Breakout Forex strategy

Trading sessions in the Forex market are one of the most important elements, thanks to which the market operates around the clock. The thing is that each trading session is tied to a specific region where a large exchange platform is located.

The thing is that each trading session is tied to a specific region where a large exchange platform is located.

Thus, when a session closes in one region, it immediately begins in another. Depending on your geographic location, you can also observe surges in activity on certain trading instruments.

So, for example, quotes of the American dollar move very actively during the American trading session , the European currency is active during the European trading session.

And Asian currencies such as the Japanese yen are active during the Asian trading session.

That is why at night you will never see strong movements in the US dollar and the European currency, and the yen can reach new heights.

General principles of the Breakout strategy.

Due to a simple and well-known pattern in the activity of certain currencies according to trading sessions, the “Forex Breakout Strategy” was invented. During a certain trading session, a currency, as it moves, creates a certain trading range that has a minimum and a maximum.

These created levels during the session are very important, because when they are broken, the price gains new momentum. Such surges are very noticeable during the transition from the Asian trading session to the European one, since the European currency seems to wake up after complete inactivity.

Also, if the euro is gaining ground very strongly, then during the American trading session the dollar is trying to restore its status. Therefore, when working on the strategy, no attention is paid to where exactly the currency will go, but a bet is made that when the border of a certain session is broken, the chart with quotes will update a new minimum or maximum and create its own range. To do this, the strategy uses two differently directed pending orders.

Preparing your strategy for work

Trading sessions can be easily identified manually in the MT4 trading terminal depending on the time, however, to make the trading process more convenient, we will use a special indicator. To do this, go to the end of the article and download all the necessary elements of the strategy.

Next, through the file tab, enter the terminal data directory and copy the indicators to the Indicators folder, and the template to Template. After updating the tools in the navigator panel, enter the list of templates and run “Breakout of lows and highs of trading sessions.” As a result, you will get this type of work schedule:

Features of the breakout strategy and trading signals

The trading strategy “Breakthrough of the minimums and maximums of trading sessions” can be used on any time frame, since the trading session is strictly limited in time, so the number of candles does not matter, because the i-Sessions indicator strictly displays certain trading sessions and their minimums and maximums.

As you may have noticed, the indicator highlights them in the form of rectangles, with the Asian one highlighted in light brown, the European one in gray, and the American one in blue.

The breakout strategy is designed for currency pairs that contain European or American currency. For example, the most popular pairs for the strategy are pound/dollar and euro/dollar.

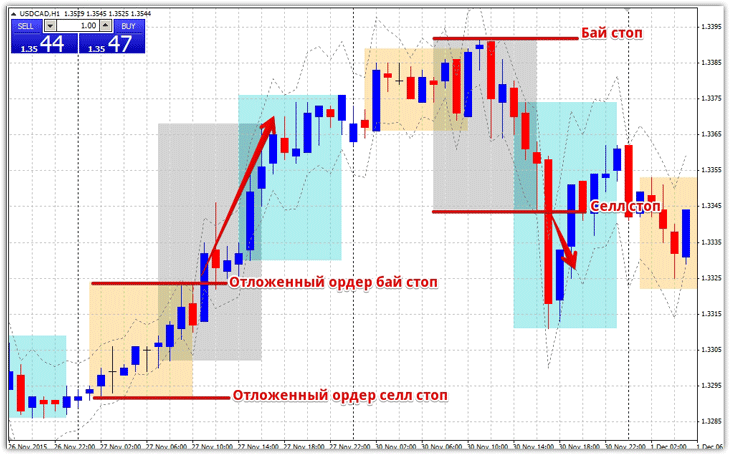

So, now to the signal. To work according to the strategy, two pending orders, buy stop and sell stop, are used, which must be set at the minimum and maximum of the trading session. The buy stop is set at the high of the trading session, and the sell stop at the low of the trading session. See an example below:

The example shows established pending orders at the lows of the Asian trading session and the European one. Some traders do not delete the second pending order if the first one is triggered, but so that you do not end up with a lock when one is triggered, the second one must be deleted.

The example shows established pending orders at the lows of the Asian trading session and the European one. Some traders do not delete the second pending order if the first one is triggered, but so that you do not end up with a lock when one is triggered, the second one must be deleted.

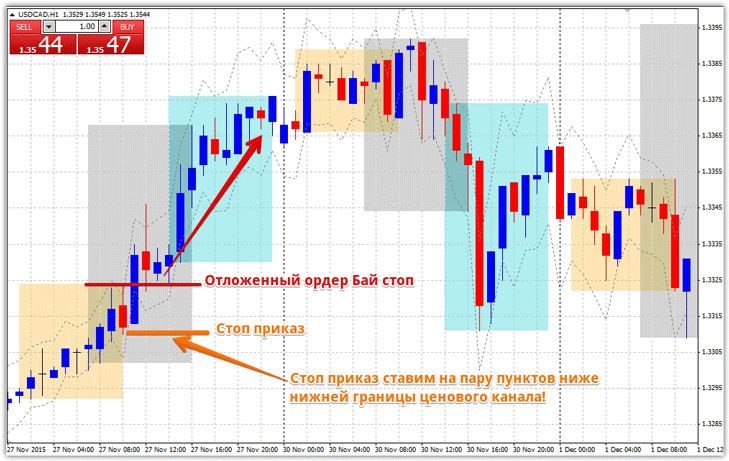

Setting a stop order

The ATRonChart indicator is used to determine the levels for setting stop orders. It draws a price channel around the price as dotted lines. When a buy stop pending order is triggered, we need to place our stop order a couple of points below the lower border of the channel, and when a sell stop order , we place our stop order a couple of points above the upper border of the channel.

Alternatively, you can place an order using the Parabolic or Fractal indicator. Example in the picture below:

Profit setting, money management

If everything is very clear with setting stop orders and placing pending orders, then problems always arise with defining goals in this type of strategy.

For breakout strategies, you can use two options for setting profit, namely, with the first method, your profit is equal to the stop order, and with the second method, you need to measure the number of points from the minimum to the maximum of the trading session and set the profit equal to half of this distance.

In terms of risk management, you need to correctly calculate your trading lot . Try to follow the classic risk management model, namely, your loss per position should not exceed more than three percent of the deposit.