Trend strength indicator.

When opening a new trade, every trader wants to know how long the existing trend will last and whether it will reverse immediately after the order is placed.

it will reverse immediately after the order is placed.

The trend strength indicator provides a way to determine this; it shows how actively a given currency is being bought and sold.

Unfortunately, the indicator displays information specifically for currencies, not currency pairs, so traders must draw their own conclusions about the trading instrument.

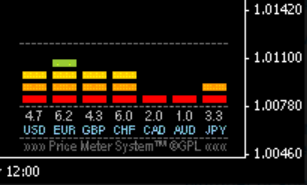

The screen displays the seven most popular Forex currencies—USD, EUR, GBP, CHF, CAD, AUD, and JPY—with a trend strength value and a bar with multicolored rectangles above each. This display method allows you to quickly draw conclusions about the current situation.

The numbers represent trader activity on a 10-point scale; the higher the value, the more trades are being executed in that currency.

How do you use the trend strength indicator in trading?

It's quite simple: select the two currencies with the highest value and switch to the chart of that currency pair. If there's an active Forex trend , enter a trade in the direction of the trend.

For example, if the euro and dollar have activity values of 8 and 9, respectively, then take the EUR/USD currency pair and see that the price has been actively moving upward for an hour, so enter a buy trade.

The trend strength indicator also helps you monitor the duration of trades. It's recommended to close open positions if there's a sharp change in activity in one or both currencies in the pair .

Download the trend strength indicator.