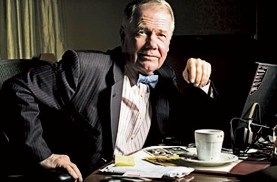

James Beeland Rogers

When we look at the success stories of various notorious figures in the trading world, we forget about the people who helped them rise to the top.

people who helped them rise to the top.

James Beeland Rogers is a leading financier, international investor and co-founder of the well-known international investment fund Quantum.

Yes, it was precisely that “Quantum” thanks to which the whole world learned about such a person as George Soros.

James is also known for his world records and wonderful books that motivate goal-oriented people to engage in investing and provide instructive advice on how to avoid the mistakes the author himself encountered.

The beauty of his books is that they are written in accessible language, and their author is not just a writer, but a real trader and investor who has shown from his life experience that anything can be achieved.

History of life.

James was born in 1942 in Baltimore, Maryland. He spent his childhood in Demopolis, Alabama. James was initially fascinated by history, so he studied history at Yale University.

However, as a student, he decides to enroll in Oxford, where he begins to study in depth the world of finance, political science, and philosophy.

In 1970, he landed a job at the leading investment bank, Arnhold and S. Bleichroder, where he successfully pursued his career. George Soros was also working at the bank at the time, so their meeting was inevitable. Sensing their potential, the future investment legends decided to create their first hedge fund, Quantum.

It was after the creation of Quantum that both George Soros and James Rogers experienced phenomenal success. This success was backed by enormous performance indicators. For example, Quantum demonstrated a 4,200 percent increase over its ten years of operation, while the S&P 500 Index rose only 48 percent over the same period.

1980 marked a turning point in James's life, as he decided to leave the Quantum fund. From then on, his investments were based solely on the capital he had earned.

With so much free time, he began teaching at Columbia University's Graduate School of Business, and believe me, his lectures were very popular. James also began to get involved in media production, appearing on various business channels and hosting his own shows.

Hobbies and Success.

In 1990, James Rogers became the official Guinness Book of Records holder after he managed to travel 160,000 kilometers through 52 different countries on his motorcycle.

This trip allowed James to experience many countries from the inside, so his investment ideas were shaped not by general information but by meetings and firsthand experiences. This trip inspired him so much that, after the tour, he wrote a book, "Investment Biker: Around the World with Jim Rogers."

In 1998, James Rogers created his first commodity index, the Rogers International Commodities Index. Just a year later, Rogers decided to repeat his journey, this time not on a motorcycle, but in a specially modified car with his wife.

His journey lasted for three years, during which he covered a distance of 240 thousand kilometers and visited 116 different countries around the world.

Upon his return, he wrote another book entitled “A Bull in China: Investing Profitably in the World’s Greatest Market,” and his stunt was again included in the Guinness Book of Records.

In 2004, he published a fascinating investment book entitled "Commodity Exchanges: The World's Hottest Markets: How Anyone Can Invest and Profit." After all his travels, James Beeland Rogers became an active investor in the Asian market, and he ardently convinced everyone that Asian markets were the future.

So in 2007, he and his family moved from New York to Singapore. In 2012, he launched a new index called the Rogers Global Resources Equity Index, which brings together the most advanced companies in various promising economic sectors.

James Beeland Rogers has insisted in every interview that the future lies in the development of industries that produce natural products. He therefore smirks when he says that in the future, it will be farmers driving Lamborghinis, not Wall Street financiers.

He also sees excellent opportunities for economic growth in Russia in the near future, and, unlike George Soros, he is actively investing in various sectors of production in the Russian Federation.