Average Directional Movement Index

A trader needs a clear understanding of the market's direction, its current direction, and its future direction.

The most interesting thing is that hundreds of trend-following forex indicators and strategies can help with this task.

Yet, despite this, traders continue to suffer losses. The answer to this problem is obvious, yet no one wants to acknowledge it.

It's easier to assume that forex indicators are misreading the trend than to realize that the trend itself was misjudged.

After all, the effectiveness of a signal in a strong or weak trend will be completely different.

The Average Directional Movement Index, or more familiarly abbreviated as ADX, is the creation of the highly influential technical analyst and practicing trader Welles Wilder.

The development itself appeared in 1978, when his famous book on technical analysis was published.

ADX is a trend indicator that, unlike many other trend-following tools, not only shows the current trend and its changes, but also allows you to analyze the trend's prospects, its strength, or weakness.

Thus, thanks to its nature as a complex tool, the ADX is often used to develop absolutely any trading strategy on any time frame.

Moreover, there are no restrictions on its use on specific trading assets, but it's important to understand that it was originally used on futures and stocks.

Installation:

The beauty of using the Average Directional Movement Index in practice is that today this indicator can be found on any trading platform.

The fact is that when the ADX was written and created, personal computers and online trading as we know it today did not exist.

Therefore, when trading platforms were first being developed, developers, without exception, expanded their collections with popular developments.

Since the indicator was published in a book, it has gained incredible popularity among traders and investors.

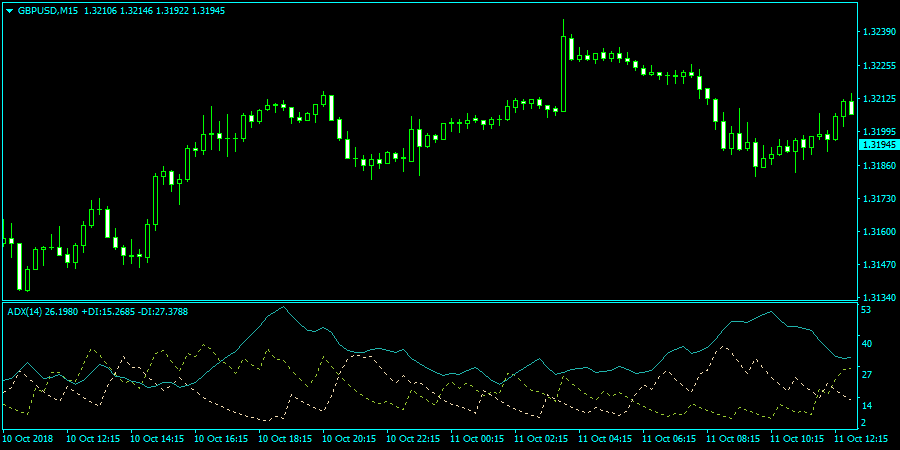

In the most popular platforms, MT4 and MT5, this tool is included by default, specifically in the trend instruments category. If you apply it to a chart, you will get the following working environment:

Using the Average Directional Movement Index

So, before we discuss its use cases, let's take a closer look at the Average Directional Movement Index.

First, when you plot the ADX on a chart, you'll see three lines in one window: two dotted and one solid.

The solid blue line is the ADX line. Its purpose isn't to indicate the trend's direction, but rather to show the strength of the trend and its potential. Therefore, don't be surprised if the blue line falls in a rising market, or vice versa.

The dotted lines, labeled +DI and -DI, represent bullish and bearish trendlines, and their subtle relationship can indicate both an entry point and a clear indication of the current trend direction.

Therefore, the ADX can easily be used for two purposes: as a signal indicator and as an auxiliary filter, allowing you to enter the market only during a strong trend or exit a trade when the trend begins to fade.

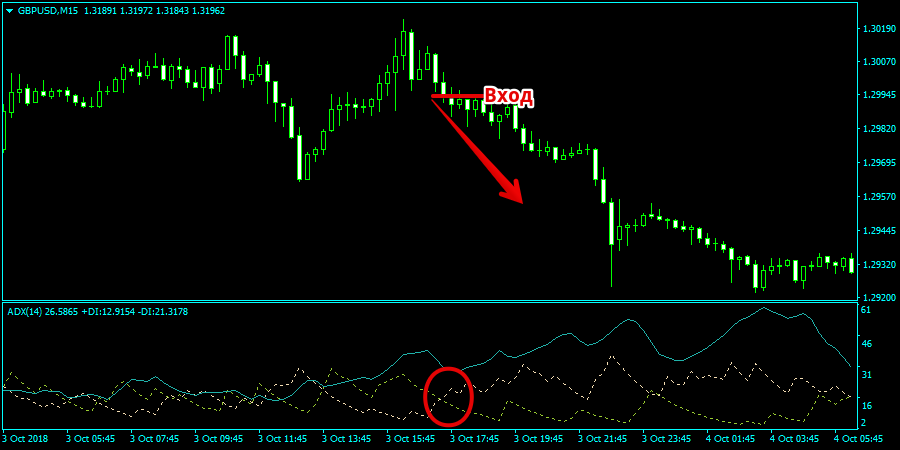

To find an entry point, two lines are used: +DI and –DI. If the lines cross and the +DI (yellow dotted line) is above the –DI (purple dotted line), we open a buy position. If the opposite cross occurs and the –DI is above the +DI, we open a sell position.

A +DI above the –DI indicates bullish dominance over bearish dominance, indicating an uptrend. A –DI above the +DI indicates bearish dominance.

To analyze the strength of a trend, pay attention to the scale on the right side of the indicator and the blue ADX line. If this line is above 20, it indicates a strong trend.

It's worth noting that when using the ADX line to confirm trend strength in your strategy, the indicator line must necessarily rise. If you receive a signal and the line falls, the trade is ignored. Here's a simple example of how the ADX line filters signals from +DI and –DI.

Many traders make a huge mistake by trying to position the Average Directional Movement Index as a complete system and using it alone. This approach won't yield the desired success, as the indicator doesn't cover all aspects of the market. Therefore, be sure to use it as part of a system, not alone!

In parallel, it is suggested to use the indicator - http://time-forex.com/indikators/ultra-wizard