Gas futures as a chance to make good money this fall

There are many assets whose prices are subject to seasonal influences, one of which is natural gas.

Moreover, prices for it are rising not only in anticipation of cold weather, but also with the worsening geopolitical situation.

Problems with gas supplies to Europe and the approaching winter are actively stimulating the growth of the price of this energy source.

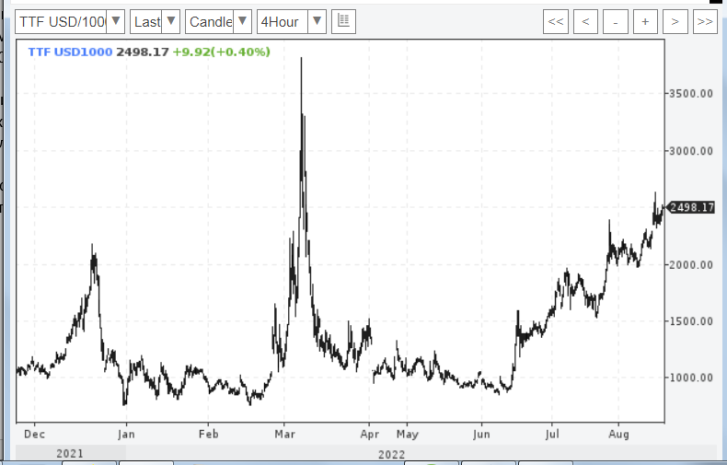

The market is actively reacting to current events, and the price of European futures has already exceeded $2,500 per 1,000 cubic meters, while on the American NYMEX gas is selling at a price above $900 per 1,000 cubic meters.

The impact of negative news on the market can be assessed by analyzing the price of gas in Europe, which was less than $1,800 in July and now exceeds $2,500:

Given the current situation, further price increases for TTF futures are expected. Especially since they are still a long way from this year's high of $3,900 per 1,000 cubic meters.

This means that buying autumn gas futures can, in the long run, hope to achieve a return of over 50% on long trades. Using leverage can increase profitability several-fold.

Futures trading broker - https://time-forex.com/vsebrokery/broker-fuchersy

Of course, you need to buy TTF contracts, since the price of gas on the American exchange is already quite high and there are no guarantees of its further growth.

It is advisable to enter a trade during a correction , after the pullback ends and a new price increase begins.

Alternative futures that may rise in price ahead of winter 2022 include oil, fuel oil, and coal.