How does an increase in the base interest rate affect the economy and the national currency exchange rate?

Recently, the US Federal Reserve raised its base interest rate from 1.5% to 1.75%.

This hasn't happened in the US economy since 1994, so many people are wondering what the impact of raising the interest rate might be and how such a decision will affect the US dollar's exchange rate against other world currencies.

To better understand the situation, we should first understand what changes the increase in the key rate leads to and what processes it affects.

Money is becoming more expensive – Central banks are raising interest rates on loans to commercial banks, which in turn are raising interest rates on loans to individuals and companies.

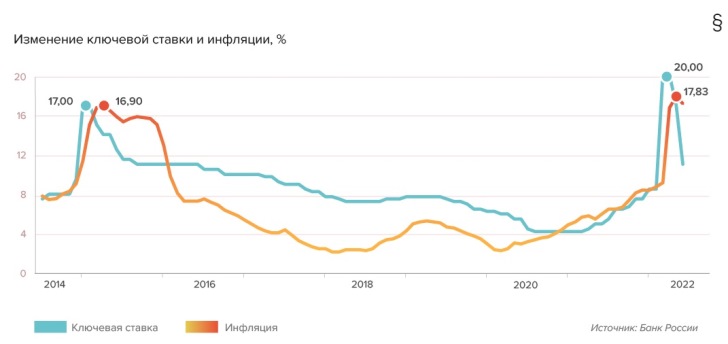

The figure below clearly shows how inflation in Russia is declining after the Central Bank's rate hike:

This means that such a step will, first and foremost, stop or at least slow down the rise in prices on the American market.

Business activity – the rising cost of financial resources leads to companies being reluctant to take out expensive loans with high interest rates.

Businesses stop expanding production using borrowed funds, business activity falls, which leads to an increase in unemployment.

Real estate prices – if loans become more expensive, then the number of people willing to use them to purchase real estate will decrease.

This means a decrease in demand for real estate, which will at a minimum lead to a slowdown in price growth in the US real estate market or, at a maximum, to a decrease in prices:

The national currency exchange rate – since after the base rate increases, it becomes more expensive to receive money, the national currency begins to strengthen.

This means that we can assume that the US dollar will continue to strengthen against the euro and other global currencies.

Perhaps not as much as what happened in a similar situation with the Russian ruble, but it is still possible to predict a fall in the euro to dollar exchange rate to values close to 1 to 1.

However, this does not mean that we need to urgently get rid of the euro and buy up American dollars; strengthening the dollar against other world currencies is not beneficial to the American economy, and it is possible that the Federal Reserve will take steps to weaken it in the near future.