Description of the Bloomberg trading platform and its main features

Metatrader is currently the most popular trading platform, but it's always interesting to explore alternative trading software options.

Bloomberg is an international trading platform that provides information on financial markets, as well as on companies and industrial sectors in general.

The platform allows you to receive data in real time, as well as conduct market analysis and make investment decisions.

The history of the Bloomberg trading platform involves a multi-stage process, beginning with the company's founding in 1981 by Michael Bloomberg.

Over time, the company has grown into a multi-billion dollar business providing financial information and trading technology to professional financial market participants worldwide.

Bloomberg Key Features

Market data and news

Bloomberg provides a wealth of data on financial markets, such as stock prices, indices, currencies, etc.:

Data is updated in real time, allowing traders and investors to quickly respond to market changes. The platform also provides information on international news that could impact financial markets.

Analytics and research

The trading platform allows for market analysis and research on companies or entire economic sectors. Users have access to a variety of reports and analytical articles to help them make investment decisions.

Just like the familiar MetaTrader, Bloomberg allows you to create your own indicators or other scripts. This allows traders and investors to tailor the platform to their needs and improve ease of use.

Opening trades on the exchange

Using Bloomberg, you can trade a wide range of assets, including stocks, bonds, currencies, and commodities:

Trading can be performed using various order types, such as market, limit , and stop-limit. It is also possible to open IF-Done orders, which consist of two orders in which the first order triggers the opening of the second order.

Investment portfolio management

investment portfolio management . Users can use the platform to create and edit portfolios, track their performance, and determine risk.

The platform also offers tools for assessing the value of a portfolio and its distribution among various assets.

Communication

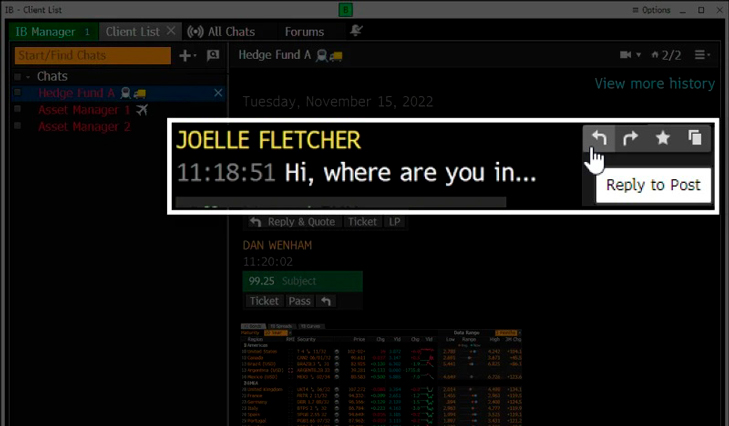

Bloomberg offers the ability to communicate and share information. Users can use Bloomberg's chat system to communicate in real time with other traders and investors, as well as participate in public forums:

In addition, the platform allows you to create groups and chats to discuss specific topics.

Speaking of advantages, the main one I'd say is the ability to quickly obtain comprehensive information on any asset. For example, you can see who owns certain securities and how much, and get complete information about the stock itself.

The main drawback I would say is the complexity of working with this trading platform; a novice trader will need more than one month to master the program.

If you compare the capabilities of the Bloomberg trading platform with Metatrader without bias, it's difficult to find any truly compelling advantages worth paying $2,000 per month—the cost of a monthly Bloomberg subscription.

Missing services can easily be found for free or purchased for just a couple hundred dollars a month; the high price of the Bloomberg trading platform is more a matter of prestige than a truly justified benefit.

But if you are still determined to purchase this platform, you can do so on the website - https://www.bloomberg.com/professional/solution/bloomberg-terminal/