Bid exchange (price) selling price

Exchange operations have two directions - buying and selling, each operation is carried out at its own price.

Bid (price) is the price at which you sell currency or another asset on the exchange; this indicator is always lower than the Ask selling price and is listed first in the currency quote.

Bid (price) is the price at which you sell currency or another asset on the exchange; this indicator is always lower than the Ask selling price and is listed first in the currency quote.

In other words, bid is the price at which you buy an asset you previously purchased or the price at which you open a short sell position.

Sometimes it is also called the asking price, since it is the bid that more fully characterizes the level of demand for a particular financial instrument.

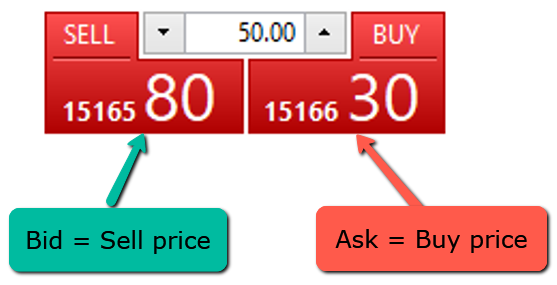

This is clearly visible in the trade opening window, where under the Sell button you see the exchange bid price used for the sell transaction:

Where else is bid used besides the Forex exchange?

The use of this term is quite broad; in addition to the forex market, it is also used in other areas of activity:

When conducting foreign exchange transactions at commercial banks, the buying and selling rates are always indicated. You can see an example of this at any exchange office or currency exchange rate :

On the stock exchange, there's also a price for selling shares of stock.

This applies to transactions involving precious metals and other commodities. For example, gold is bought from you at $50 per gram and sold at $60 per gram.

On the commodity exchange, there are quotes for goods such as oil, wheat, cotton, and gas.

The bid indicator is always lower than this, since this is the price that is taken into account when you open a sell transaction in the trader's trading platform by pressing the "Sell" button.

You will conclude all sell transactions at the bid (price) on the exchange, and in order to make a profit, you will need to wait for the price to fall even further; it must overcome the spread and fall below the ask .

Since you will have to close the sell trade at the ask price, if you sell and then immediately close the trade with a buy, you will incur a loss equal to the broker's spread.