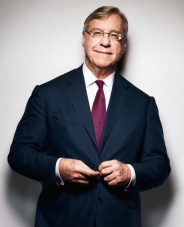

Trader Jim Chanos: The Biggest Bear in Financial Markets

If you study the success stories of many traders, you will come to the conclusion that they were all typical "Bulls", namely, they managed to find undervalued stocks and after purchasing them, they became millionaires in a matter of months.

However, it was extremely rare to encounter a success story where a trader, without any inside information, managed to predict the collapse of a company or the economy and profit from these events.

Of course, you can cite the example of George Soros, but he has been repeatedly accused of using insider information, and the so-called Black Friday may not have been an accidental victory, as many believe.

However, while all hedge funds are constantly busy searching for undervalued stocks, the Kynikos fund and its founder, Jim Chanos, are the largest short sellers who profit from the weaknesses and vulnerabilities of companies and countries.

Jim Chanos has a real knack for spotting scam companies and magically profiting from their bankruptcy.

The family had enough income to provide their son with a decent education, as they owned a chain of laundries in the city.

Jim Chanos spent his summers working part-time at a laundromat, which allowed him to support his education. After graduating from Birmingham Groves High School, he enrolled in Yale University's economics and political science department, graduating with honors in 1980.

Trader career

The future legend and biggest bear in the financial markets began his career at the very bottom – as an analyst. For $12,000 a year (a thousand a month) and an eighty-hour week, Chanos produced analytical forecasts and reviews for Blyth Eastman Dillon.

In one interview, Jim Chanos admitted that he would have earned more in a year shoveling snow in his hometown than working for the company. However, Chanos's career didn't stand still, as after the company's demise, Jim was invited to join a new company and significantly promoted, giving him the opportunity to implement his ideas.

Chanos's position as an analyst at the new Gilford Securities firm brought him enormous fame, as his forecasts enabled the company to profit from the decline in Baldwin-United shares, as Chanos had predicted the company's bankruptcy, and the Gilford Securities fund began shorting the stock a couple of months before the bankruptcy.

A successful career as an analyst at Gilford Securities allowed him to earn good money and move on to the next level, becoming an analyst and then vice president at Deutsche Bank Capital Corp.

Working in a company where the potential of a trader and manager was limited could not bring moral satisfaction to Jim Chanos, so he decided to resign from his position at the bank.

And open your own hedge fund in 1985 under the name Kynikos, which translates from Greek as "Cynic".

The company, which specializes exclusively in short positions, has greatly attracted the attention of investors, especially since at the time of the fund's founding, the authorized capital was no less than 16 million dollars.

However, the fund's greatest notoriety and wealth came after the massive collapse of Enron. Jim Chanos studied the company's financial statements and discovered that it was engaged in fraud on a massive scale.

By involving the media, Jim Chanos created a huge scandal, which months later led to the collapse of the company, while Chanos had already been in sales for a long time and was earning billions of dollars from this deal.

During 2013, the fund's asset size decreased by almost 13 percent and amounted to $4 billion, but in 2014 the fund successfully made short trades on the fall in oil prices, as well as precious metals, increasing by more than 19 percent annually.

The foundation currently stands at over $8 billion, and its founder is actively involved in teaching and philanthropy.