Pending limit orders on the exchange: is it worth using this type of order?

One of the most effective tools in stock trading are pending orders, which help implement a variety of simple strategies.

In fact, using such orders to open trades allows for automated trading using only the trading platform's functionality, without the need for third-party scripts.

In the MetaTrader 4 trading platform, we have two types of pending orders available: Stop and Limit. It is precisely when working with limit orders that traders have many questions.

Pending stop orders are logically clear: the opening price of such an order is specified further along the trend, that is, when setting a Buy Stop, it should be higher than the current price, and when setting a Sell Stop, it should be lower than the current price.

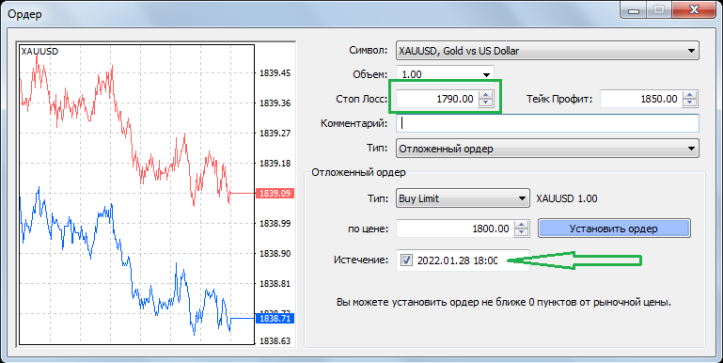

For example, you are betting on buying gold, the price is currently falling and is at $1,815, but you assume that as soon as it reaches $1,800 per Troitsk ounce, it will immediately begin to rise, and you set a Buy Limit with a value of 1,800.

What is the purpose of such orders? To open a position at the best price and maximize profit.

Risks of working with limit orders on the exchange

At first glance, it may seem that placing pending orders against the existing trend is quite dangerous, because we have always been told that trading against the existing trend is impossible.

But this statement is only partially true, since when placing an order, you can also specify stop-loss parameters:

So, if we return to our example of buying gold at $1,800, we could also specify a stop loss of $1,790 in the same order. If the price continues to fall after opening the buy position, the stop loss at $1,790 will be triggered, protecting our deposit from being wiped out .

It would be a good idea to also set the order expiration time, because if the position opens before the weekend, there is a high probability of a price gap occurring and the stop loss will be triggered at the price of the first quote, and not at the price we set.

It's safe to say that using a limit order in exchange trading is no more dangerous than any other, as long as you remember to set a stop-loss when placing it. At the same time, such orders help you enter the market at the most favorable points in the price channel .