Euro-dollar exchange rate forecast for autumn 2024: which currency to choose?

The most liquid and convenient currencies for storing savings today remain the euro and the US dollar.

As an alternative, you can, of course, use Swiss francs, but they have less liquidity and sometimes have problems exchanging them, so the dollar and euro remain the preferred currencies.

At the end of April 2024, the EURUSD exchange rate was around 1.07 US dollars per euro, but many skeptics predict a rapid decline in the euro's value and a 1:1 price reduction, as happened in 2022.

But is it worth getting rid of euros now and urgently exchanging them for US dollars, so as not to lose on the exchange rate due to the euro's decline?

Euro-dollar forecast for the second half of 2024

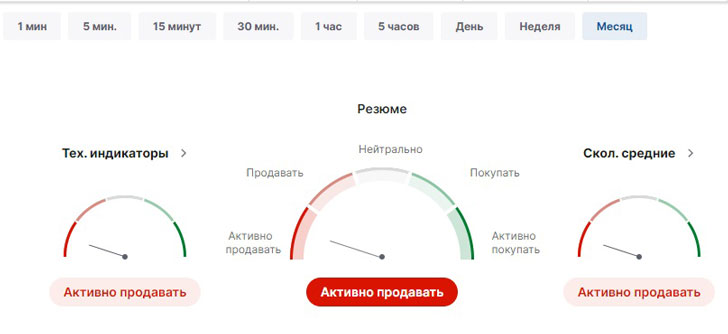

If you trust technical analysis indicators, most of them recommend actively selling the EURUSD currency pair now, exchanging euros for dollars:

The indicator readings are supported by most analysts, who predict a decline in the exchange rate after the change in interest rates. It is assumed that the higher the dollar interest rate, the more the price of the EURUSD currency pair will fall.

But not everything is so simple in this matter; there are many prerequisites for a significant fall in the exchange rate of the US dollar.

Seasonality of the euro exchange rate

In summer, demand for the European currency traditionally increases; summer is the holiday season, and vacationers from outside the eurozone flock en masse to Italy, Spain, France, and Croatia, exchanging their home currencies for euros.

Therefore, in the summer the euro will begin to strengthen or, at least, will move in the range of 1.05 – 1.10 dollars per 1 euro.

But the most interesting things will begin in the fall of 2024. As is well known, the exchange rate of a national currency is most strongly influenced by events within the country. This fall, the US presidential elections will take place.

The confrontation between Republicans and Democrats hasn't been this strong in a long time, meaning the fight for the presidency will be fierce.

In the fall of 2024, mass unrest may break out in the United States, escalating into major clashes between Republican and Democratic supporters.

In anticipation of these events, the US dollar will begin to weaken as early as October 2024, and possibly even earlier. Major financial players understand all the risks and are trying to reduce their exposure to US dollars in their assets.

If we talk about specific figures, then depending on the development scenario, the EURUSD currency pair may rise in price to 1.15 and higher.

Therefore, now is the time to think carefully about whether it is worth buying the US dollar or whether it is better to bet on another currency.

We shouldn't forget about stablecoins, which are pegged to the US dollar. If the dollar depreciates, the price of these coins will also fall. It's advisable to divest these assets as autumn approaches.

The fall of the dollar will traditionally drive demand for gold, which you can open a deal to buy right now with the following brokers - https://time-forex.com/vsebrokery/brokery-zoloto-serebro