Momentum Trading Strategy

Momentum trading is a short-term trading strategy that is actively used to make money on the stock market, and has recently found its application on Forex.

The principle used to open trades using this strategy is quite simple; it is based on non-standard price behavior.

This type of trading is often called impulse trading, since the investor needs to notice the appearance of an impulse and open an order in its direction.

The basis for opening positions here is not fundamental factors, as is usually customary in the stock market, but statistics on price behavior and technical analysis.

The strategy is quite difficult to use, so previously it was used only by fairly experienced traders.

Reasons for opening transactions in impulse trading.

There are many signs by which you can determine that a good trend has emerged in the market and the price will allow you to make a profit.

1. Price acceleration - in this strategy this is the main entry signal; if you see that during the day the price is moving at a speed of 10 points per hour, and in the last 10 minutes 20 have passed - this is the best signal for placing an order.

To use this signal, you must first study or independently the statistics of the speed of movement for the selected stock or currency pair.

2. An increase in volumes always confirms the movement that has occurred and, to some extent, can serve as an additional filter against false signals.

2. An increase in volumes always confirms the movement that has occurred and, to some extent, can serve as an additional filter against false signals.

3. Overcoming resistance or support levels - a breakdown of the boundaries of the price channel, can also speak in favor of a good moment to enter the market.

4. Fundamental factors - although the strategy is based on technical analysis, it is never a bad idea to check the reasons for a sharp jump in price.

And if such reasons are present in the news feed, this will be additional confirmation of the emerging movement. To simplify the process a little, you can use the volume indicator and channel indicator

Automation of the Momentum Trading strategy

In addition to the above options, there is another, simple way to catch the impulse; to do this, it is enough to place a pending order.

This order will only work if the price reaches the level we set within a certain time.

That is, according to calculations for 4 hours, the exchange rate of the euro/dollar pair should not exceed 1.1555, and if it reaches 1.1600, then our Buy Stop , after which a purchase transaction will open.

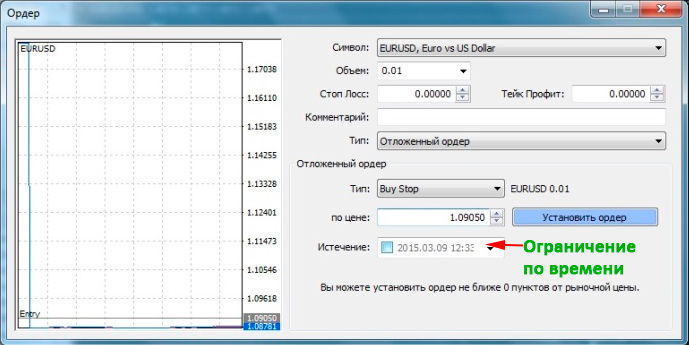

Technically, we set a time limit when activating a pending order, in which we put a checkmark in the “Expiration” box and set the time until which our order is valid.

Technically, we set a time limit when activating a pending order, in which we put a checkmark in the “Expiration” box and set the time until which our order is valid.

For example, if you set it to two hours, then if the price does not reach the desired value within two hours, the order will no longer work. This means that the impulse has not arisen and the trend is moving at the usual speed.

Closing trades occurs after you notice a slowdown in price movement and a reduction in trading volume, both of which can indicate the likelihood of a reversal.

The “Momentum Trading” strategy allows you to get quite a large profit, since the price covers a fairly large period in a short time.

The main thing is to notice the beginning of the impulse in time and open a deal. You will find a description of another version of a similar strategy on the page - http://time-forex.com/strategy/strategiya-torgovli-na-impulsakh