The Wyckoff Price Cycle, Part Two

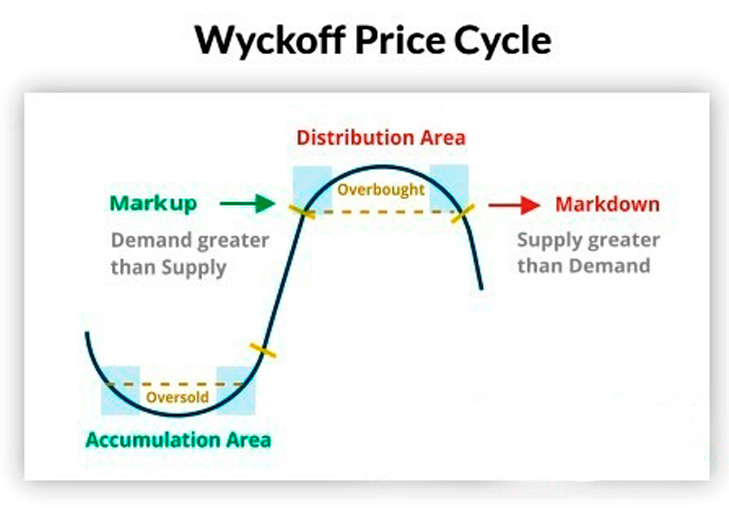

According to Wyckoff, investors can understand and predict markets through supply and demand analysis, conducted by studying the behavior of price, volume and time.

He described a diagram of the stages of the price cycle, thereby determining the most successful entry time.

Accordingly, the time to open a buy order occurs at the end of preparation for an uptrend (the end of the accumulation phase).

And the time to enter a sell is at the end of preparation for a downward trend (the end of the segmentation period). distribution).

4 Stages of the Price Cycle or Wyckoff Price Movement

Accumulation phase

This is the period when large players in the market begin to accumulate assets. A large amount of money is poured into the market gradually so that the price does not react too much.

In the accumulation phase, the market tends to move sideways, also called flat .

Bullish phase

When the market exits the accumulation phase, the bullish phase will begin. Having carried out a sufficiently large number of shares, plus the selling force weakened, buyers quickly pushed the price up, and a new trend was formed.

The bull phase encourages those not participating in the market to buy shares, causing demand to exceed supply, pushing prices even higher:

However, during this bullish phase it is not necessary for the price to always go up, but the market will have short periods of accumulation (overaccumulation, pause) or small declines ( correction ), then the price will move sideways or down for a short period of time before resuming this bullish phase.

The stage of distribution

Once the need to buy shares was satisfied, high-yield investors began distributing their assets to late entrants, selling shares to lock in profits.

This stage is also skillfully done by market makers so that the price does not fall quickly and the shares maintain their price.

Sale period

Market makers began selling more shares, pushing the market lower, which prompted other investors to sell shares as well, causing supply to exceed demand, pushing the price lower.

Compared to the period of accumulation and rising prices, the bearish phase is faster and more intense because during this phase, investors tend to want to quickly sell assets to exit their positions:

Similar to the bull phase, the market does not always go down during the bear phase, but there will be short periods of time when the market reallocates or corrects upward (also known as a temporary recovery) before the downtrend continues .

At the end of the bearish phase, the market will resume the cycle with a new accumulation phase.

Wyckoff chart in two important phases of the price cycle: accumulation and distribution.

One of the main goals of the Waikoff method is to find the correct entry point for the best risk and remuneration ratio.

Wyckoff defines a trading range (TR) as the place where the previous trend (up or down) stops and there is a relative balance of supply and demand in the market:

In a trading range, the "major forces" of the market prepare their bullish or bearish strategy during periods of accumulation and distribution.

In the TP accumulation or distribution phase, buying and selling activity is very active, but in the accumulation phase more shares are bought than sold, and in the distribution phase more shares are bought than sold. bought.

The degree of accumulation or distribution will determine the strength of the price breakout from the TR zone.

A trader using the Wyckoff method succeeds by correctly assessing the direction and strength of price when it leaves the TR zone.

This method will provide traders with guidance on identifying events and price behavior during each period of accumulation and distribution, thereby determining price targets in the next trend.

And for this, the Wyckoff method divides the period of accumulation and distribution into many different sub-periods, describing the behavior of the price in each of these sub-periods.

To be continued