TDI indicator

Market analysis and forecasting is difficult to perform without technical analysis tools at hand.

After all, all factors, one way or another, are interconnected and can influence each other.

The direction of the trend, the speed of price movement, volatility, overbought or oversold - all these factors determine the further movement of the price.

That is why in recent years many traders have gradually moved away from using standard forex indicators, which determine one characteristic of the market.

Instead, complex hybrids are increasingly being used. Their essence is that the hybrid can combine from two to five forex indicators in one window and conduct a more professional market analysis.

The TDI indicator is a complex hybrid consisting of at least three technical indicators, namely two trend Bollinger Bands and Moving Average, as well as one Relative Strange Index oscillator.

Thus, TDI is a comprehensive tool that allows you to virtually simultaneously analyze the state of the market, the direction of the trend and, most importantly, volatility.

The script can be used on any trading assets in your MT4, and this feature also applies to time frames.

That is why TDI is no less effective tool both in the hands of a scalper and in the hands of a long-term investor.

Installing the

Traders Dynamic Index indicator became very popular and world famous after a trading strategy based on it, more famous by its name Trading Made Simple, was published on many foreign forums.

The thread with this strategy received more than a thousand comments, while TDI, thanks to the accuracy of its signals, became the basis for dozens of strategies for MT4.

The installation actually follows a standard scheme.

At the end of the article there is a download link, which you need to follow to acquire the indicator file directly. You will need to drop this file into a folder in the MT4 directory, namely in Indicators.

By the way, you can enter the data directory directly through your MT4 after you enter the file menu by selecting the appropriate option in the drop-down menu. The third and final step after installation is to restart the trading terminal or make an update using the additional menu in the “Navigator” panel.

After all the actions taken, TDI can be found in the list of custom indicators, and plotted on the chart it looks like this.

After all the actions taken, TDI can be found in the list of custom indicators, and plotted on the chart it looks like this.

Practice using TDI

The first acquaintance with TDI can cause confusion, since the huge number of lines can simply make your eyes run wild.

But once you understand the basic principles of working with it, within five minutes you will understand how simple a technical tool it is. When you first apply this indicator, first of all, pay attention to the key levels numbered 68, 50, 32. They, as when using any oscillator, are the very boundaries of the overbought and oversold zones .

It is necessary to trade at the exit from them, namely at the moment of crossing level 68 from top to bottom, we open a sell position, and when crossing level 32 from bottom to top, we open a buy position.

