The collapse of global stock markets

The past year of 2015 and the beginning of 2016 were a truly shocking period for major investors around the world.

around the world.

Many traders and analysts knew about the collapses of global financial markets only from textbooks and financial journals, and few of us could have imagined that we would witness such a so-called collapse with our own eyes.

Various news outlets reported on how superpower indices plummeted, how the decline of stock exchanges in certain countries actively influenced the indices of other countries, and it seemed that the loss of just one element caused the entire financial system to collapse, one after another, in a chain reaction.

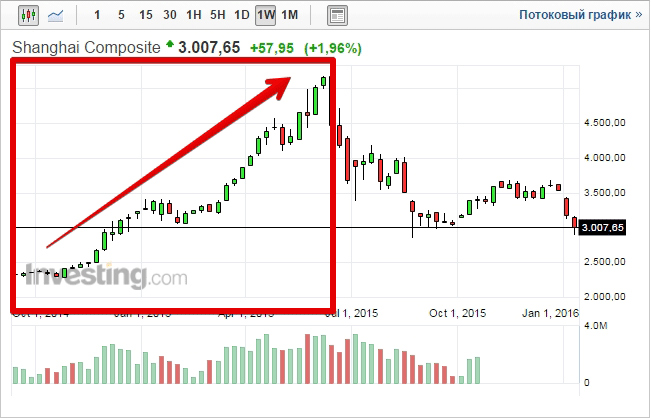

Events in China

News from China has had one of the strongest impacts on the financial world this year. The usual rise in the Shanghai Composite Index, traded on the Shanghai Stock Exchange, lured investors from around the world.

Just imagine: from November 2014 to June 2015, the index rose by more than 2,500 points. Rising production, a strong economy, and cheap labor simply drove the growth of shares in China's largest companies, and as a result, the leading index, the Shanghai Composite Index.

However, June 2015 proved to be a fateful day for China's economy. To be honest, this collapse was not due to any major changes within the country, the outbreak of military conflict, or a cataclysm, but rather to the simple bursting of the bubble that had long been inflating around the country.

However, June 2015 proved to be a fateful day for China's economy. To be honest, this collapse was not due to any major changes within the country, the outbreak of military conflict, or a cataclysm, but rather to the simple bursting of the bubble that had long been inflating around the country.

The fact is that the growth of investment in Chinese stocks and indices was so great that the actual economic situation was no longer consistent with the funds poured in. Simply put, we all witnessed the usual artificial growth of major indices and stock prices due to the real, strong infusion of investor money, while companies simply couldn't keep up with this growth.

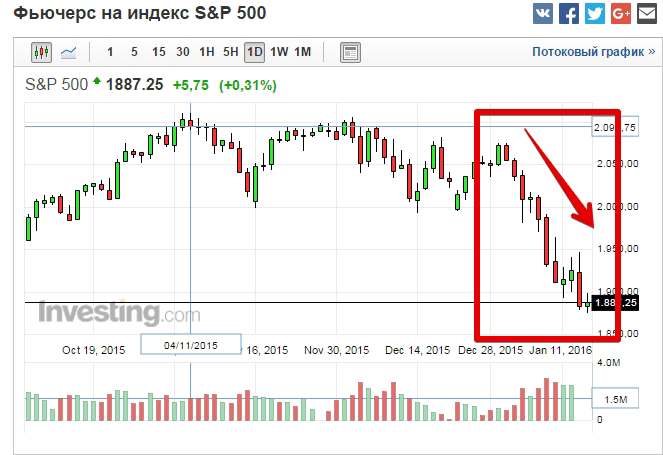

Thus, the time has come when the bubble simply burst, taking the entire world with it. Due to the collapse of the Chinese stock exchange, we can see the S&P 500, the Japanese Nikkei 225, and virtually all global indices fall by an average of 8 percent.

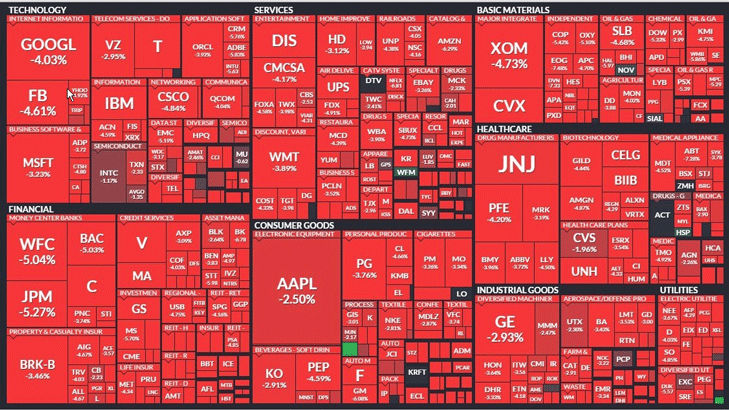

The same story applies to many shares of large companies. Probably no one has ever seen this picture:

Despite all the steps China has taken to stabilize the situation, we can clearly see the decline of their national currency, with the dollar having strengthened significantly against the yuan:

Despite all the steps China has taken to stabilize the situation, we can clearly see the decline of their national currency, with the dollar having strengthened significantly against the yuan:

The same can't be said for the US stock market; shares of the largest American corporations plummeted in a matter of hours. The Dow Jones fell 5%, and the Nasdaq 6%—such movements hadn't been seen in decades.

The same can't be said for the US stock market; shares of the largest American corporations plummeted in a matter of hours. The Dow Jones fell 5%, and the Nasdaq 6%—such movements hadn't been seen in decades.

The most likely reason for this decline was that investors panicked and began selling shares of US companies, thereby fueling the downward trend.

It is expected that the prices of these companies' assets could recover within one to two years, almost to their previous levels.