Using Stock Indices in Forex Trading

Fundamental analysis of the currency market is effective for long- and medium-term trading.

Such analysis involves more than just an overview of macroeconomic factors. News reports don't always reflect reality.

There are more effective methods for forecasting currency pair prices, particularly stock indices.

The relationship between the currency and stock markets:

Forex brokers' liquidity providers are large investment companies or commercial banks.

• industry;

• IT technologies;

• GDP;

• Central Bank interest rate;

• business activity indices, etc.

The average return on an industrial sector is calculated based on the asset value of the largest companies in that industry. This data is accurately reflected by the Dow Jones Industrial Average, which represents the assets of 100 large companies in the US industrial sector.

The dynamics of the US financial sector can be assessed using the NASDAQ Financial-100 index (which includes financial corporations and large investment companies), while the level of technological progress and information technology growth can be measured using the NASDAQ 100 index (which includes companies specializing in IT development and promising startup projects).

The dynamics of the US financial sector can be assessed using the NASDAQ Financial-100 index (which includes financial corporations and large investment companies), while the level of technological progress and information technology growth can be measured using the NASDAQ 100 index (which includes companies specializing in IT development and promising startup projects).

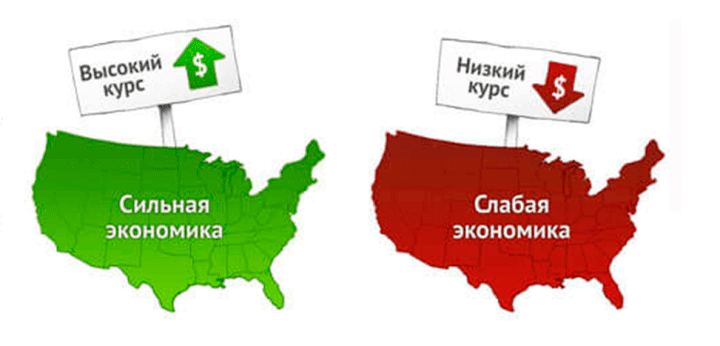

Thus, the state of the US economy is primarily measured by stock indices. The value of the currency is determined by the state of the economy and the level of demand for the national currency. Consequently, Forex exchange rates are directly dependent on stock market indicators.

Analytics:

Everyone remembers the method for calculating arithmetic means from school algebra. When forecasting Forex exchange rates, it is important to consider the following factors:

1. Data published in the economic calendar (GDP, interest rate, and consumer and industrial activity indices).

2. NASDAQ Financial 100, NASDAQ 100, and Dow Jones Industrial Average (NASDAQ Biotechnology indices are not taken into account, as such structures do not have a significant impact on the dollar Forex exchange rate).

Using the data obtained, a table should be compiled to determine the outlook for the development of the US national currency's value. When calculating, priority should be given to the dynamics of the Federal Reserve interest rate over the past six months and the Dow Jones Industrial Average chart. Other data is of secondary importance.

Using the data obtained, a table should be compiled to determine the outlook for the development of the US national currency's value. When calculating, priority should be given to the dynamics of the Federal Reserve interest rate over the past six months and the Dow Jones Industrial Average chart. Other data is of secondary importance.

Practical application in trade

The EUR/USD currency pair, despite its popularity, is not the most effective instrument for making money on Forex. With the aforementioned fundamental approach, it's better to favor assets in which the USD is in the numerator, meaning it's the base currency. The second currency should be significantly less popular in terms of international demand.

After conducting an analytical review, the best entry point should be found using technical analysis tools and candlestick patterns:

• search for reversal patterns;

• identification of divergence using oscillators;

• drawing trend lines and local levels.

Contrary to the naive expectations of novice traders (those who love arrows on charts), these methods of analysis remain the most effective.

Signals are searched for on the H4 or D1 timeframe. Stop Loss is set at the nearest local level. Potential profit is at least 500 pips within 1-2 months (depending on trading volumes and the selected currency pair).

Signals are searched for on the H4 or D1 timeframe. Stop Loss is set at the nearest local level. Potential profit is at least 500 pips within 1-2 months (depending on trading volumes and the selected currency pair).

Practical application of fundamental analysis in trading will significantly improve its effectiveness.

The dollar is the basis on which the value of other currencies largely depends on the Forex market. Therefore, fundamental analysis should begin with the US.