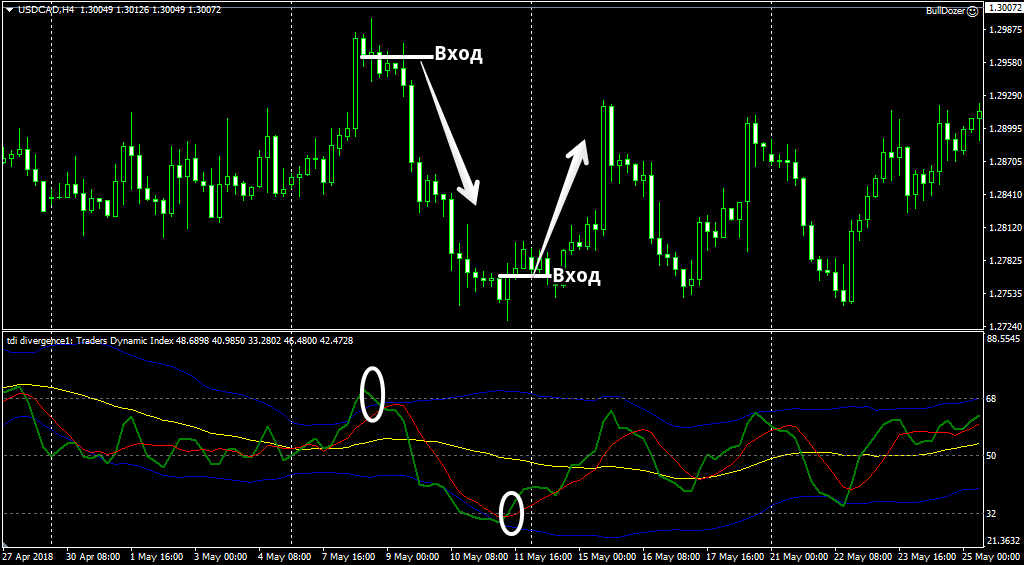

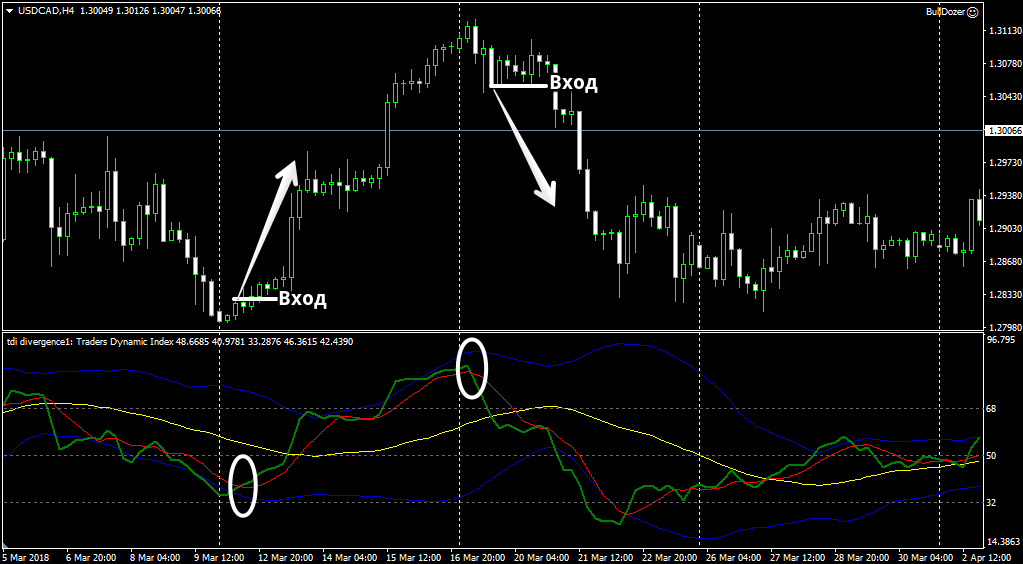

The next favorite signal, which all scalpers use, appears due to the interaction of the moving average and the RSI line with each other.

Thus, when the green line crosses the red one from bottom to top, we open a buy deal, and when from top to bottom, we open a sell deal. Signal strengthening is considered to be the case when such an intersection appears in oversold or overbought areas of the market:

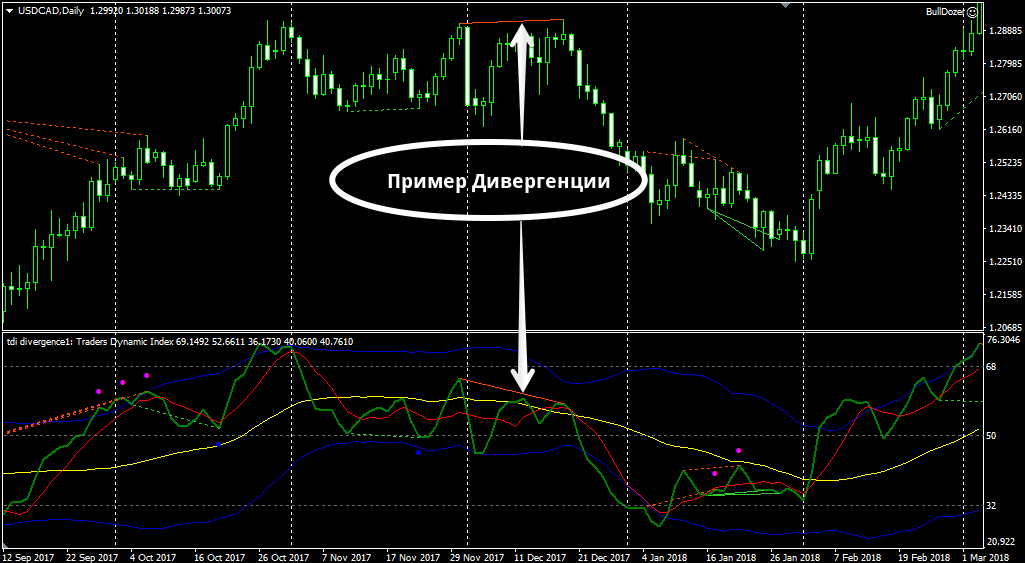

TDI also perfectly captures divergences on the chart, which in turn are one of the strongest signals for a reversal. It is worth noting that in the settings you can enable the function of displaying divergences both on the chart and on the indicator itself, which will allow you not to miss this signal. A small example:

Also, during the trading process, you should definitely pay attention to the blue Bollinger bands, which are built not according to the price, but along the line of the RSI indicator .

Firstly, you need to pay attention to the width of the displayed channel, since the narrower it is, the lower the volatility and market activity.

In addition, the exit of the lines beyond the boundaries may indicate the emergence of a strong deviation, which may lead to the development of a new trend or a return of the price to some average value.

To summarize, we can safely say that Traders Dynamic Index is one of the most successful and frequently used hybrids of standard indicators. Its functionality allows you to solve many problems; moreover, even alone, this tool can replace an entire trading strategy .