Disappointing news from Japan and the fall of the Yen.

Lately, Japan has been increasingly plagued by natural disasters; before the country had time to recover from one shock, a new disaster brings trouble.

First of all, this is a significant drop in exports; compared to last year’s figures, in October, Japanese goods exports fell by more than 10%.

Moreover, this is not a short-term decline, but a long-term trend; a decline in demand for goods from Japan has been observed for more than a year.

The main reasons for the current situation are the general deterioration in the global economy, which has caused a sharp drop in demand. Consumers are now buying essential goods; unfortunately, electronics do not fall into this category.

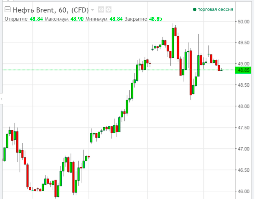

New jump in oil prices.

Good news has been rare lately, so the sharp rise in oil prices came as a pleasant surprise to many Russians.

I would like to hope that the trend will continue and the price will reach $100 in the foreseeable future.

Meanwhile, on Tuesday, December 22, 2016, the price of oil was literally a couple of cents short of breaking the psychological mark of $50 per barrel.

In the following days, there was a minor correction, after which a resumption of the upward trend can be expected.

Perhaps a positive role will be played by the decision of the countries that are the largest oil and gas producers to stabilize the energy market.

Gold news.

The price of precious metals has always surprised those who decide to invest in gold, and this time there were no surprises.

As soon as the forecasts became known that Trump would win the US presidential election, the price of gold rose, and it seemed that a fairly stable trend had formed.

The price drop following news from India was a surprise; who would have thought that the fight against the shadow economy could collapse the gold market.

After the Indian government decided to withdraw and exchange banknotes of the highest denominations from circulation, Indian investors no longer had time to buy gold.

As is well known, this country is the largest consumer of precious metal and often creates market demand.

US GDP growth forecast.

Despite what skeptics may say about Trump's election, most analysts have adjusted their forecasts for US economic growth.

According to experts, US GDP growth is expected to be 2.2% in 2017; according to preliminary forecasts previously voiced, this figure was at 1.5%.

That is, with Trump, the American economy will grow 0.7% faster next year, which is quite a lot, considering its size.

An equally optimistic long-term forecast is that growth of 2.4% is expected in 2018.

Forecasts are based on the new president's plans, which he announced after his election, but in reality these are just plans, and they do not always come true.

US Treasuries - Downtrend is just around the corner.

No matter how much talk there is about the insolvency of the US economy and its proximity to collapse, US government bonds still remain one of the most attractive investment instruments.

Moreover, these securities are mainly used by central banks to create reserves that stabilize national currencies.

Recently, the yield on government bonds has increased significantly and reached 1.734%, which is actually the maximum for 2016.

It would seem that an increase in yield would definitely lead to an increase in price, but despite this, Russia and China have begun to gradually reduce the share of this type of security in their reserves.

The Russian portfolio shrank from $89.1 billion to $76.5 billion, a loss of $12.6 billion, while China sold $28.1 billion in bonds. While these amounts are relatively small, they could still serve as a warning sign of widespread selling and a downward trend.

Rising oil prices stimulate the ruble.

No matter how much the skeptics talked about cheap oil, their expectations were not met; Brent crude oil prices began to rise rapidly and reached $46 per barrel, while Light crude was selling for $45.

The reason for the price increase was the statements about the intention of OPEC members to develop a plan to reduce oil production.

This information came from an employee of the Egyptian Ministry of Oil Production.

According to him, this issue will be key at the December summit; low prices do not suit the majority of OPEC members.

The second reason that influenced the increase in oil prices was the terrorist attacks in Nigeria, which damaged key oil pipelines.

Trading volumes on US exchanges remain high.

As we know, one of the most significant indicators that influences the strength of a trend is volume. It can confirm or refute an existing trend.

The US elections and subsequent election of Donald Trump as President triggered a downward trend in most securities, market volatility reached unprecedented proportions.

