Is it worth investing in gun stocks now?

Sales statistics show that the global demand for weapons has increased significantly since the onset of the pandemic. For example, Smith & Wesson Brands increased its gun sales by 2.5 times in 2020.

People began to arm themselves en masse in order to try to ensure their own safety in these troubled times.

The outbreak of military action in Ukraine has once again spurred demand for weapons, but unlike previous years, the increased demand now is for anti-aircraft missile systems, armored vehicles, and military aircraft.

What's happening right now with the stock prices of weapons companies that produce and sell weapons? Should we expect profit from such investments?

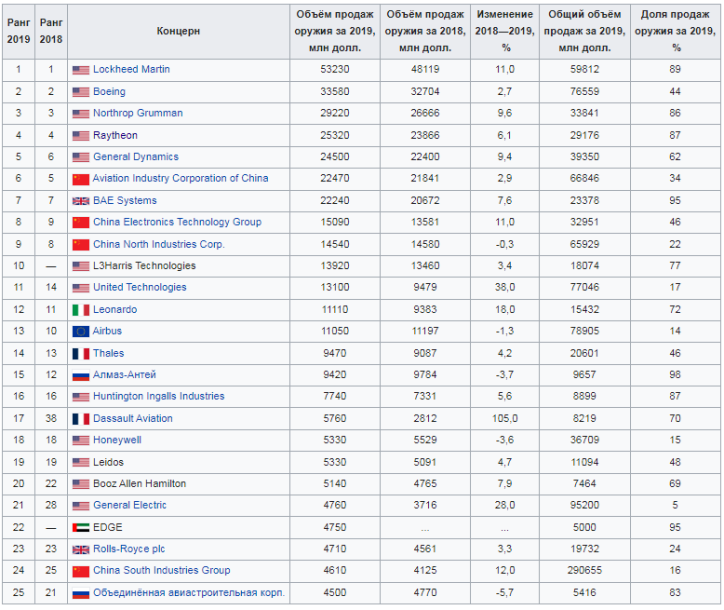

Wikipedia provides a list - List of largest military-industrial companies :

From this, it is easy to identify corporations in which arms sales are a priority and, using their example, to learn how the stock prices of arms companies behave.

Let's take, for example, the well-known Raytheon Technologies Corp. company, which is a manufacturer and developer of the Patriot air defense system, the Stinger MANPADS, missiles for aircraft and ships, as well as military radars.

In other words, Raytheon Technologies Corp. manufactures products for which there has been increased demand since February 24, 2022. Therefore, the shares of this particular weapons company can serve as an example.

Raytheon Technologies Corp. shares are traded on the stock exchange under the symbol RTX:

As the RTX chart shows, the stock price reacted quite strongly to the outbreak of hostilities on February 24, 2022, and by the end of February, the price had risen from $90 to $104 per share. However, a traditional pullback followed, and the stock is now trading at $101.

Now we can confidently predict further price increases against the backdrop of growing arms sales; the global arms race has once again begun, and most countries are increasing their military spending.

Raytheon Technologies Corp.'s products are among the most in-demand, which will lead to increased sales and, consequently, profits in the first half of this year.

In addition, dividend payments on Raytheon Technologies Corp shares are planned for June 17, 2022, so demand for purchases will only increase until May 18.

It's difficult to expect a quick end to military conflict in Ukraine, so military-industrial complex stocks are only expected to rise in the first half of 2022. This is confirmed by the fact that many investment funds have also invested in this market segment.

You can buy shares from the following brokers - https://time-forex.com/vsebrokery/brokery-fondowogo-rynka