Which currency should you keep your money in in 2024?

Oddly enough, you can lose money even without trading on the exchange, but simply by keeping your deposit in the wrong currency.

The currencies of CIS countries regularly lose tens of percent of their value against hard world currencies.

Moreover, the fall in the exchange rate is so significant that the losses outweigh the profit from interest on the deposit for several years.

I experienced this firsthand: I kept a large sum of money in a deposit for three years at 10% per annum. During this time, I earned 30%, but after the sharp decline of the national currency, I lost 50% when converting the money into US dollars.

For this reason, it is recommended to keep money only in foreign currencies, even taking into account the low interest rates on deposits.

But there is another question: What currency should you keep your money in in 2024, since even the strongest currencies are subject to exchange rate risks?

Given the current situation, answering this question is easier to name currencies that are not worth holding at the moment than to choose the most stable currency.

The best option during periods of economic instability would be diversification or the creation of a currency basket.

This means you don't keep your money in one currency, but rather distribute it among several, which is quite easy to do.

- At the bank – by opening several foreign currency accounts and earning interest on them. Minimal risk and easy implementation.

- With a broker – by opening buy trades in selected currencies or by keeping funds in an account and earning interest. Wide choice of currencies and high interest rates. List of brokers - https://time-forex.com/spisok-brokerov

Which currencies should you choose for long-term savings?

Surprisingly, there aren't many options, since the currency must be not only stable but also liquid; you can't open a bank account in just any currency.

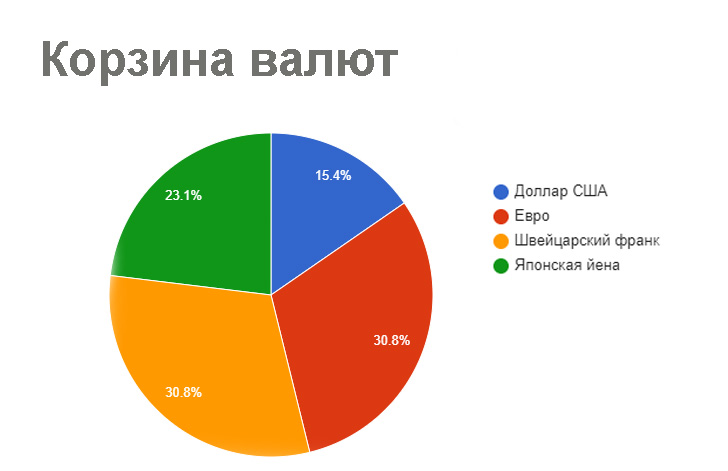

Therefore, when creating a currency basket, it is recommended to use such liquid currencies as the US dollar, Euro, Swiss franc and Japanese yen.

In this case, it is necessary to wisely distribute funds between the named currencies:

The US dollar currently commands the least confidence, so minimal investment is recommended. Meanwhile, the Japanese yen holds considerable promise and could appreciate significantly.

The US dollar currently commands the least confidence, so minimal investment is recommended. Meanwhile, the Japanese yen holds considerable promise and could appreciate significantly.

Traditionally, we invest part of the money in Swiss francs and the euro, which should rise after the ECB increases the key interest rate.

This distribution will minimize losses from exchange rate fluctuations and even earn interest on your deposited funds . However, you can also create your own basket based on your preferences and forecasts.