How to Reduce Taxes by Trading Cryptocurrency

For many investors involved in cryptocurrency trading, it comes as an unpleasant surprise when they have to pay a significant amount of taxes.

It would seem that if you trade cryptocurrency, you are not obligated to pay anyone anything, but in fact, any profit is subject to taxation, including that from cryptocurrency trading.

Tax liabilities arise as soon as you exchange cryptocurrency for regular money and it arrives in your account, or you receive cash.

We discussed cryptocurrency taxation in more detail in this article - https://time-forex.com/kriptovaluty/nalogi-kriptovaluty . Today, we'll discuss how you can avoid paying taxes on your cryptocurrency earnings.

Available options for optimizing cryptocurrency taxation

Today, there are several options for reducing taxes on profits from cryptocurrency trading:

Completely legal – only the profits you've earned are withdrawn to your personal bank account, while the principal remains stored in your crypto wallets.

In this case, you'll pay income tax only on the amount received, which significantly simplifies the calculation process. If your entire amount were deposited into your account, you'd have to spend a long time explaining that only a portion of it is income, and that the rest was yours previously.

Don't withdraw money – that is, pay directly with cryptocurrency for the goods or services you receive.

Today, quite a few services and major online stores accept cryptocurrency payments, including Amazon, Subway, Burger King, and KFC. As a result, you save about 15% of your purchases this way.

Cryptocurrency cards – these cards are issued by cryptocurrency exchanges; they can be quickly topped up with virtually any cryptocurrency and used almost like a regular debit card.

This method is rather controversial, as you have to provide all your personal information, including your country of residence, when opening the card. Whether the exchange will leak information about your transactions depends on the amount on the card and the exchange's policies.

Online exchange is currently the most reliable way to convert crypto into cash without revealing your identity.

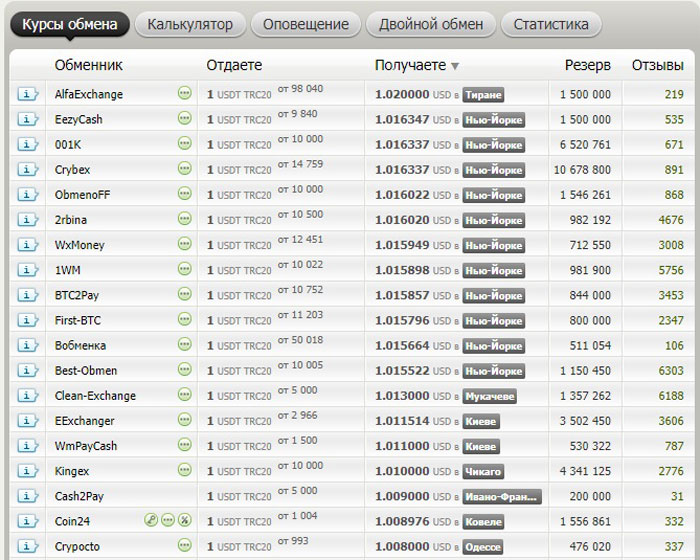

For these purposes, you can use services like https://www.bestchange.ru/; thanks to the exchange, you can quickly convert digital money into cash at the final exchange rate.

You just need to choose which asset and where you want to exchange, and then make the exchange.

Exchange offices – these services operate on the same principle as the regular money exchange offices we're used to seeing on our streets.

To complete the exchange, you need to transfer cryptocurrency to the specified account and then receive cash in the selected currency. You can exchange up to $1,000 anonymously; for larger exchanges, you'll need to provide identification.

Payment services – there are currently a lot of payment services that are not banks and therefore do not submit reports on their clients.

These services also issue their own debit cards, which can be used to pay for goods and services in regular stores.

Entrepreneurial activity is another option that can almost legally reduce the amount of taxes.

Since the income tax amount is typically several times higher than the entrepreneur's tax rate, for example, in Ukraine the income tax rate is 18%, while for an entrepreneur it's 5%. However, you'll have to fake your business to explain where the funds come from.

In general, unless you're dealing with very large sums, maintaining anonymity when converting cryptocurrency into cash is quite easy. With some effort, you can even cash out amounts over $10,000.

At the end of the year, you can indicate the required amount in your tax return and pay taxes to fully legalize the profit received.