Oil market collapse

It's become commonplace for us to experience most troubles on Monday.

Important events accumulate over the weekend, and when the exchanges reopen, these events are reflected in prices.

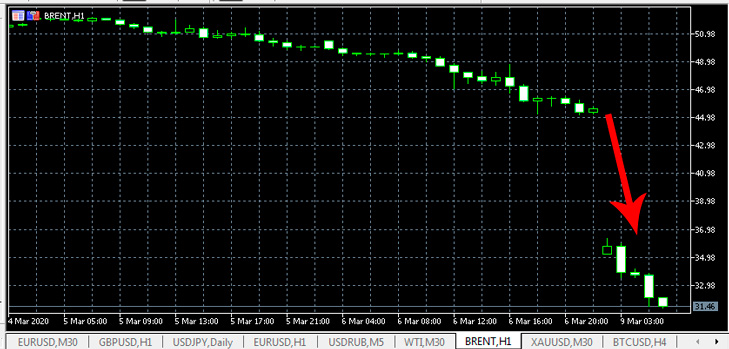

Monday, March 9, was no exception; after the holidays, the oil market opened with a truly enormous gap.

The price of Brent crude plummeted from $45.35 on Friday to $35.22 on Monday, a drop of more than $10, or about 22%.

Such a massive collapse hasn't been seen since 2015, and such a rapid one hasn't been seen in decades.

Experts cite two reasons for this phenomenon.

Experts cite two reasons for this phenomenon.

The first is the coronavirus crisis, as major consumers have sharply reduced their oil consumption, thereby reducing demand for the commodity.

The second is Saudi Arabia's announcement that it will increase oil production, with the planned increase amounting to approximately 20% of current levels.

It's difficult to even imagine the extent to which the decline will continue; some analysts have even speculated on $20 per barrel for Brent crude.

This scenario is quite likely if the coronavirus epidemic isn't contained by summer, as the drop in sales will lead to the closure of oil-consuming industries.

Gasoline and diesel consumption is already beginning to decline sharply, with people preferring to postpone planned trips and stay home.

Based on current events, it's highly likely that the oil price will quickly correct upward, allowing it to rise from $31 to $35 per barrel for Brent crude.

Further price action will depend on news such as whether OPEC countries will be able to reach an agreement, how quickly the coronavirus spreads, and whether there will be any news about the availability of a vaccine.