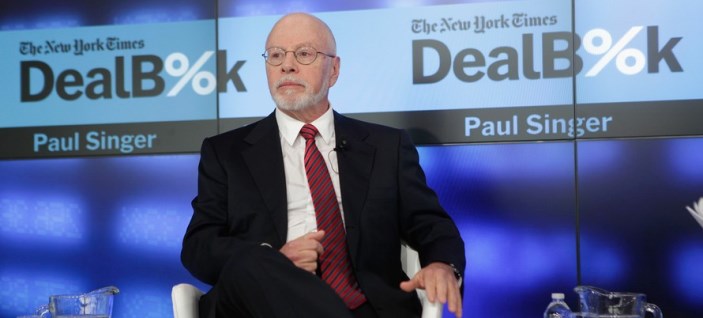

Financier Paul Singer is someone who makes money off other people's debts

A debt trap is the weakness of any state or government, which, through its stupidity and desire to please the people, effectively destroys its own economy.

Most interestingly, a debt trap as a result of mismanagement has sunk dozens of countries, not to mention the largest companies, which, despite having enormous capitalization, suddenly disappeared into oblivion.

However, while shareholders and ordinary employees suffer continuous losses, traders called "vultures" earn millions of dollars.

You will learn about the biography of one such "vulture," Paul Singer, who made billions on other people's debts, in this article.

Early Years. Paul Singer's Education.

The future billionaire Paul Elliott Singer was born on August 22, 1944. He grew up and spent his childhood in Teaneck, New Jersey.

His father was a simple pharmacist, and his mother was responsible for running the household and raising the children.

Almost nothing is known about Paul's early years, but in his youth Singer was very interested in psychology, so after finishing school, the obvious choice was made in favor of Rochert University,

There he received a bachelor's degree in psychology in 1966. He then continued his studies at Harvard Law School, graduating in 1969.

Trader career

Paul Singer was a very talented and financially savvy man, so when you study his biography, you won't find dozens of companies that he changed every year.

The only place where he worked for someone other than himself was the investment bank Donaldson, Lufkin & Jenrette, to which he essentially dedicated three years of his life.

In three years, they acquired colossal experience and their first capital, which became the basis for opening their own company.

In three years, they acquired colossal experience and their first capital, which became the basis for opening their own company.

So in 1977, having collected capital from his friends and relatives in the amount of 1.3 million dollars, Paul created his own investment fund called Elliott Associates LP.

To optimize taxation, he also opened a subsidiary in the Cayman Islands, NML Capital Limited.

Operating Principles and Incidents:

Paul Singer's nickname "The Vulture" is not without reason, as it effectively describes his operating principles.

Paul and his fund buy up corporate debt or government bonds that are on the brink of default.

The debt is thus sold for pennies, but thanks to pressure and a strong position in international courts, they are able to squeeze out maximum profits with minimal costs.

One such well-known story involves the purchase of $11 million in defaulted Peruvian bonds.

The Peruvian government was owed approximately $58 million in debt, which it categorically refused to do.

However, when internal unrest erupted and Peru's representative tried to flee, Paul's company grounded all planes and issued an ultimatum to repay the debt.

Naturally, in order to save his life and avoid going to prison, the president repaid the debt to Singer's company in full, which allowed him to earn 500 percent profit on one deal.

Another rather interesting situation arose with the purchase of Argentina's bonds. After the country defaulted, it contacted Paul Singer and offered a settlement, paying only 30 cents on the dollar.

Another rather interesting situation arose with the purchase of Argentina's bonds. After the country defaulted, it contacted Paul Singer and offered a settlement, paying only 30 cents on the dollar.

This situation didn't satisfy the fund, so it began defending its position in international courts. Consequently, numerous Argentine courts and assets were frozen, after which the government made its payments.

This enormous wealth propelled Paul to power, as he became a key player in the Republican Party's financial affairs. It's worth noting that Paul Elliott Singer is a vocal advocate for the LGBT community and was the only Republican to lobby for the legalization of marriage for couples with non-traditional sexual orientations.

According to numerous financial ratings, Paul Singer's personal net worth is estimated at $3.2 billion.

Another option for profiting from debt is to open trades selling shares of companies with large accounts payable. Filing claims will inevitably lead to a drop in price and, as a result, to your profit.

You will find other equally interesting strategies in the section - http://time-forex.com/strategy