar's fall against the euro, goods produced in the United States have become significantly cheaper, which only contributes to the growth of demand and further stimulates production.

It's expected that once Trump manages to contain the unrest and launches mass production of a coronavirus vaccine, the situation in the US will begin to rapidly improve.

It's expected that once Trump manages to contain the unrest and launches mass production of a coronavirus vaccine, the situation in the US will begin to rapidly improve.

What will the US dollar exchange rate be in the second half of 2020?

In the best-case scenario, the EUR/USD currency pair will continue to rise to 1.20 euros per US dollar, and after positive news (and there will definitely be some), it will begin to decline to 1.10 and hold there until the end of the year:

It is possible that the decline could happen a little earlier, it all depends on how circumstances develop this week.

It is possible that the decline could happen a little earlier, it all depends on how circumstances develop this week.

It's likely that unrest is currently putting more pressure on the dollar exchange rate than economic factors.

Therefore, the situation is rather uncertain, and it remains to be seen whether the dollar will rise above 1.16-1.17 or begin to fall below 1.15 dollars per euro.

However, according to the majority of analysts, the probability of growth is still higher than the probability of decline.