What is a basis point and what does 25, 50 or 100 basis points equal?

There are a multitude of forex terms we encounter even in real life.

The term "basis point" is one such concept; we hear it mentioned almost daily in financial news when discussing interest rate changes.

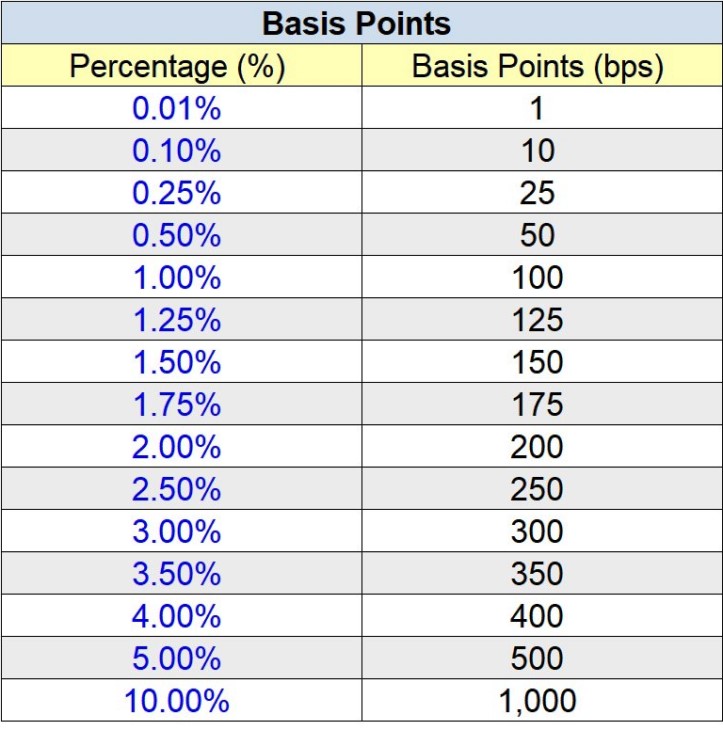

A basis point is one-hundredth of a percentage point, meaning 100 basis points equals 1%.

It characterizes the change in the new interest rate relative to the previous one; it's not the rate itself, but its change.

For example, if you heard that the US Federal Reserve's interest rate on the dollar changed by 0.5% and is now at 2.5%.

That is, there is a simple formula for converting basis points into percentages; for example, you heard that the US dollar rate increased by 50 basis points.

2% (initial value) + (0.01% × 50 (change) = 2.50%

If you want to calculate the percentage change in business points yourself, it's even easier to do. To do this, multiply the number of points by 0.01%:

For example, if information was received that the Central Bank's interest rate was changed by 25 basis points, it is easy to calculate the amount of the change in percentage

% = 25 x 0.01% = 0.25%

Accordingly, 10 pt. = 0.1%, 50 pt. = 0.5%, and 100 pt. = 1%

It would seem that such calculations only add confusion to simple things, but this variable is introduced to reflect minor changes in interest rates.

It's easier to say that the interest rate changed by five basis points rather than by zero point five percent.

Application of the basis point in other cases

The concept of a basis point is often confused with a point in a stock exchange quotation , but it turns out they only have the same name.

A point in a stock exchange quotation denotes a change in the last digit of an asset's price, and quotations themselves can have from one to five decimal places.

Here, completely different calculations come into play; for example, in the EUR/USD currency pair quote of 1.09251, one point will be equal to 0.0001.