How to make money on a PAMM account (specific example).

Independent Forex trading requires a significant amount of time for learning and even more for mastering practical trading skills. This is why PAMM investments have become so popular recently. However, successful investment requires considering many aspects.

trading skills. This is why PAMM investments have become so popular recently. However, successful investment requires considering many aspects.

How do you choose a profitable account?

When choosing a manager, several factors should be considered, not the least of which is the broker with whom you open your account.

For greater clarity, I decided to invest a small amount into one of the accounts, so we will continue with a specific example.

• PAMM broker - this should be a truly reliable company that will not disappear a month after the investment.

The methods of transferring money to and from the account, as well as the time of withdrawal, also play an important role.

I've been working with Alpari for several years now, a company known to almost everyone involved in stock trading. I know the broker quite well, so I didn't have to spend much time choosing, especially since the company fully meets my requirements and allows me to earn money with a PAMM account.

To begin, go to the Alpari website and select the "Investments" section in the menu.

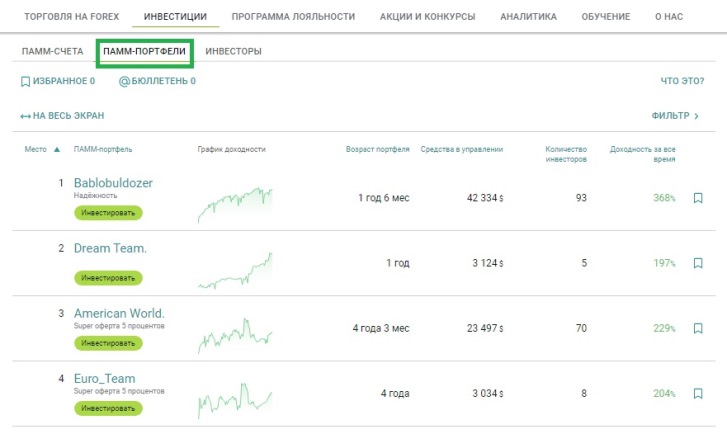

• Select an investment object - the broker's website has a large selection of ready-made PAMM portfolios for those who don't want to bother creating their own investment portfolio themselves:

If you still want to do everything yourself, then when choosing a manager, you should pay attention to the following parameters:

Trading period - the longer, the better.

Account balance - the amount of funds always speaks in favor of the manager.

Maximum drawdown - that is, the maximum loss allowed by the manager; less than 10% is already a good indicator for Forex.

Stop-loss level - limits losses from a single trade, preferably no more than 10%-15%.

Profitability - obviously, maximum is better, but don't forget to take into account the above parameters; it can range from 5 to 100% per month.

Manager's remuneration - the lower this percentage, the better, the more you receive; the average is 50%.

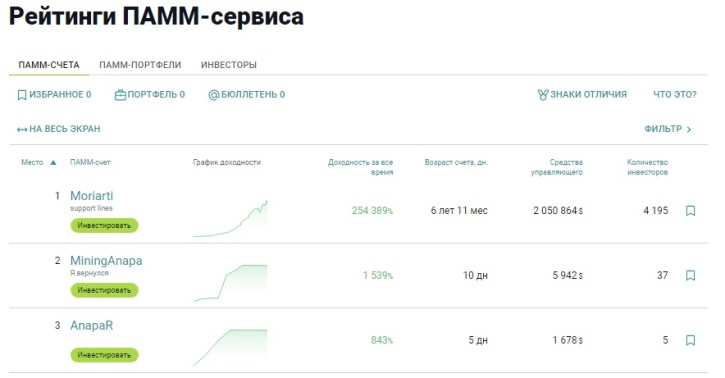

For those who want to choose their own manager, here's a link to the PAMM Account Rating : However, don't settle on just one manager. If you have more than $100, spread it among several managers rather than investing in just one. Moreover, one of the advantages of Alpari is its vast selection of managers, with over 4,000 available.

However, don't settle on just one manager. If you have more than $100, spread it among several managers rather than investing in just one. Moreover, one of the advantages of Alpari is its vast selection of managers, with over 4,000 available.

Additionally, an interesting tool called "investor rating" has recently emerged. This allows you to see which investors have been more successful and copy their strategies.

Other PAMM brokers offer brokerage companies with PAMM accounts.