How the currency market works, schedule, holidays, principles

The Forex currency market is not, by its very nature, an exchange in the true sense of the word. All transactions are conducted online, meaning it does not have a specific trading location.

Currency buying and selling is carried out on dedicated servers, with orders sent over secure lines.

The currency market operates virtually around the clock, opening at 2 a.m. Moscow time on Monday and closing Friday night.

That is, almost 5 days a week, excluding holidays – Easter, New Year, national holidays.

Trading is conducted according to trading sessions, which are tied to time zones. Typically, there are four such sessions: Asian, European, American, and Pacific.

The working hours coincide with the operating hours of banking and financial institutions, for example:

Asian – banks from Japan and the Asian region operate.

European – trading takes place during the opening hours of European financial institutions.

American – tied to the operation of sites in New York and Chicago.

Pacific – currency trading takes place on Australian platforms.

Also at this time, all the important news that affects the exchange rates of a given region is released.

The reference here is purely conditional, based only on the time zones that correspond to a particular part of the world.

If you are interested in specific trading hours, please see the trading session schedule - http://time-forex.com/torgovye-sessii-forex

The foreign exchange market operates a little differently with cryptocurrencies. Although this asset is classified as a digital asset, it can still be classified within this niche.

Unlike a traditional currency exchange, the cryptocurrency market operates 24/7, that is, 7 days a week, including Saturday and Sunday.

How does the foreign exchange market work during holidays?

Like any exchange, there are holidays and weekends, but there's one peculiarity. As a rule, trading is only suspended during the trading session in the country where financial institutions are closed.

That is, for example, on US Independence Day, there is no trading only during the American trading session, but on the same day, you can trade on other exchanges.

If you're interested in how the forex market operates during holidays, you can find the holiday schedule here: https://time-forex.com/info/vyhodnye-prazniki-forex

Laws of the foreign exchange market

The foreign exchange market operates according to general market laws; exchange rates are influenced by both internal and external factors.

External – economic events in the country responsible for issuing a particular currency, news from world markets that are to some extent related to a given monetary unit.

Internal – the size of supply and demand.

The trading process itself consists of a few simple steps performed using specialized software. A trader simply submits a buy or sell order for a currency at the current market rate, and the transaction is considered open.

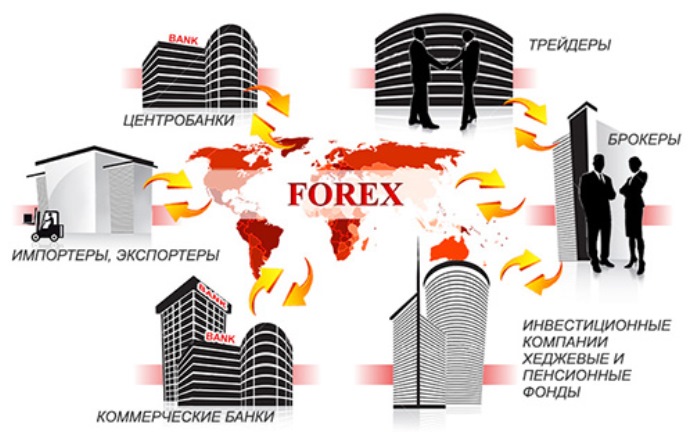

Participants of the foreign exchange market.

There are several main groups of traders who operate in the Forex currency market:

Market makers are the largest market players; they conduct their trading directly on the currency exchange itself, concluding large volumes of transactions. They have the power to independently influence exchange rates.

Dealing centers are essentially intermediaries through which anyone can trade. These companies accept orders from ordinary traders and forward them to large companies operating in the Forex market.

If you wish, you can start trading currencies yourself; all you need to do is choose a Forex dealing center.

DCs can also independently create their own trading platforms and provide currency liquidity; in this case, trading is conducted within the company, but at real forex quotes.

Traders are investors who invest their own money and trade on the forex market. Almost anyone with a small amount of money (literally a couple of dollars) can become a trader. To trade on the currency market, simply register with a forex broker and download the necessary software.

Using a trading terminal, a trader opens an order to buy or sell currency; the order is transmitted to their dealing center, which in turn transmits the order to their representative on the exchange.

Understanding how the foreign exchange market works is quite simple; the main thing is to correctly understand its entire structure and the process of conducting transactions.