Platinum brokers and other important points when trading this precious metal

Platinum is a precious metal valued for its beauty, durability, and resistance to corrosion.

It is also used in various industrial processes such as the production of catalysts, jewelry and electronics.

Exchange trading of this metal is not as popular today as gold and silver, but still has its fans.

The main difficulty here is finding a broker that would allow you to open transactions on an asset like Platinum.

It's quite complicated, but still quite possible. Today I'll give examples of several such companies, and then I'll tell you what else is important if you decide to try your hand at trading this interesting asset.

Stock brokers trading platinum

AMarkets is a broker with 15 years of experience in the forex market. The company offers a wide range of services, including forex trading, CFDs, metals (including platinum), energy, indices, and stocks.

AMarkets is regulated by the FCA, CySEC, and ASIC, ensuring customer safety.

Main trading conditions of AMarkets:

- Spreads: from 0.2 pips

- Minimum deposit: $200

- Withdrawals: Up to $100,000 per day

- Platforms: MetaTrader 4 and MetaTrader 5

- Customer support: 24/7 in Russian, English and other languages

Disadvantages of AMarkets:

- Availability of an initial deposit of $200

- Not a large selection of assets for the stock market

AMarkets is a reliable and popular broker with over a million clients. The company is known for its customer loyalty and fast order execution.

Amarkets company website - www.amarkets.org

ForexClub is a broker with 25 years of experience in the forex market. The company offers a wide range of services, including trading cryptocurrencies, CFDs , metals, including platinum, and other assets.

ForexClub's main trading conditions:

- Spreads: from 0.00 pips

- Minimum deposit: $200

- Platforms: MetaTrader 4, MetaTrader 5, cTrader, Webtrader

- Customer support: 24/7 in Russian and English

Disadvantages of ForexClub:

- Some trading conditions may not be favorable for experienced traders

- Not all countries can use ForexClub services, including Russia and Belarus

Overall, ForexClub is a reliable and popular broker offering a wide range of services and favorable trading conditions. Its unique offering makes it attractive to traders of all experience levels.

ForexClub website - www.fxclub.org

RoboForex is a brokerage company founded in 2009. The company is regulated by the FSC and provides exchange trading services for instruments such as currencies, cryptocurrencies, precious metals, stocks, indices, and offers the option to open trades in platinum and other metals.

Basic trading conditions:

- Spreads: from 0 pips

- Commissions: 0%

- Minimum deposit: $10

- Platforms: MetaTrader 4, MetaTrader 5, R StocksTrader

- Customer support: 24/7 in Russian and English

Flaws:

- There is no Russian language on the site

Overall, RoboForex is a reliable broker offering a wide range of trading conditions and competitive prices. You can test the company on both a demo and a cent account. New clients are also offered a $30 no-deposit bonus.

RoboForex website - https://roboforex.com/

Important points when trading platinum on the exchange

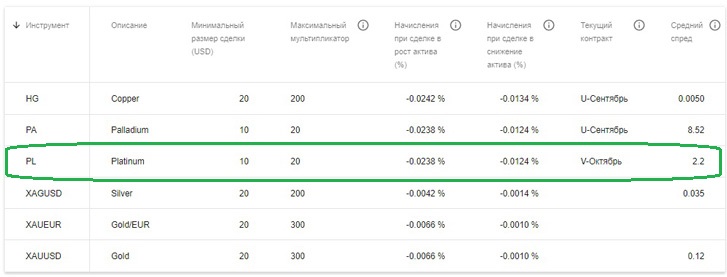

Platinum is traded on the exchange through futures contracts. A futures contract is an agreement to buy or sell a specified amount of metal at a specified price on a specific date in the future. Therefore, be sure to check the contract's expiration date before opening a position.

Platinum is traded in troy ounces. One troy ounce equals 31.1034768 grams.

The size of one lot in a stock exchange transaction, depending on the broker, ranges from 50 to 150 troy ounces.

Commissions for opening and maintaining transactions

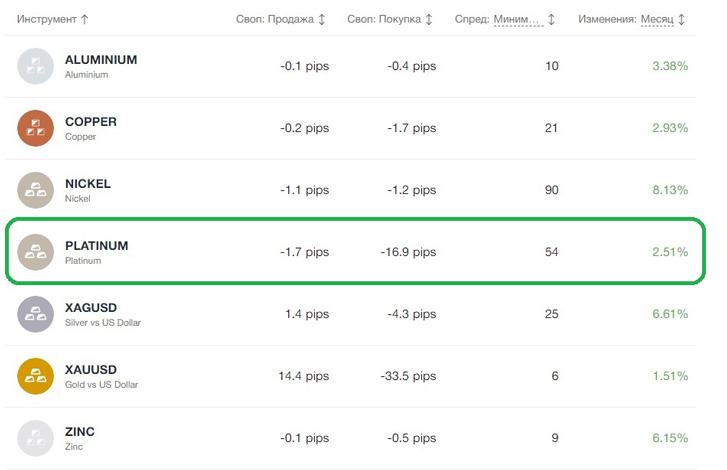

When trading platinum on the exchange, there are two main types of commissions: spread and swap.

A platinum swap is an interest rate paid by a buyer or seller of platinum in exchange for the right to own the metal for a specified period of time.

The spread is the difference between the buy and sell prices of a metal. It is charged when opening each new trade and depends on the size of the position being opened. The spread size also depends on the broker used to open the trade.

Factors Affecting the Price of Platinum

The following factors influence the price of platinum on world exchanges:

Supply and demand for the metal – the demand for platinum in various industrial sectors. Today, the metal is widely used in automotive manufacturing, jewelry, and several other industries.

Platinum's supply is limited because it is mined in a relatively small number of countries. This means its price can be more volatile than that of gold .

Price dynamics of other precious metals : The price of platinum often moves in tandem with the price of gold. This is because platinum and gold are precious metals and have similar properties.

However, platinum is a rarer commodity than gold, and its price is currently at a low. As a result, platinum may be more attractive to investors seeking safe haven assets.

Changes in global economic conditions – global economic conditions can also impact the price of platinum. For example, during periods of economic growth, demand for platinum increases, as the metal is used in various industrial sectors.

However, during an economic downturn, demand for platinum may decline as businesses cut spending.

Natural disasters – natural disasters such as earthquakes, floods, and volcanic eruptions can also impact the price of platinum. This is because natural disasters can damage or destroy platinum mines, reducing the supply of the metal.

Trading platinum on the exchange is a complex process that requires traders to understand the various factors that influence the metal's price.

However, with the right approach, platinum trading can be profitable and attractive to investors. The most profitable option is to purchase platinum through a broker.