Forex trading on Mondays

Stock trading is influenced by many factors, one of which is the dependence of trend behavior on the day of the week.

Therefore, when analyzing trend movements, it's important to keep this factor in mind; the day of the week factor has its greatest impact on Monday.

It's not for nothing that Monday is often called the "difficult day of the week," and this applies to stock trading as well.

The difficulty of trading on this day of the week lies not only in the need to return to work after the weekend, but also in several other aspects.

Peculiarities of trading on Mondays

The start of the trading week is notoriously treacherous. Many traders, after two days off, begin opening trades, only to be met with the following surprises:

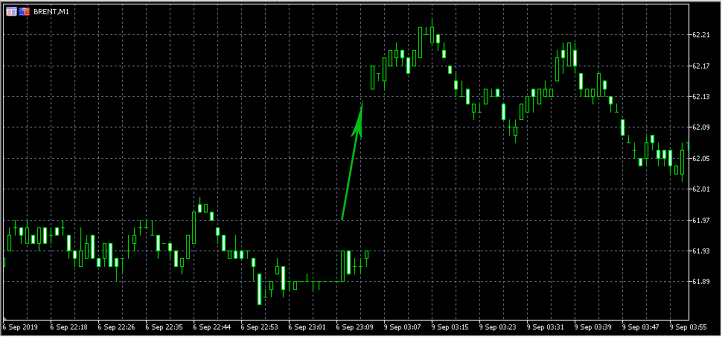

• Gaps – these happen more often than ever on Mondays, as it's rare that a weekend goes by without news that doesn't affect one currency or another.

And since news can't immediately be reflected on currency pair charts due to the weekend, the market reaction only occurs after the opening of the trading session:

a gap  typically appears immediately after the opening of a trading session, before traders have opened any new trades.

typically appears immediately after the opening of a trading session, before traders have opened any new trades.

Those who left open orders open since Friday are the first to suffer, as the price gap doesn't always move in the direction of the open position.

At the same time, those who opened positions immediately after a price gap in its direction may also suffer, as there is a rule that a price gap must close within one session.

For example, if positive news on the euro was released over the weekend, on Monday the EURUSD currency pair opened with a gap at a higher price and began to rise.

You naturally open a buy trade, as the market is trending upward, but the gap-closing rule kicks in, and so does your stop-loss.

Therefore, it's more rational to wait for the gap to close and only then determine the trend or use a gap-closing trading strategy. Thus, turning the disadvantage of this day of the week to your advantage.

• Trend reversal – it would seem that the situation has stabilized, the gap has closed, and the price is moving further, but even here you may be in for trouble.

The start of a new week is characterized by new news, typically much more so on Monday than on other days of the week, as many weekend events simply didn't make it into the press.

The start of a new week is characterized by new news, typically much more so on Monday than on other days of the week, as many weekend events simply didn't make it into the press.

News can trigger a change in an existing trend, so when opening a new trade, you should be prepared for a trend reversal.

At the same time, you can try to profit using a news trading strategy , monitoring new events and opening trades when strong signals appear.

It's worth noting that Monday is a rather ambiguous day, but despite its complexity, you can equally lose money and make a profit.

Many strategies are specifically designed for trading on Mondays, because even an unpleasant pattern is a pattern that can be exploited.

Read about the specifics of trading on other days of the week here - http://time-forex.com/sovet/forex-dni-nedeli