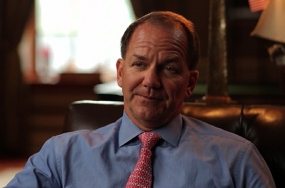

Paul Tudor Jones - Kings are not born, they are made.

Paul Tudor Jones is one of the most secretive figures in the stock market. However, the size of his fortune, which exceeds three billion dollars, says more about him than any soap opera.

exceeds three billion dollars, says more about him than any soap opera.

Paul has been repeatedly recognized as the world's best futures trader by the prestigious Financial World magazine, and his fund has branches in many countries around the world. His fund's assets are currently valued at over six billion.

However, Paul was not born a billionaire; he had to go through a difficult path from an ordinary newbie to the king of the futures markets.

The renowned trader was born in 1954 in the small town of Memphis, Tennessee, USA. He received his undergraduate education at the University of Memphis and later earned a PhD from the University of Virginia. As a very young man, Paul first encountered the world of finance in 1976, when he took a job as a clerk at a brokerage firm.

The ambitious young man didn't stay in his position for long and quickly became a broker. According to Paul, he wasn't happy with the job, which relied on commissions, and the nagging feeling that he was profiting from both losers and winners prevented him from staying long in the position.

Therefore, starting in 1980, for two years, Paul became an independent trader and worked exclusively for himself. To build on his achievements and gain new knowledge about the world of finance, Paul Tudor Jones enrolled in Harvard Business School.

After studying for a very short period of time, he realizes that the knowledge he is receiving does not correspond to his ideas and desires, so he immediately leaves the educational institution.

Realizing that his knowledge and experience weren't yet sufficient for independent trading, Paul turned to his uncle, William Donavont, who had been familiar with the stock market for years. Seeing his excellent results, his uncle decided to recommend him as an apprentice to renowned cotton trader Alice Tiley.

Opening your own hedge fund.

After moving to New Orleans and completing his training, Paul began trading cotton futures , and was successful. Having earned his first capital, the 25-year-old made the crucial decision of opening his first investment fund, Tudor Futures Fund.

The decision he made in 1980 changed his life forever. From its first days, the fund's fortunes steadily improved, and its annual returns never dropped below 100 percent for five years. Paul now recalls with irony how, in 1986, his fund returned only 99.2 percent, which severely damaged his ego. The 20 percent drop in the Dow Jones Industrial Average in 1987 in a single day ruined hundreds of traders. However, Paul and his Tudor Futures Fund quickly adapted to the new extreme conditions and increased the fund's assets by 62 percent in just one month.

1993 proved to be one of the most challenging years in the fund's history, as a conflict arose between Paul and his principal partner, leading them to opposing sides. This severely impacted the fund's returns, resulting in a $300 million outflow.

However, Paul doesn't stop there and begins opening his own countries in Europe and Asia. Having lost some investors, Tudor Jones begins actively reinvesting all his money into his own fund, and this manager's self-confidence attracts even more investors.

Trading strategy.

According to Paul Tudor Jones, his earnings are based on finding reversal points, while trades following an established trend typically result in losses. However, searching for reversal points results in a significant number of losing trades, and according to Paul himself, no more than 15 percent of trades turn into profits.

Despite a low percentage of profitable trades, he manages to earn six-figure sums only because he manages his capital wisely. Therefore, Paul Tudor Jones can confidently say that proper money management is the key to every trader's success.