Forex trend line

The trend line is one of the oldest and most effective tools of technical analysis, which dates back to the first definition of the trend by Charles Dow.

Before moving on to the trend lines themselves, I suggest you remember what a trend is and what types of trends are identified by technical market analysis.

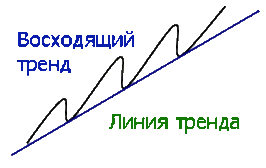

According to the Dow, a trend can be upward, downward, or horizontal. An uptrend is a successive increase in peaks, with each new peak and trough higher than the previous one.

A downward trend is characterized by the gradual appearance of downward peaks, with each new peak forming lower than the previous one.

A horizontal trend, also called a flat , is characterized by the fact that all new peaks and troughs are in the same vertical plane and practically at the same level.

Drawing trend lines

Since trend lines are the most popular tool in technical analysis , there are simply a lot of ways and methods for constructing them. Sometimes there is an opinion that there is simply no clear definition of how to build a trend line, since everything depends on the trader’s vision of the reference points, rather than on a clear, logical construction algorithm.

However, if you bring the whole mess into one plate, then you can highlight one simple rule: to draw trend lines you need at least two reference points. If for an uptrend the line is drawn using two price minimum reference points, then for a downward trend it is drawn using two maximum reference points.

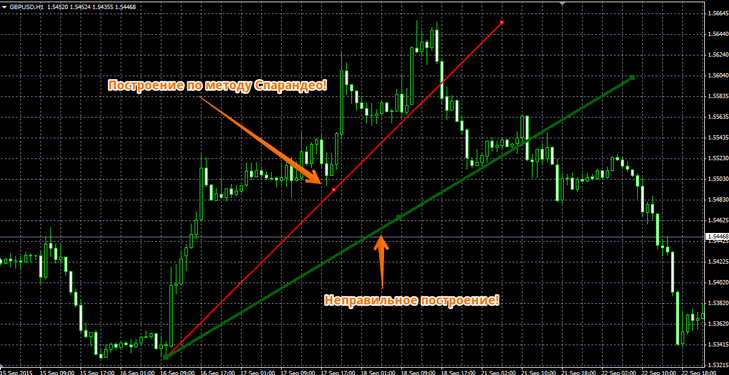

Victor Sparandeo more clearly formulated the rules for constructing trend lines, and you can get acquainted with his method in the article entitled Sparandeo Method . Briefly described, Sparandeo for an uptrend suggests building a trend line based on the minimum point and the second point that precedes the largest price maximum.

For a downtrend, the line is drawn from the high point and the second point that precedes the highest low. An example of constructing a trend line is shown in the picture below:

In the example, you can see two types of trend line construction, but if you build according to Sparandeo, you would see much earlier that a trend break has occurred, unlike the other option, when you would take a broken trend as still active.

Therefore, in terms of construction, the Sparandeo method is the clearest and is what I recommend using for all beginners. Also, most people have a question: should they build based on shadows or closing and opening prices? In this case, there is no definite answer, but most often it is more convenient to build using the shadows; however, the trend line drawn using the body of the candle will also be correct.

Trading signals when working with trend lines

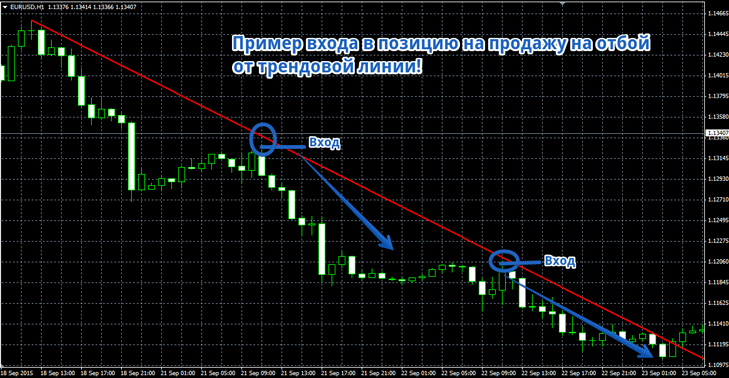

Since we have learned how to build trend lines, let's look at the trading signals they give. Despite the fact that they perfectly show a trend reversal, the vast majority of traders use them as support and resistance lines and enter a position in the direction of the trend to rebound from the line. For better understanding, I suggest looking at the example below:

