Forex Trends: Concept, Trend Indicators, and Strategy

The movement of the exchange rate always has its own direction, which is also called a trend; the direction in which the price moves determines the direction of opening transactions.

The rate can rise or fall, and in some cases it can remain practically unchanged and remain at the same level.

A Forex trend is the movement of an exchange rate within a specific time period. The time interval used for analysis is important, as different time frames can show completely opposite price movements.

If you compare two adjacent time frames, you can find that they have trends in different directions.

The main indicators that characterize a Forex trend are its strength, duration, minimum and maximum points, and the magnitude of fluctuations.

Key indicators

- Strength – shows the strength of the underlying factors that triggered the current trend. For example, the earthquake in Japan caused a sharp and prolonged decline in the Japanese Yen against other global currencies. A weakening of this indicator increases the likelihood of a reversal of the current trend.

- Duration – how long the price movement has been observed in a given direction, for example, the euro has been rising against the US dollar for a week.

- The magnitude of fluctuations is the range over which a currency pair's value changes, the magnitude of pullbacks on a given time frame. Even if the rate moves steadily in one direction, there are always minor fluctuations in the opposite direction.

- Minimums and maximums are the maximum and minimum values that the price reached during a given period of time.

Types of Forex trends

There are three main types of trend movement: ascending, descending and horizontal.

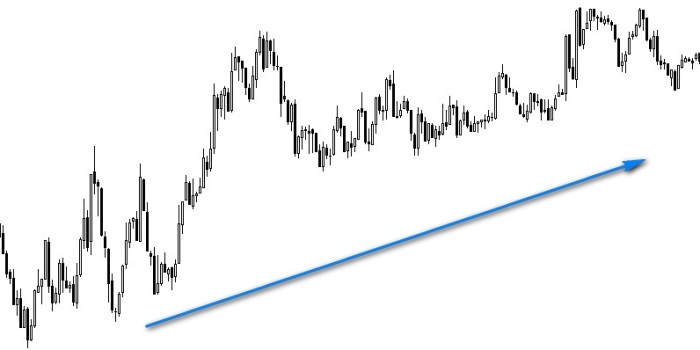

Ascending – this is characterized by a constant increase in the rate, with each subsequent level being higher than the previous one.

At the same time, long positions are opened to buy the base currency. In this case, one can confidently say that demand for the instrument in question has increased.

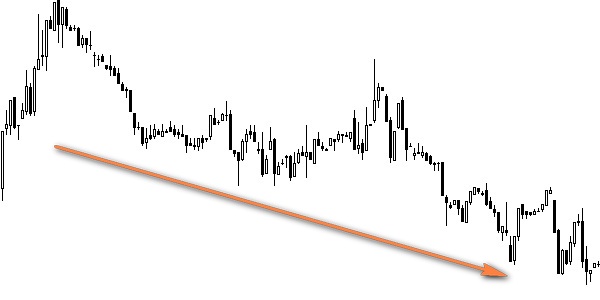

A Forex downtrend occurs when the value of the base currency in a currency pair falls, with each subsequent price low being several pips lower than the previous one. In this case, short sell trades are entered into en masse.

The reason for this may be either a decrease in demand or the emergence of negative news regarding the base currency.

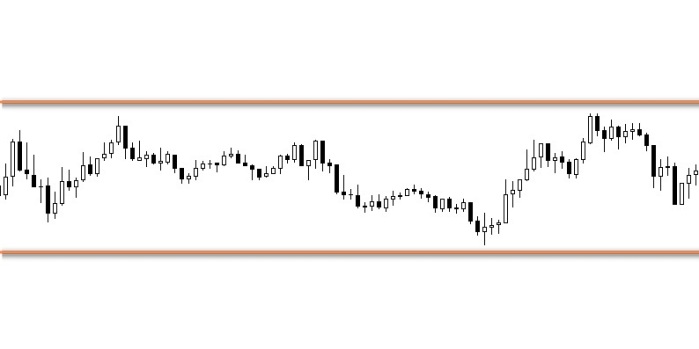

A horizontal Forex trend is characterized by relative calm in the currency market; the price remains at one level and its value remains virtually unchanged.

This situation is also known as a flat state; speculative trading is practically non-existent at the moment; only pending orders can be placed, which will be triggered when a clear trend emerges.

Such a situation can last from several minutes to several days and usually ends with a sharp movement in one direction.

The basis of any strategy is trading in the direction of price movement; it is based on concluding transactions exclusively in the direction of the prevailing trend. This trading option is recognized as the least risky and allows for the greatest profit, sometimes reaching several hundred points.

A large number of different tools have been developed to analyze forex trends—graphical shapes, lines, levels, channels, pitchforks, and waves. Some of these tools are available in the MetaTrader trading platform under the "Insert" tab.

Trend indicators used in Forex

There are quite a few indicators that allow you to determine the current trend on the Forex or stock exchange.

Many of them are already by default in the MetaTrader trading platform on the "Trend" tab, such tools as Bollinger bands, Envelopes and the Parabolic SAR strategy, based on which you will find here - https://time-forex.com/indikators/parabolic-sar .

There are also other options for indicators to determine the prevailing trend; they are discussed in the article - https://time-forex.com/tehanaliz/indikatory-trenda