Is it worth buying Tesla shares and when is the best time to do so?

One of the main rules for large investors is to buy shares of companies whose products you'll sell and that you're comfortable with.

So, if you believe weapons production is unethical, then investing in military-industrial complex stocks is definitely not a good idea.

Tesla is one company I'd consider owning, thanks to its commitment to environmental protection and the use of cutting-edge technology.

Furthermore, financial considerations are also important.

The last few months have seen fairly rapid profit growth, and forecasts for the near future are more than optimistic.

The main arguments in favor of purchasing securities of this company:

Stock split – which occurred not long ago, made them cheaper and more accessible. An artificial price drop always has an incentive for buyers, as it creates the illusion of greater growth prospects.

This has already been confirmed by the market itself: after the split, securities rose in price by 12% and are still maintaining a positive trend:

It's much more palatable to buy a $400 stock with the belief that its price will one day reach $2,000 again.

It's much more palatable to buy a $400 stock with the belief that its price will one day reach $2,000 again.

Global prospects : The global trend away from internal combustion engines is gaining momentum. Clearly, this will only stimulate electric vehicle sales and profit growth for manufacturers.

Especially since Tesla is currently the leader in this type of vehicle, thanks to the exclusivity of its batteries and the implementation of innovative technologies.

Optimistic plans primarily include the opening of factories in Europe and China, the announcement of a budget Tesla model priced at just $25,000, and the inclusion of the company's shares in the S&P 500 index.

This last point is especially interesting, as it will further enhance the company's stock appeal.

Based on all of the above, it seems that now is the time to buy Tesla shares, especially since a strong rally was followed by a correction, and then the price has begun to rise again.

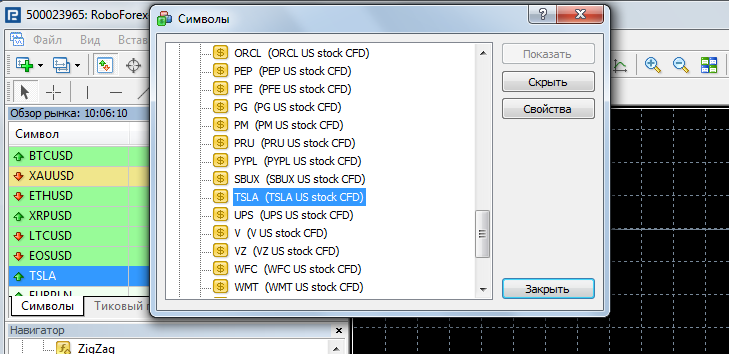

The easiest way to make a purchase is in the MetaTrader trading platform, by adding the company's shares from the "Symbols" - "US Stocks" section to the "Market Watch" window. The asset itself is listed under the name "TSLA" in the trading platform:

Despite the rosy forecasts, one shouldn't forget about the coronavirus situation. It's advisable to monitor reports of sales cuts, which could also critically impact the company's share price.

Despite the rosy forecasts, one shouldn't forget about the coronavirus situation. It's advisable to monitor reports of sales cuts, which could also critically impact the company's share price.

You can also set stop orders in the trading platform, thereby protecting yourself from unexpected events in the event of a sharp price drop.