Ruble exchange trading in the current realities of spring 2022

Since the outbreak of military action in Ukraine, the number of exchange transactions involving the Russian ruble has increased hundreds of times.

Most transactions involve exchanging Russian cash for harder currencies from other countries. The US dollar and euro are traditionally the most popular.

In this way, people try to protect their savings from depreciation due to inflation and a rapidly falling exchange rate.

The situation on the foreign exchange market is quite complex, and the introduction of a 12% tax on the purchase of foreign currency has only further accelerated the downward trend.

It would seem that at this time, unlimited opportunities for earning on the USDRUB and EURRUB currency pairs are opening up; to make a profit, you only need to open a deal to buy the dollar or euro.

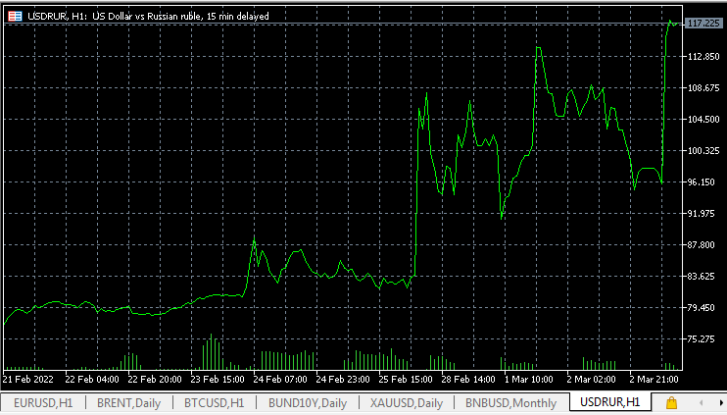

But in reality, the situation is not as simple as it seems at first glance. Take a look at the USDRUB pair chart:

Despite the prevailing uptrend, the price moves upward with simply enormous pullbacks of several percent. Impressive gaps .

Therefore, you need to carefully assess the situation when opening a new transaction and be prepared for a strong correction; transactions using leverage .

The second issue is the inability to open new orders in the trading platform. Most brokers have switched trades on ruble currency pairs to "Close Only" mode. Therefore, opening a new trade is impossible.

As a result, the only option left is to use alternative exchange options in the trader's personal account, electronic payment systems, or online exchange offices.

However, in order to make a profit, you will first have to wait until the rate compensates for the large commission paid for opening the transaction.

Therefore, the best option now is to stop trading the Russian ruble until the exchange rate stabilizes and trading is transferred to Full Trade mode.