What is an STP broker and is it better or an ECN broker?

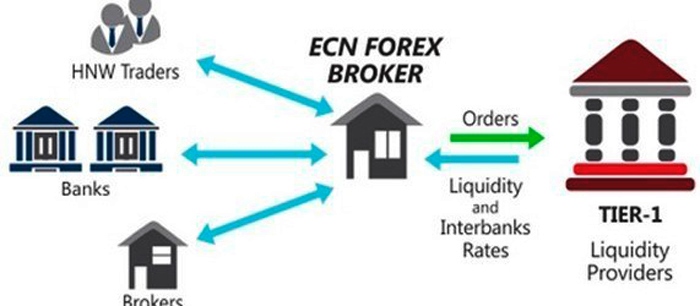

We are all accustomed to the idea that the best broker option today is ECN brokers, which use an electronic order execution system (Electronic Communication Network) in their work.

But there is an equally interesting alternative option, which also involves the use of the NDD trading system - the STP broker.

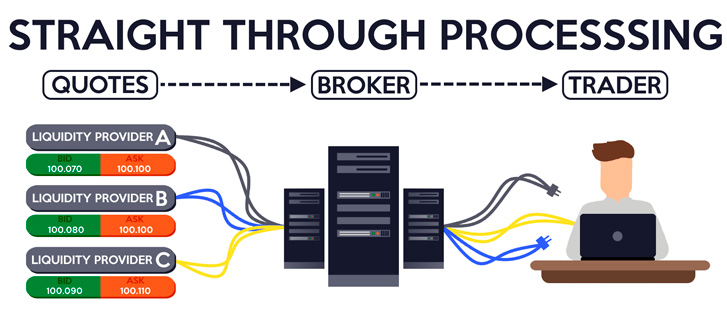

STP (Straight Through Processing) is a form of direct trade processing, meaning that upon receiving a trade order from a trader, the broker immediately passes it directly to its liquidity provider.

Liquidity providers may include: banks, hedge funds, investment groups, the interbank market, and currency exchanges.

In addition, when using Straight Through Processing, traders' orders are executed without any restrictions, even during periods of increased market volatility.

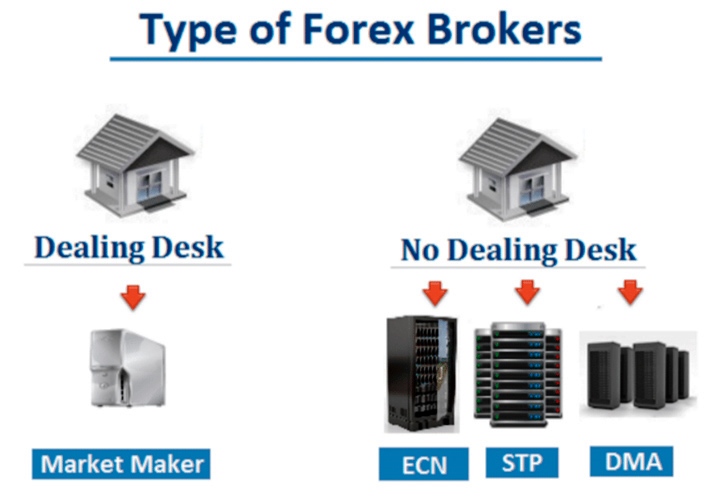

Comparison of STP brokers with companies using Dealing Desk technology

DD (Dealing Desk) is a technology in which clients' transactions are not sent to the external market, but are executed within the brokerage company.

Since forex operates continuously 24 hours a day, 5 days a week, exchanges experience constant changes in liquidity and trading volume.

Because of this, a DD broker can't always find buyers and sellers for the same volume. Therefore, in most cases, such companies will act as the other party to the transaction; that is, if you buy, they sell, and vice versa; if you sell, the broker buys.

Very often, the income of such companies, in addition to commissions for opening trades, also comes from the trader's deposit itself. Market maker brokers use various tricks to extract as much money as possible from their clients.

Very often, the income of such companies, in addition to commissions for opening trades, also comes from the trader's deposit itself. Market maker brokers use various tricks to extract as much money as possible from their clients.

Therefore, it is practically impossible to make a profitable deal with a broker using Dealing Desk technology.

At the same time, STP brokers don't have conflicts with their clients. They act merely as intermediaries, transmitting traders' orders via the STP protocol.

Thus, the STP platform's main source of income is the spread or commission. This benefits both parties: the trader receives fair trading, and the broker avoids the risk of being accused of fraud.

Comparison of STP and ECN brokers

STP and ECN brokers are quite similar; both execute trades using No Dealing Desk (NDD) , without acting as the other party to the trade. However, many traders prefer pure STP because opening an account with this type of brokerage does not charge a commission per trade.

While ECN brokers often charge commissions calculated as a percentage per lot traded,

scalpers prefer ECN accounts due to lower commissions and often faster trade execution.

However, there is also a category of traders who choose to trade with a spread on STP accounts instead of paying a commission for each trade.

Therefore, if you like trading without commission, then the STP account is for you.

In terms of transaction speed, ECN also has an advantage over regular STP accounts because it sends orders directly to liquidity providers.

In terms of transaction speed, ECN also has an advantage over regular STP accounts because it sends orders directly to liquidity providers.

While STP trades may be brokered, orders are passed on to larger brokers or liquidity providers, which can lead to slow trading and requotes.

If we talk about my personal opinion, I would still choose an ECN broker for trading, especially since they offer ECN accounts without commission for transactions, with only one spread.

Popular ECN brokers , accounts from $10.