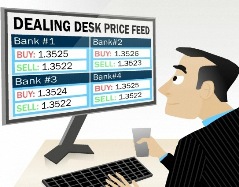

Dealing Desk, intra-company trading

Many traders, upon hearing that their broker offers dealing services using the Dealing Desk system, immediately panic, expecting various problems from the broker.

panic, expecting various problems from the broker.

Dealing Desk (DD) is a system for organizing trading in currency or other financial assets, in which an internal platform is created, the liquidity of trading instruments on which is provided by the dealing center itself.

In other words, everything is as simple as possible here: if you submit a request to buy the EURUSD currency pair, the system begins to search for a counter-order to sell it. If one does not exist, your brokerage company will act as the second party to the transaction.

Features of trading on the Dealing Desk (DD).

1. Account type – all cent brokers conduct transactions on cent accounts using a Dealing Desk. In practice, it is difficult to imagine how an order to buy one euro would be transmitted to the interbank market, while large brokers can generate hundreds of thousands of such orders per day.

Therefore, if you decide to trade on mini accounts, you should not count on pure dealing.

Dealing desk brokers are often referred to as market makers, meaning they create the market themselves, although the quotes for such trading are typically no different from actual exchange quotes.

2. Liquidity – to avoid broker interference in the dealing process on DD accounts, choose the most popular currency pairs and trade only during peak market activity.

This way, the broker won't be forced to act as the other party to the transaction; when opening a new order, there will always be plenty of counteroffers from other traders.

No Dealing Desk trading, which typically requires volumes starting from 1 lot and a deposit balance of at least $300.

In fact, when trading Forex, the broker's reputation and willingness to share profits are more important than the trading method itself.

There aren't many brokers for large-scale Forex trading. One such company is AMarkets . If you want to be sure you won't be hindered in earning and withdrawing significant profits, it's best to choose this company.