According to the latest data, trading volumes on the New York Stock Exchange continue to remain high, with 800,000,000 shares traded on November 15, a 45 percent increase over the average.

It is true that a growth trend is beginning to emerge, for example, the total number of securities whose price increased by 10% is greater than the number of those that lost weight.

It can be argued that the market is gradually recovering from the shock and it is time to think about buying deals.

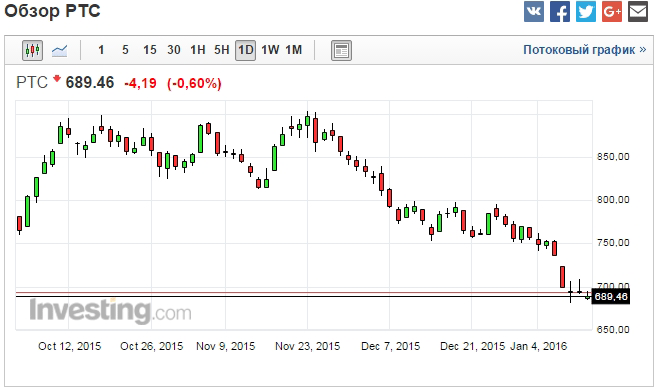

Oil and the Russian Stock Market Crisis

The record-breaking collapse in oil prices also caused significant panic worldwide. While analysts had previously smirked that the price of oil wouldn't fall below $45, today's $30 per barrel has dealt a severe blow to the main indices of oil-producing countries. A look at Moscow's leading RTS index clearly demonstrates the consequences:

The collapse of global stock markets

The past year of 2015 and the beginning of 2016 were a truly shocking period for major investors around the world.

around the world.

Many traders and analysts knew about the collapses of global financial markets only from textbooks and financial journals, and few of us could have imagined that we would witness such a so-called collapse with our own eyes.

Various news outlets reported on how superpower indices plummeted, how the decline of stock exchanges in certain countries actively influenced the indices of other countries, and it seemed that the loss of just one element caused the entire financial system to collapse, one after another, in a chain reaction.

Forex in Russia after the New Year: First Impressions

The Russian Federation's new law regulating dealer activity in the forex market has created enormous panic among traders.

enormous panic among traders.

Fear of losing their money due to the banal blocking of brokerage company bank accounts by the Russian National Bank has led to clients withdrawing their funds en masse and frantically waiting for the financial world to be turned upside down in the new year.

However, despite the enormous panic and fear among traders, almost all brokers operated as usual and showed no signs of unrest.

Only a few directors spoke about the flaws of this law and hinted at the consequences, as a result of which even honest companies that paid all taxes to the state treasury would be forced to move to another jurisdiction, since they simply would not be able to compete with foreign competitors.

Good news on binary options.

Trading in financial markets has firmly established itself as one of the most popular ways to make a profit. Many experts agree that the binary options market is currently the most promising trading platform.

Many experts agree that the binary options market is currently the most promising trading platform.

It allows you to earn money simply by guessing the price direction of a particular asset, which does not require any special skills or financial education.

Only up or down! Moreover, trade durations in binary options trading start at 30 seconds, during which it's entirely possible to double your deposit.

Verum Option, a company that has recently revolutionized binary options trading, has captured the online community's attention. By skillfully combining the advances of Western European and American brokers with its own unique developments, it has offered a fundamentally new approach to trading.

What's next for Forex in Russia?

The recently adopted law regulating dealer activity in the forex market has created a great deal of buzz among traders and brokerage company executives.

deal of buzz among traders and brokerage company executives.

This law has sparked rumors that most brokerage firms will simply be unable to obtain a license, meaning they will be liquidated.

Fear of losing money has forced a large number of traders to withdraw their funds and switch to companies under different jurisdictions.

The law itself will come into effect on January 1, 2016, so it's important to carefully consider whether it's worth risking your deposit with a company or simply withdrawing all your funds during this time of panic. Is this law really so detrimental to DCs and their clients, and what awaits the forex market in Russia in 2016?