Dow Theory for Forex Trading

Before you begin learning technical analysis, you need to study the history and principles on which it is based.

After all, if you begin to study such a broad area, a ton of questions arise that are connected precisely with the foundations and foundation on which it is built.

The world first learned about the Dow Theory thanks to the world-famous publication of the book "The ABCs of Stock Market Speculation," which was written by S. Nelson.

It was here that you first encountered the term "Dow Theory." The book's author based it on articles written by Charles Dow in the Wall Street Journal, where he shared his theoretical views on the stock market.

The articles were published in the late 1990s, but Charles died a few years later, and the world never saw his practical research. However, this didn't stop Nelson from systematizing his acquired knowledge and formulating it as Dow Theory, which became the foundation for the development of technical analysis.

Like any theory in any scientific field, it is built on unshakable postulates. Once you familiarize yourself with them, you'll immediately understand why Dow Theory remains relevant today and can be applied to both stock market and forex trading. Now, let's get to the postulates:

1) The price takes everything into account.

Charles Dow argued that price takes into account all factors that can influence the market, so when you see a particular price for a stock, index, or currency, you should understand that all economic indicators, statements by politicians, and various natural disasters, catastrophes, terrorist attacks, and calamities are taken into account.

You might ask why? The fact is, we all buy and sell based on certain facts. Some pay attention only to political statements, others look at economic reports, and still others rely on key psychological factors. But one way or another, all factors collectively influence the price, because we, as market participants, move the price with our purchases and sales based on these factors.

2) Price movement is always subject to trends.

For a long time, it was believed that price movements were chaotic and unpredictable. However, Charles identified three types of trends: uptrends, downtrends, and sideways. Their definition is extremely simple: if each new peak is higher than the previous one, you're in an uptrend . In a downtrend, each new peak is lower than the previous one, and in a sideways movement, new peaks are roughly in the same range. For a better understanding, see the image below:

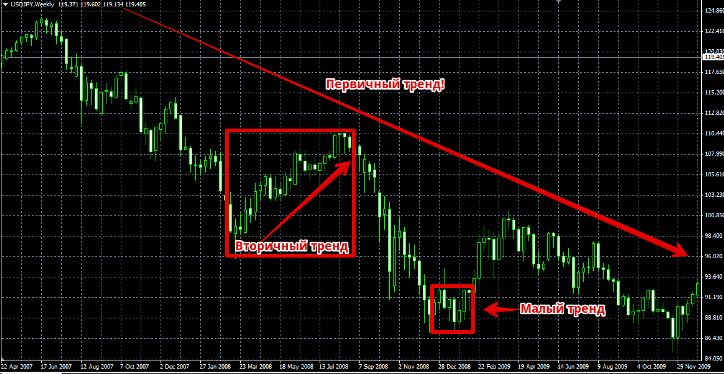

The theory's author also divided trend types based on trading ranges. According to the theory, there are three types of trends: primary, secondary, and minor. The primary trend is considered long-term, the secondary trend is intermediate, and the minor trend is short-term. For a simple understanding, open a chart of any currency pair and the first thing you'll see is a major primary trend.

It is, by Dow's definition, primary, but we also see large pullbacks, which the author calls secondary trends. It's important to remember that both primary and secondary trends are not so straightforward and consist of smaller movements, which Charles calls minor trends. To understand what he's talking about, I suggest looking at the image below:

3) The primary trend consists of three phases

Charles Dow identified three phases of a primary trend: accumulation, participation, and realization. The accumulation phase is the beginning, or, more simply, the reversal of a primary trend and the emergence of a new one. The first phase is interesting because it occurs thanks to the most far-sighted traders, who begin buying or selling currencies while the main participants are oblivious and hoping for a continuation of the trend.

Typically, this movement is very small, and many perceive it as a pullback . The participation phase occurs thanks to traders using technical analysis and, upon seeing a new wave, actively participating in it. During the second phase, the price moves a long distance, leading to the formation of an obvious trend.

The implementation phase is interesting because it is entered into when the trend is already obvious, but it is during this phase that a turning point occurs, since the first two groups that participated in the first phases begin to close their positions and go against the trend.

The third phase can also be called the hype phase, since it's during this phase that all TV channels and news outlets trumpet the current market situation. To understand the three phases, look at the image below:

4) Indexes must be consistent

This rule primarily applies to the stock exchange and the two Dow Jones indexes, and their rule states that if a signal appears on one index, then after a certain period of time a signal should appear on the second index.

This rule also applies to the forex market, because if you see a reversal in one grade of crude oil, such as Brent, then WTI will also reverse. The situation is similar with currency pairs : if you see a rise in EUR/USD due to bad news for the dollar, then you should expect a similar reaction in other currency pairs that use the dollar as confirmation.

5) Trading volume must confirm the trend

Unfortunately, this rule only applies to the stock market, as the tick volume we see on Forex doesn't reflect the actual flow of funds into buys or sells. However, according to theory, every trend should be supported by a monetary volume that reflects the actual interest of market participants.

6) The trend continues until new signals appear to change it

First and foremost, this rule tells us that any trend is not limited in time and will continue until new factors emerge that reverse it. Many people misconception that a trend is somehow tied to time, and that if a chart has been trending upward for a year, it will soon reverse.

This misconception is shattered if you look at the gold chart and calculate how many years it has been growing.

Let me remind you that the Dow Theory lies at the origins of technical analysis , so it remains relevant in the Forex market to this day.