Forex myths and reality.

Forex is an over-the-counter interbank currency market where, thanks to rapid technological advances, anyone can make money.

There's a myth that a degree in economics is required to achieve stable profits in Forex.

While this is partly true, a university degree isn't necessary.

All the necessary knowledge can be acquired online or through paid, or sometimes free, training at a brokerage firm.

You can also study on your own; at the moment, a lot of useful information is posted on specialized Forex websites.

It is important to pay attention to:

- principles of fundamental analytics;

- methods of technical analysis of price charts;

- study the functionality of indicators to confirm the accuracy of the forecast.

On specialized websites, you can find numerous "profitable" strategies that supposedly guarantee monthly profits of 100%.

Double your capital in a month on Forex. What's the catch?

It's indeed possible to make money trading currency pairs. Optimal returns are considered to be 15%-25% per month.

Beginner traders can expect to receive 10% of their capital based on their monthly performance. Profit levels are directly related to proportional risks.

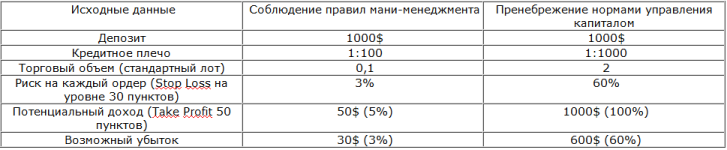

There are capital management guidelines that stipulate that the risk on each open order should not exceed 3%-5% of the deposit.

deposit acceleration has become popular lately , but even in a high-income environment, the risk shouldn't exceed 10%. If you don't want to lose your investment within the first month, you should adhere to this rule.

Before opening an order, it's important to calculate the volume based on the expected Stop Loss level.

For example:

The comparison table below clearly shows that ignoring capital management rules will allow you to earn more. However, if you make just one losing trade, your deposit will have to be restored for an entire month. This is no longer a myth, but a reality of Forex trading.

It's important to understand that a profitable strategy doesn't guarantee accurate trade execution.

It's important to understand that a profitable strategy doesn't guarantee accurate trade execution.

The primary goal of a trading system is to ensure that profitability outweighs drawdown. The characteristics of an effective strategy look something like this:

1. The ratio of profitable to unprofitable trades is 70:30.

2. The profit received upon closing an order is between 3% and 5% of the capital.

3. The maximum loss per order is no more than 3%.

As a result, 25% per month is a good income, something only an experienced trader can boast of. A return of 100% or more is only possible in two cases:

1. Neglecting money management rules.

2. Using the doubling method, which sooner or later is guaranteed to lead to the loss of invested funds. This method involves doubling the trading volume each time a loss is recorded.

It's important to understand that stable earnings on Forex are only possible if the following factors are met:

1. Having a proprietary, proven strategy with proven results.

2. Compliance with capital management standards.

Ready-made strategies for Forex trading -

http://time-forex.com/strategy Furthermore, it's important to eliminate the emotional component from your work, as the human factor can hinder correct trading decisions. At the same time, you should always try to prevent Forex myths from interfering with your actual trading.