When to buy stocks to receive dividends?

At the moment, there are many companies that regularly pay dividends on their securities.

The size of such payments sometimes amounts to more than 10% per annum, which attracts the attention of a large number of potential investors.

For those who think there is nothing easier than buying high-yield stocks and then receiving dividend payments on their investments.

But in reality, such an investment requires taking into account a lot of nuances, the most important of which is the timing of the purchase of the security.

Sometimes beginning investors think that receiving dividends requires holding a company's stock for a certain period of time. This is similar to how it works with bank deposits, where you need to sign a contract for a term of at least one month to receive interest on the deposit:

There are no such rules for dividend income; simply purchase the stock a couple of days before the shareholder register closes. This means that even if dividends are paid once a year and you purchase shares a week before the register closes, you'll still receive the same amount as investors who hold the stock for the entire year.

When is the best time to buy a stock?

At first glance, it may seem that the best option is to buy shares before the share register closes, as this can make a couple of percent profit in just a few days.

But, unfortunately, this theory is not always confirmed in practice, and the market price of the security itself is to blame for this.

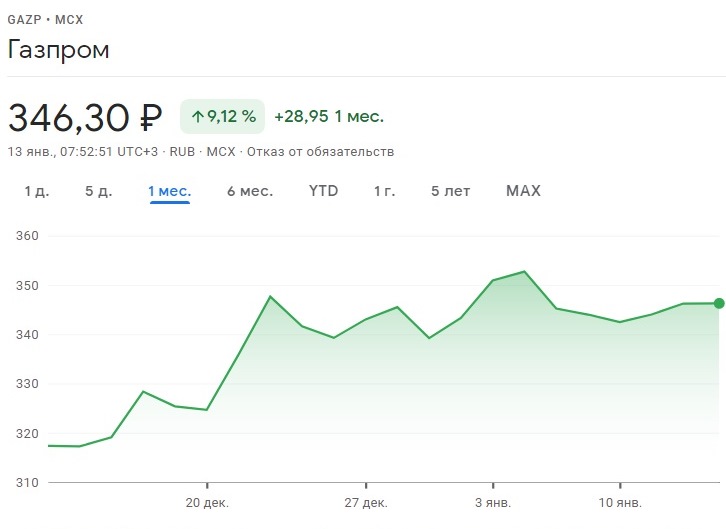

As a rule, a stock begins to rise as soon as the amount of dividends for the reporting period becomes known:

For example, Gazprom's management announced that it would pay out approximately 48 rubles per share by the end of 2021, representing a profit of almost 14% of the current price.

This news triggered a rise in the stock price, and you will now be buying the stock at a higher price than you were a month ago.

In addition, after the payment itself is made, the price of the shares, as a rule, falls and you will sell the asset cheaper than you bought it for.

Therefore, when buying a company's shares, it's better to focus not on the dividend payment schedule, but on the current market price and its growth prospects. For example, if we take Gazprom, there's a high probability that gas prices will fall by the spring of 2022, which would mean a decline in the company's share price.

Therefore, in this case, it is better to wait until spring and make a purchase decision taking into account the current price of Gazprom shares.