Gold or Stocks: Which to Choose for Long-Term Investments?

With the price of gold skyrocketing, do you ever wonder, "Shouldn't I have invested in gold instead of stocks?"

This is a completely logical concern, especially in the context of instability in financial markets, an economic crisis and potential risks to securities.

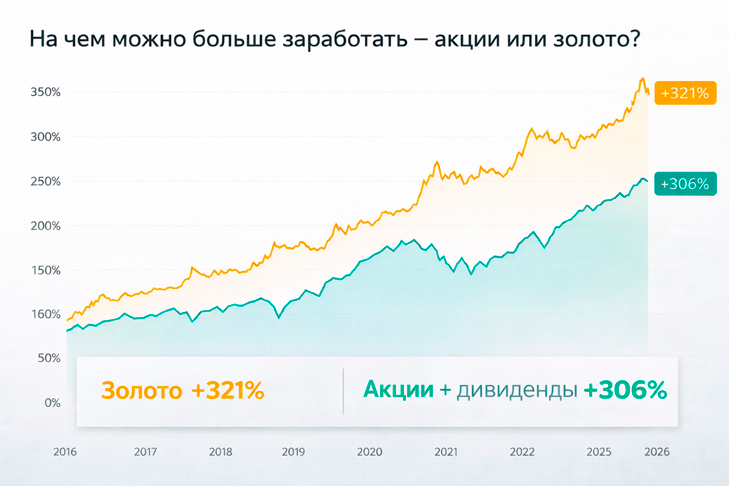

To understand which asset will generate more profit in the long term—gold or stocks—let's consider how much you can earn over 10 years by investing the same amount in each of these instruments.

For the sake of clarity, we will compare the results using the S&P 500 index , which includes shares of the 500 largest American companies.

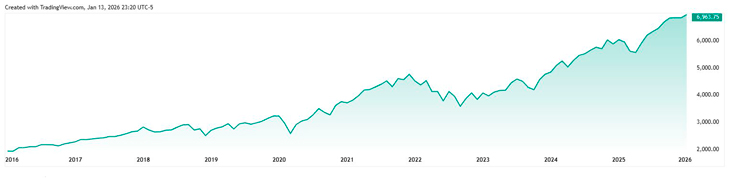

Stock Investing: What Has the S&P 500 Index Gained in 10 Years?

Over the past 10 years (2013–2023), the S&P 500 index has grown by 270%, representing a 3.7-fold increase in investment value. Furthermore, dividends, which average 1.8% per annum, add another 36% to the total return, bringing the total growth to 306%.

So, if you had invested $10,000 in the S&P 500 10 years ago, your investment would have been worth $40,600 . However, to achieve this, you would have had to monitor the market, sell losing stocks, and update your portfolio.

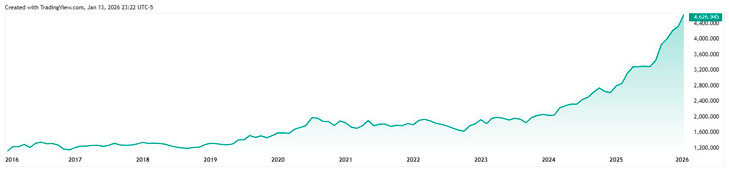

Investing in gold: what is the return over 10 years?

Now let's turn our attention to gold. Over the same period (2016–2026), the price of gold rose by 321%, meaning $10,000 invested in gold would have become $42,100 . Unlike stocks, gold doesn't pay dividends , but it has value as a safe haven asset that steadily appreciates over the long term.

This makes it less susceptible to risks associated with market fluctuations.

Gold or stocks taxation of profits

Another important factor when deciding on an investment is taxation. For example, in Poland and most other countries, when selling shares, you'll be required to pay a profit tax, which can range from 10% to 20%, depending on local legislation. If you sell the shares after 10 years, you'll need to deduct the tax on the proceeds from the sale.

For example, if you sold stocks and received $40,600, your net profit after paying income taxes (say, 19%) would be $32,900 . In contrast, selling gold bullion does not require income taxes, allowing you to keep the full $42,100 .

We conclude that it is now more profitable to invest money in gold bars or company shares

From the above analysis, we can conclude that while stocks can generate high returns, gold is a more profitable asset in the long term, given its stable price growth and the absence of taxes on its sale. For investors seeking to minimize risk and generate passive income, gold is an excellent option.

However, if you're willing to actively monitor the market and buy and sell stocks based on market movements, the S&P 500 index can also generate solid profits. In any case, the decision depends on your investment strategy and risk tolerance.

Thus, while stocks remain a popular instrument among investors, gold is becoming a more stable and profitable option over the long term for those who don't want to deal with tax implications and market volatility . It's clear that for those seeking security and stability, gold is an excellent choice.