Direct and indirect currency exchange rates explained with simple examples

A currency rate is the price of one currency in units of another currency. It reflects the relationship between two currencies and is used for currency exchange.

In this case, the first entry in the record is the currency that is being bought or sold, and the second entry is the monetary unit in which the price is indicated.

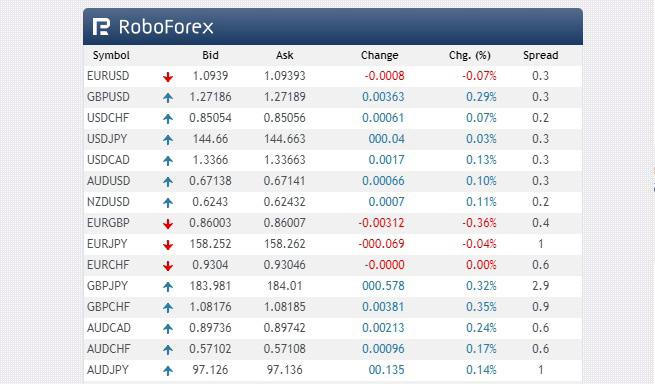

For example, a standard entry looks like this: EURUSD 1.25, the cost of the euro is currently 1.25 US dollars per 1 euro.

The price of a currency is set during trading on the Forex currency exchange or at a fixed rate by national banks of countries.

Today there is a direct and inverse exchange rate:

A direct quote shows how many units of one currency can be purchased with one unit of another currency. For example, if the direct quote between the US dollar and the euro is 1.25, this means that one US dollar can buy 1.25 euros.

Direct quotation is also used when setting the exchange rate of the national currency to foreign currencies.

For example, we are used to seeing that in Ukraine the exchange rate of the Polish zloty to the Ukrainian hryvnia is 9.6 hryvnias per 1 zloty, and the entry would look like this: PLNUAH.

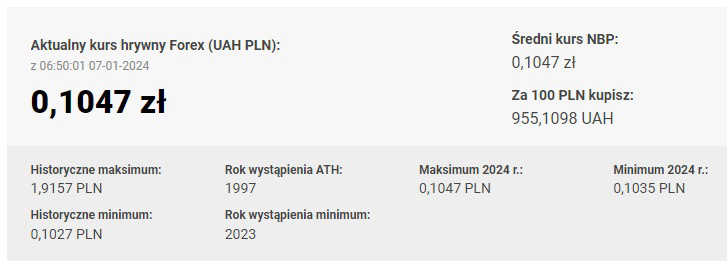

At the same time, if you come to Poland, you will already see that in this country, all exchange offices exchange hryvnia for zloty, and the price is indicated as 0.1 zloty for 1 Ukrainian hryvnia. Accordingly, the direct quote has a different form: UAHPLN.

Examples of the most commonly used direct quotation:

USD/EUR = 1.25

USD/GBP = 0.75

USD/JPY = 110

An inverse quote indicates how many units of one currency are worth one unit of another currency. For example, if the inverse quote for the US dollar to the euro is 0.8, this means that one dollar is worth 0.8 euros.

This exchange rate conversion option is used when you need to perform the reverse transaction, because you will not always sell dollars for British pounds, you may want to perform the opposite transaction.

Examples of inverse currency quotations:

EUR/USD = 0.8

GBP/USD = 1.33

JPY/USD = 0.0091

In the financial sector, a direct quotation is often used, which is used for exchange trading on the currency exchange - https://time-forex.com/kotirovki

However, the euro or the US dollar is not always the base currency

This is due to certain standards used in exchange trading, and we're more accustomed to this notation. For example, if you want to buy euros with US dollars, you're more likely to say you want to buy 1.25 euros per dollar rather than 0.8 dollars per euro.

However, a reverse quote can also be useful in some cases. For example, if you want to calculate how much money you'll get for selling dollars, you'll need a reverse quote.

So, for example, you have $150 and want to determine how many euros you'll get for it: 150 x 0.8 = 120 euros. For many, this option will seem simpler than dividing 150 by 1.25.

Conclusion

Direct and indirect currency quotes are two basic terms used in foreign exchange transactions. They reflect the relationship between two currencies and are used for currency exchange.