Why you need an ECN account on Forex, brokers, and trading features

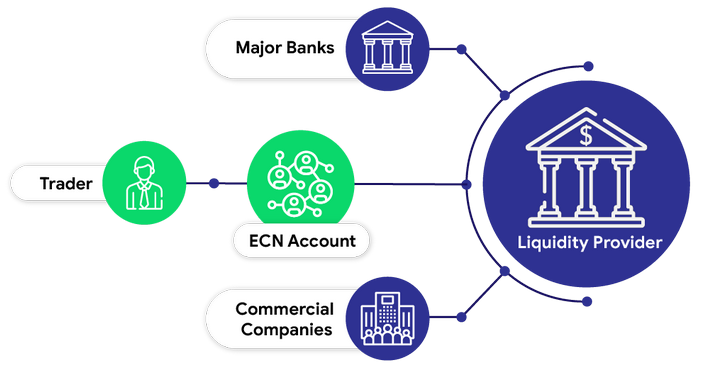

An ECN account is one of the most convenient options for trading, as trading in this case is conducted using the Non-Dealing Desk system.

case is conducted using the Non-Dealing Desk system.

This means that all transactions are transferred to the interbank market, where currency trading itself takes place.

This approach allows for maximum liquidity, reducing spreads to near zero.

This type of account is available through ECN brokers , whose presence in the forex market is growing daily.

Trading without broker intervention occurs through electronic systems that transmit client orders to the foreign exchange market at maximum speed.

It's no coincidence that the acronym ECN stands for Electronic Communication Network. Using such a system does not require human intervention in executing trading orders:

In other words, you submit a request to open a trade in the trading platform, it is sent to your broker's server, and from there to the global currency market, where it finds a counter-order.

The main advantage of an ECN account is that this type of trading does not create a conflict of interest, whereby the broker profits from the client's losses.

The brokerage company's responsibilities include only ensuring uninterrupted communication and charging a commission for its work.

Peculiarities of trading on ECN accounts

When it comes to the advantages of trading on ECN accounts, there are quite a few, and it's no wonder this option is recognized as the best solution for professional trading:

- Lower spreads (fees for opening trades)

- The ability to make transactions of maximum volume

- The maximum order execution speed depends only on the speed of the Internet connection

- 24/7 trading, and 7/7 when using cryptocurrency pairs

- Availability of information on the volume and direction of transactions concluded by other trading participants

- The ability to influence the market by concluding large transactions

As for the disadvantages of these types of accounts, they include:

- lower leverage, usually several times lower than on PRO

- Some brokers have high initial deposit requirements, often with a minimum of $500

an ECN account with a deposit of $10 from a leading broker

However, even this doesn't make ECN accounts any less attractive for trading, as you're not trading in a private office, but in the real currency market. This virtually eliminates the possibility of fraud from your forex brokerage.

In addition, I would like to point out that while ECN accounts previously only allowed for Forex trading, now these accounts also allow for trading other assets, such as metals, stocks, commodities, and indices.