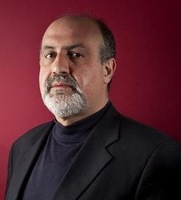

Nassim Nicholas Taleb

Nassim Nicholas Taleb is a renowned trader, philosopher, and scientist. In addition to being a renowned theorist, Taleb is also a practicing trader and the founder of Empirics LLC.

His hedge fund generated billions in profits for its investors during a severe financial crisis. His books were translated into 17 different languages, and Nicholas himself was recognized as a genius of the stock market.

Nicholas had a particular interest in statistics, specifically random events that could influence the global economy.

Nassim Nicholas Taleb was born in 1960 in Amoun, Lebanon. Nassim's family belonged to the Orthodox Christian caste and represented their interests at various political levels.

His grandfather and great-grandfather were deputy prime ministers of Lebanon, and his paternal grandfather was the highest judge in Lebanon. As for his parents, his father was a renowned oncologist. Overall, Nassim grew up in a wealthy, noble family.

After their deportation, Taleb's parents were able to obtain French citizenship, which allowed him to attend a French school and receive a much-needed education. Nicolas initially graduated from the University of Paris, where he also earned a PhD.

He later attended the University of Pennsylvania School of Business. His economic education provided a tremendous boost to his stock market career and worldview.

Achievements

Nassim Nicholas Taleb acquired his wealth during the 1987 financial crisis, but he gained worldwide recognition as one of the world's best managers in 2008, during the so-called global market recession. To understand just how successful this man has been in the stock market, just look at his list of positions.

Nassim held the position of chief trader at Union Bank of Switzerland, as well as chief derivatives trader at CS-First Boston and Banque Indosuez. Nassim was also a long-time executive director of CIBC-Wood Gundy.

Nicholas Taleb also served as the chief arbitrage trader at BNP-Paribas and as an independent market maker at the Chicago Mercantile Exchange. Taleb also serves on the boards of the Silvercrest-Longchamp NonGaussian Fund, BVI, Centaurus Capital LP Alpha Fund, and Centaurus Kappa Fund.

His successful career culminated in the creation of his own hedge fund, Empirica LLC, which focused on options and futures trading. During the crisis, this fund's returns reached 65 percent, a remarkable achievement during a period of widespread recession.

Taleb and the Black Swan

Taleb's views on statistical market analysis were quite different. He is considered the most vocal critic of statistical analysis and clearly asserts that what happened in the past does not guarantee its recurrence in the future. For example, in his book "The Black Swan," he uses a simple example based on the discovery of Australia, where the first black swan was observed.

So, for three hundred years, humanity encountered only white swans, so there was no debate about any other color for this bird. However, when humanity discovered Australia, they were surprised by a black swan, something they had never seen before. Thus, 300 years of observations and assertions were shattered by a single chance occurrence.

Taleb successfully adapted his theory to financial markets and, in his semi-philosophical book, showed with examples how unplanned events and statistics influenced historical price changes, namely those random events, such as so-called black swans, that completely rewrote the global economy.

For example, consider the collapse of the Twin Towers, sudden wars, and how they could influence markets. It was the theory of random events and their influence on financial markets that allowed Taleb to amass a vast fortune.

Taleb has authored a number of such bestsellers as “Fooled by chance"The Black Swan," "The Procrustean Bed," and "Antifragility." "The Black Swan" is considered a must-read for economists and future stock traders.