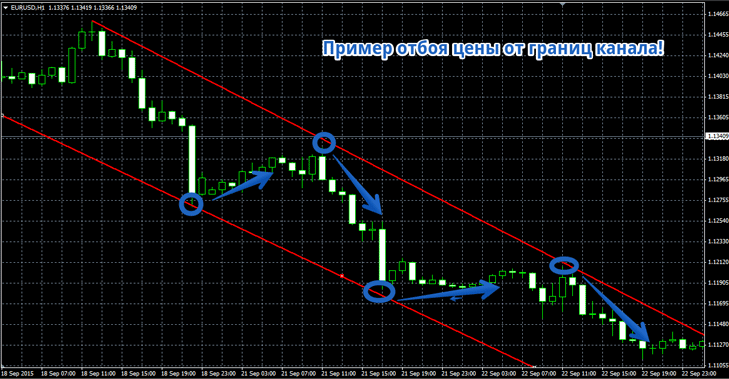

Using trend lines, a technical analysis tool such as a channel is constructed. To do this, it is necessary to draw, in addition to the usual trend line, a second line according to the same principle but at the minimum or maximum points, depending on the trend (upward or downward).

Thus, we plot a support and resistance line on the chart that forms the boundaries of the channel and trade to rebound from them. For understanding, see the picture below:

When working in a channel, you must understand that the trades that you open against the main direction of the trend should have a small profit, since you are working against the trend, which is often fraught with consequences. However, thanks to this approach, you have the opportunity to take profits from the slightest wave-like price movements.

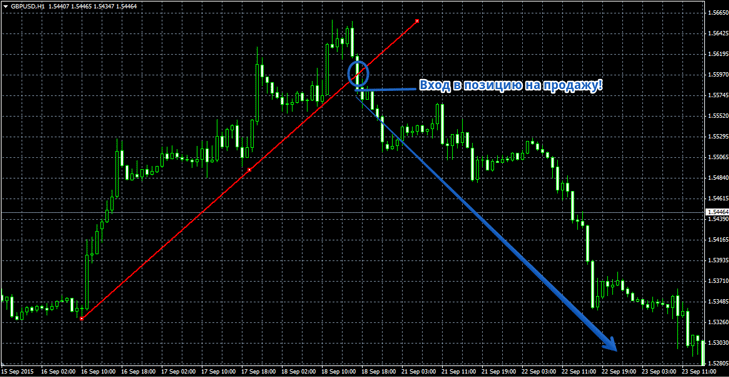

Also, with the help of trend lines, you can promptly learn about a change in trend and at least close the positions that you had open along the trend, as well as enter a position along the newly formed trend. The position is entered when the trend line is broken. For a complete understanding, I suggest you look at the picture below:

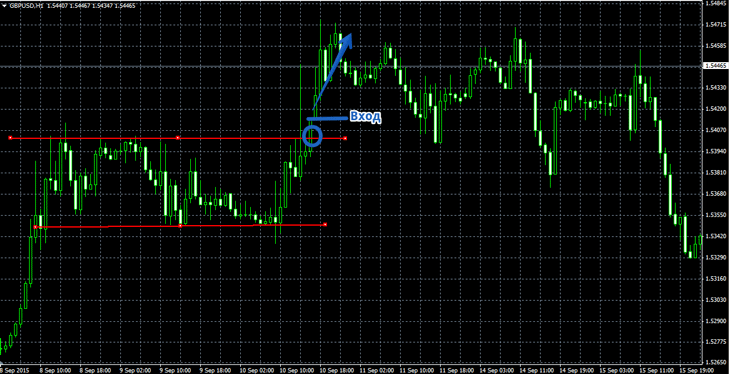

Trend lines that are drawn for a horizontal market, or in the slang of flat traders, are called levels. Such lines act as support and resistance, and construction occurs at two points for each of the lines. The signal to enter a position is the price breaking through one of the lines. An example is shown in the picture below:

Trend lines are one of the first tools of technical analysis, however, despite their antiquity, if used correctly, you can build quite profitable trading tactics. The variety of their applications, as well as the number of trading signals they provide, will not let even the most active traders get bored.