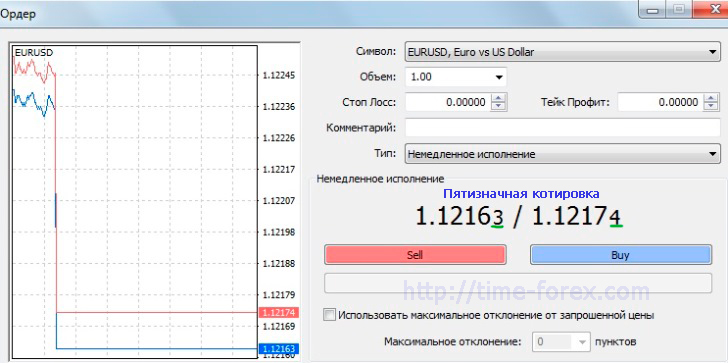

What are the differences between two-digit, four-digit, or five-digit quotes?

We're accustomed to seeing exchange rates with only two decimal places; this is considered sufficient for bank clients. While

a couple of decimal places is indeed sufficient for exchanging a couple of thousand of one currency for another, in reality, four- or even five-digit rates are used in Forex.

So, if you see euros selling for 1.15 per dollar at the exchange booth, in the trader's terminal it will be 1.15328.

The significance of this extended notation becomes clear when you're making transactions worth hundreds of thousands. For example, 100,000 euros at a bank would cost $115,000, while on Forex it would cost $115,328—a difference of $328.

And for larger amounts, this difference becomes even more noticeable.

Which account should I choose with a four-digit or five-digit quotation?

First, let's look at what the last digit in the quote represents. With a five-digit quote, 1.15328 represents a price change of 1 unit, in our case, $1. With a four-digit quote, it represents a price change of $10.

It could be said that a five-digit quote is more accurate, as it reflects minimal price fluctuations, but it also reveals all the noise.

It all depends on the strategy you'll be using. For short-term scalping or pipsing , it definitely makes sense to choose accounts with five decimal places, while for longer-term strategies, four-digit quotations can be used.

It all depends on the strategy you'll be using. For short-term scalping or pipsing , it definitely makes sense to choose accounts with five decimal places, while for longer-term strategies, four-digit quotations can be used.

This should also be taken into account if you're using expert advisors for trading, as many were created for specific quotations, and the number of decimal places can affect certain indicators.

However, it's worth noting that most brokers have recently switched to five-digit accounts, and four-digit quotations are only available on cent accounts , so there's not much choice.